Save time with automated cash application

| Enabled for | Public preview | General availability |

|---|---|---|

| Admins, makers, marketers, or analysts, automatically |  Apr 1, 2024

Apr 1, 2024 |

Oct 4, 2024

Oct 4, 2024 |

Business value

Dynamics 365 Finance offers advanced bank reconciliation to help businesses manage the bank reconciliation process more efficiently. Businesses can benefit from increased automation and more functional capabilities, reducing the need for manual work and saving time for cash management clerks. By streamlining the bank reconciliation process, Dynamics 365 Finance helps businesses improve their financial management and ensure accurate reporting.

Feature details

Bank reconciliation is a crucial step for businesses. It involves comparing the cash balance on a company’s balance sheet to the corresponding amount on its bank statement, and identifying any discrepancies that may require accounting adjustments. This process can be time-consuming and labor-intensive, as it requires careful matching of records and generation of reports.

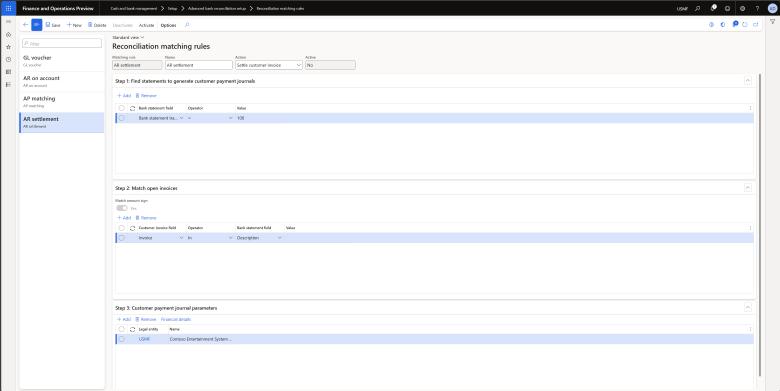

Advanced bank reconciliation in Dynamics 365 Finance can help businesses manage this process more efficiently. The following functions will be available in advanced bank reconciliation to automate the cash application:

Generate customer payment journal.

- Automatic generation: Users can configure reconciliation matching rules to automate this. Customer international bank account number (IBAN) or bank account number can be used to match the related bank account info on a bank statement to search the customer account automatically.

- Manual generation: Users can manually create customer payment journals from a bank reconciliation worksheet.

Generate vendor payment journal from bank reconciliation worksheet.

- Automatic generation: Users can configure reconciliation matching rules to automate this.

- Manual generation: Users can manually create vendor payment journals from a bank reconciliation worksheet.

Post voucher with redesigned user experience.

- Automatic posting: Users can configure reconciliation matching rules to automate this.

- Manual posting: Users can manually post GL vouchers from a bank reconciliation worksheet per bank statement line.

Settle open customer invoices with bank statement lines.

- Automatic settlement: Users can configure reconciliation matching rules to automate this. Bank statement lines will be matched with open customer invoices based on user-defined criteria like invoice number, sales order number, payment ID, and payment reference. The customer account is retrieved automatically from matched invoices.

- Manual settlement: Users can manually settle open customer invoices from a bank reconciliation worksheet.