Microsoft Invest - Understand your invoice

All members who buy inventory through one of the Microsoft Advertising Digital Platform UI products will receive an invoice every month indicating the amount they have spent. There are several types of invoices; this page explains each one.

Network users with the Financial Observer or DSP Billing role in our Digital Platform UI products can access invoices and seller statements directly within the app, including the pricing terms used when calculating fees and charges on invoices.

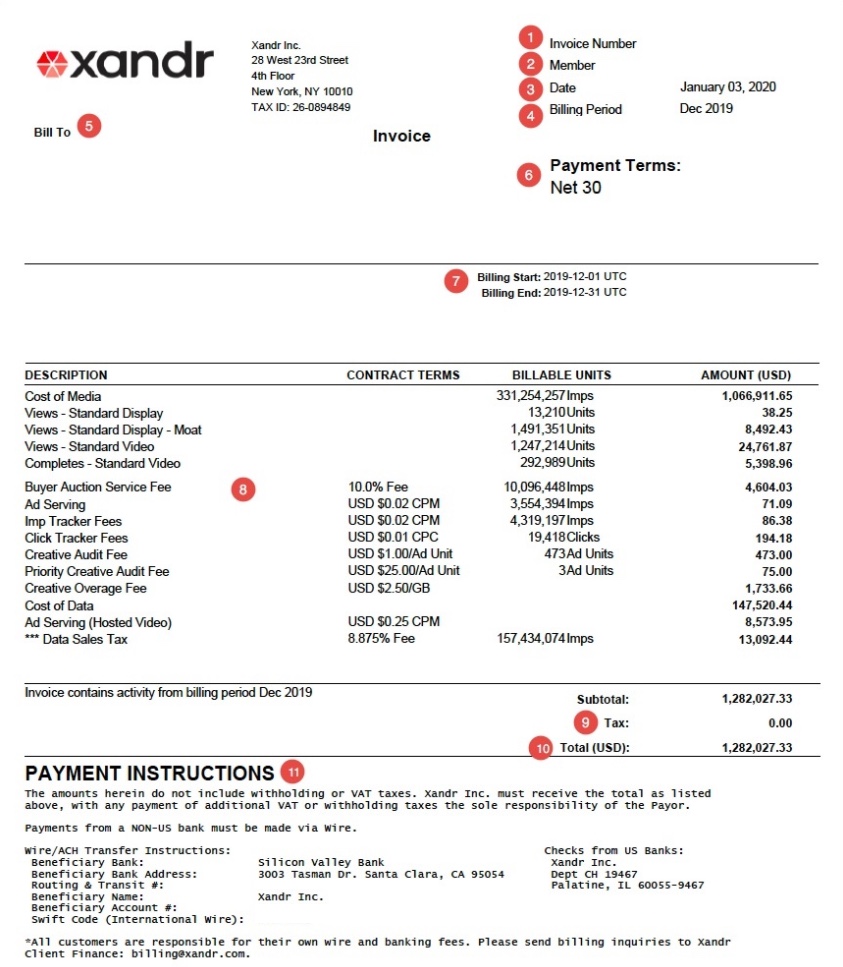

Xandr Invoice

Here's an example of what a typical invoice will look like (see descriptions of annotations below):

Your invoice lists the amount you have spent on Microsoft Advertising's platform; this is the amount you must pay Microsoft Advertising. You can reconcile some of these amounts using reports in the UI. For more information see Reconciling Your Invoice with Reporting.

Invoice Number - The unique invoice number. Please include your invoice number when using the Customer Service Portal to contact the Client Finance group with questions. If it's your first time using the Customer ServicePortal, select "Proceed as a Guest" to submit your case. Then, while we answer your first case, we'll also send you an email to setup an account.

Customer - Your unique customer ID (member/network ID). Refer to your customer number in all correspondence with Microsoft Advertising Client Finance.

Date - The date the invoice was generated.

Note

Microsoft Advertising creates invoices within the first 5 business days of the month following the activity. For example, an invoice for activity in September 2018 would be prepared within the first 5 business days of October 2018.

Billing Period - The month during which inventory was purchased on Microsoft Advertising's platform (this is not the same as your Insertion Order billing period).

Bill To - The name and address of the customer. To update this information, create a Client Finance case via the Customer Service Portal.

Payment Terms - The number of days after the end of the relevant activity billing period when payment is due, as specified in the Payment Terms section of your Microsoft Advertising Service Exhibit.

Note

To avoid being charged finance fees on overdue balances, be sure to make payments on time. To review how Microsoft Advertising calculates finance fees, see Billing FAQ. Your finance fee amount is specified in the Payments; Payment Obligations section of your Microsoft Advertising Master Services Agreement.

Billing Start/Billing End Date - The start and end date of the activity period covered in this invoice (including time zone). The time zone reflects what you use to tie out to reporting.

Description of Charges - An itemized list of the fees and charges for which you are being billed. This list may vary depending on your activity for the month. For information on how to reconcile these charges with your billing reports, see Reconciling Your Invoice with Reporting. Below are examples of some of these charges with descriptions:

Console Service Fee - Monthly charge for access to our platform. This charge can be found in your Service Agreement.

Cost of Media - The amount you owe Microsoft Advertising for inventory purchased during the billing period.

Views/Completes - The amount you owe Microsoft Advertising for display impressions and/or video completes purchased via the Viewable Marketplace (e.g., Views - Standard Display, Completes - Standard Video). For information on confirming invoice values associated with Viewable Marketplace activity, see Reconciling Your Invoice with Reporting.

Buyer Auction Service Fee - Typically, the fee for impressions bought from third parties such as Google or Yahoo!. This fee is charged in addition to the media cost. The fee percentage is specified in the Summary of Standard Microsoft Advertising Service Charges/Fees section of your Microsoft Advertising Service Exhibit. For more information about buyer auction service charges, see Buyer Auction Service Charge.

Note

Buyer Auction Service Deduction (BASC) - For all other inventory purchases, many clients have the buyer auction service charge for other inventory purchases specified as a bid reduction in their contract. This may not appear as a separate charge on your invoice automatically unless your account is setup for disclosed invoicing. If the line item is not being displayed on your invoice you can view the deduction amount in the UI using the Buying Billing Report. To enable disclosed invoicing, create a Client Finance case in the Customer Support Portal. Your cost of media will appear on your invoice net the fees.

Seller Auction Service Fee (SASC) - This fee is only applied to selling activity and only if the seller has the SASC set as a Fee instead of a Deduction in their contract terms with Microsoft Advertising. This fee is charged directly by Microsoft Advertising for impressions sold. If you have questions about this charge on your seller invoice, contact your account representative.

Ad Serving Fee (only charged to Sellers) - The charge for kept, blank, default, and/or PSA impressions. This will appear as a separate line item on your invoice and can be tied out with the Selling Billing Report in the UI. These charges do not appear by default in that report. To view them in the report, you must select Filtered Requests (under Metrics).

Priority/Creative Audit Fee - The charge for each creative audit performed by Microsoft Advertising (including both initial audits and re-audits). The creative audit fee, specified in the Summary of Standard Microsoft Advertising Service Charges/Fees section of your Microsoft Advertising Service Exhibit, is the standard audit rate with standard turnaround time. Priority audit, specified in the Ad Unit Auditing Fee section of your Microsoft Advertising Service Exhibit, is a higher fee incurred when you request expedited turnaround time.

Creative Overage Fee - The charge for serving creatives that are over the maximum size specified in the Summary of Standard Microsoft Advertising Service Charges/Fees section of your Microsoft Advertising Service Exhibit. For each oversized creative, the difference between the maximum size (in your contract) and the size of the creative is multiplied by (1) the number of impressions where the creative served, and then by (2) the bandwidth charge in your contract. For example, let's say the maximum creative size in your contract is 10KB, your bandwidth fee is $1.00 per KB, and you have a 20KB creative that served 4 times. Your creative overage fee is ((10KB x 4) x $1.00) = $40.

Data Fees – The charge for information purchased from a third party via the Microsoft Advertising Data Marketplace. Unless you have a contractual direct clearing arrangement with the third party from whom you purchased the data, Microsoft Advertising is responsible for the payment to the third party and your payments for this data should be sent to Microsoft Advertising.

Video Creative Hosting – The charge for video inventory that is purchased through Microsoft Advertising's platform.

Finance Fees – The incremental fee for any past due payments. Finance fees are never generated on outstanding finance fees (just the original amount due that has not been paid).

Tax - The charge for any applicable local taxes.

Total - The total amount due to Microsoft Advertising (e.g., all charges plus taxes).

Payment Instructions - Information to help you submit your payment via check or wire. To ensure your wire payment is applied correctly, submit it to the account listed on your statement. For more information, see Payment to Microsoft Advertising.

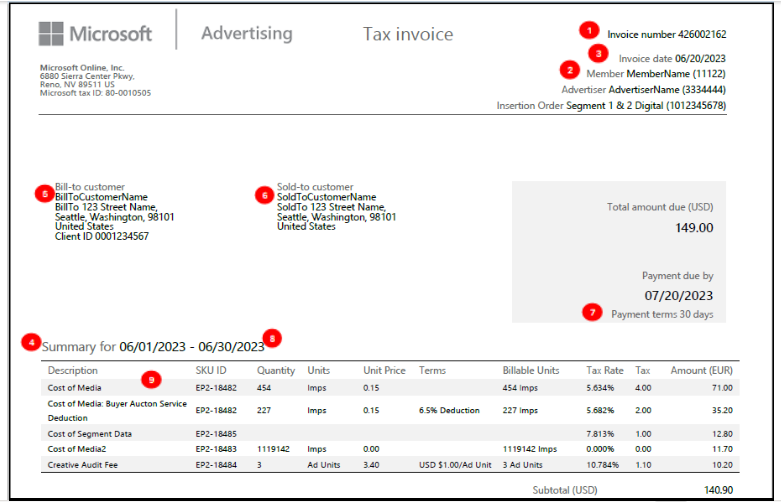

Microsoft Advertising invoice

If you are an Invest customer and you have signed a contract with Microsoft Advertising, your invoice will come from a Microsoft entity. Below is a summary of the changes to your invoice:

| Number | Name | Description |

|---|---|---|

| 1 | Invoice number | A unique identifier for the invoice. |

| 2 | Customer | Your unique customer ID (member or network ID). Refer to your customer number in all correspondence. |

| 3 | Date | The date the invoice was generated. Note Microsoft Advertising creates invoices within the first five business days of the month following the activity. For example, an invoice for activity in September 2018 would be prepared within the first five business days of October 2018. |

| 4 | Billing period | The month during which inventory was purchased on Microsoft Advertising's platform. |

| 5 | Bill-to | The billing account that identifies the name and address responsible for the payment. |

| 6 | Sold-to | The name and address of the contracting party with Microsoft Advertising. Often the same entity as "bill-to," unless the contracting party designates a different entity. |

| 7 | Payment terms | The number of days after the invoice date when the payment is due, as specified in the payment terms section of your Microsoft Advertising service exhibit. |

| 8 | Billing start and end date | The start and end dates of the activity period covered in this invoice (including time zone). The time zone reflects what you use to tie out to reporting. |

| 9 | Description of charges | An itemized list of the fees and charges for which you are billed. Charges may vary depending on your activity for the month. For details on reconciling these charges with your billing reports, see Reconciling Your Invoice with Reporting. Below are examples of some of these charges with descriptions: a) Console Service fee: A monthly charge for access to the platform. This charge is specified in your service agreement. b) Cost of Media: The amount owed to Microsoft Advertising for inventory purchased during the billing period. Note: Each fee to the buyer is displayed as its own discrete line item, alongside its respective SKU: - Cost of Media - Cost of Media: Buyer Auction Service deduction - Cost of Media: Buyer External Deduction - Cost of Media: Cost of Exchange Trade Media – Buyer - Cost of Media: DSP Service Deduction - Cost of Media: Exchange Fee (Deduction) - Cost of Media: FX Margin Buyer Deduction c) Views/Completes: The amount owed to Microsoft Advertising for display impressions and video completes purchased through the Viewable Marketplace (e.g., Views - Standard Display, Completes - Standard Video). For details on confirming invoice values related to Viewable Marketplace activity, refer to [Reconciling Your Invoice with Reporting]. d) Buyer auction service fee: Typically, a fee for impressions purchased from third parties, such as Google or Yahoo!. This fee is charged in addition to the media cost. The fee percentage is specified in the Summary of Standard Microsoft Advertising Service Charges/Fees section of your Microsoft Advertising Service Exhibit. For more information about buyer auction service charges, see Buyer Auction Service Charge. e) Seller Auction Service fee (SASC): This fee applies only to selling activity and only if the seller has the SASC set as a fee instead of a deduction in their contract terms with Microsoft Advertising. The fee is charged directly by Microsoft Advertising for impressions sold. f) Ad Serving fee (only charged to sellers): This fee is charged for kept, blank, default, and/or PSA impressions. It appears as a separate line item on your invoice and can be reconciled with the Selling Billing Report in the user interface (UI). By default, these charges do not appear in the report. To view them, select Filtered requests under Metrics. g) Priority/Creative audit fee: This fee is charged for each creative audit performed by Microsoft Advertising, including both initial audits and re-audits. The creative audit fee, specified in the Summary of Standard Microsoft Advertising Service Charges/Fees section of your Microsoft Advertising Service Exhibit, reflects the standard audit rate with standard turnaround time. The priority audit fee, specified in the Ad Unit Auditing Fee section of your Microsoft Advertising Service Exhibit, is a higher fee incurred for expedited turnaround time when requested. h) Creative Overage fee: This fee is charged for serving creatives that exceed the maximum size specified in the Summary of Standard Microsoft Advertising Service Charges/Fees section of your Microsoft Advertising Service Exhibit. For each oversized creative, the difference between the maximum size (in your contract) and the size of the creative is multiplied by: 1. the number of impressions where the creative served 2. The bandwidth charge specified in your contract Example: If the maximum creative size in your contract is 10 KB, your bandwidth fee is $1.00 per KB, and a 20 KB creative served 4 times, the creative overage fee would be calculated as: ((10 KB x 4) x $1.00) = $40 i) Data fees: This fee is charged for information purchased from a third party via the Microsoft Advertising Data Marketplace. Unless you have a contractual direct clearing arrangement with the third party from whom you purchased the data, Microsoft Advertising is responsible for the payment to the third party. Your payments for this data should be sent to Microsoft Advertising. j) Video creative hosting: This fee is charged for video inventory purchased through Microsoft Advertising's platform. |

| 10 | Tax | The charge for any applicable local taxes. |

| 11 | Total | The total amount due to Microsoft Advertising (e.g., all charges plus taxes). |

| 12 | Payment instructions | Information to help you submit your payment. To ensure your wire payment is applied correctly, submit it to the account listed on your statement. |

Advertiser-specific, Insertion order-specific, and billing period-specific invoices

You have the option to receive advertiser-, insertion order-, or billing period-specific invoices (e.g., to separate specific costs and fees for an advertiser's billing department). To opt into receiving these more specific invoices, contact your Microsoft Advertising representative.

If you opt into receiving advertiser-specific invoices, you will receive two levels of invoices:

- Advertiser Invoices: Each invoice will contain Media Cost, Buyer Auction Service Charges, Creative Audit Fees, and Cost of Data attributable to a specific advertiser.

- Member Invoices: Each invoice will contain costs and fees not otherwise specifically attributable to specific advertisers, including log-level data fees, minimums, and fixed fees (e.g., onboarding fee).

If you opt into receiving insertion order-specific invoices, you will receive three levels of invoices:

- Insertion Order Invoices: Each invoice will contain Media Cost and Buyer Auction Service Charges attributable to a specific insertion order.

- Advertiser Invoices: Each invoice will contain Creative Audit Fees or Cost of Data attributable to a specific advertiser (but not to specific insertion orders).

- Member Invoices: Each invoice will contain costs and fees not otherwise attributable to specific advertisers or insertion orders, including log-level data fees, minimums, and fixed fees (e.g., onboarding fee).

If you opt into receiving billing period-specific invoicing, you will receive three levels of invoices:

- Billing Period Invoices: Each invoice will contain Media Cost and Buyer Auction Service Charges attributable to a specific billing period.

- Advertiser Invoices: Each invoice will contain Creative Audit Fees or Cost of Data attributable to a specific advertiser (but not to specific billing period).

- Member Invoices: Each invoice will contain costs and fees not otherwise attributable to specific advertisers or insertion orders, including log-level data fees, minimums, and fixed fees (e.g., onboarding fee).

Note

If you entered a value in the Billing Code field of your Insertion Order, that value will appear on you insertion order-specific invoices and/or your billing period-specific invoices (depending on which you opted into).

Warning

Financial Obligations -Receiving Advertiser-, Insertion Order, or Billing Period-specific invoices does not change any of your financial or payment obligations to Microsoft Advertising. You are still responsible for paying all invoices associated with any of your advertisers (including their insertion orders) and their activity and buying. Microsoft Advertising does not bill advertisers for you.

Note

Billing Name/Address and Billing Code

- To display the advertiser's address in the Bill To region of your Advertiser-, Insertion Order-, Billing Period-specific invoices, you must update the fields in the Billing Information section of the advertiser. If you leave these fields blank, your Advertiser-, Insertion Order-, or Billing Period-specific invoices will only show your member billing address.

- To include a billing code on your insertion order- or billing code-specific invoices, you must enter it in the Basic Details section of the insertion order.

If you are a customer who has signed a new agreement with Microsoft Advertising, you can still avail of Insertion Order, Advertiser and Member-specific invoices but you will not be able to choose billing period-specific invoices once you have cutover.

Invoice consolidation ("Rollup")

If you have more than one member account, you can choose to receive a consolidated invoice for the buying activity across of your member accounts. For more details on this feature, contact your Account Manager.

Understand the netting statement

If you both buy and sell inventory with Microsoft Advertising, you can choose to have Microsoft Advertising “net” this activity. This means you will receive a single statement instead of separate monthly invoices and payments. The netting statement lists the amount you have spent as a buyer and the revenue you have earned as a seller. Microsoft Advertising then deducts the amount you owe as a buyer (based on your buy-side payment terms) from the revenue you have earned as a seller (based on your sell-side payment terms), determining the net amount you owe or will be paid. For more details, see Understanding Your Seller Statement.

If you have migrated to a new Microsoft Advertising contract, please note that Invest and Monetize now have separate contracts and invoices. As a result, netting will be discontinued, and you will need to review both invoices.

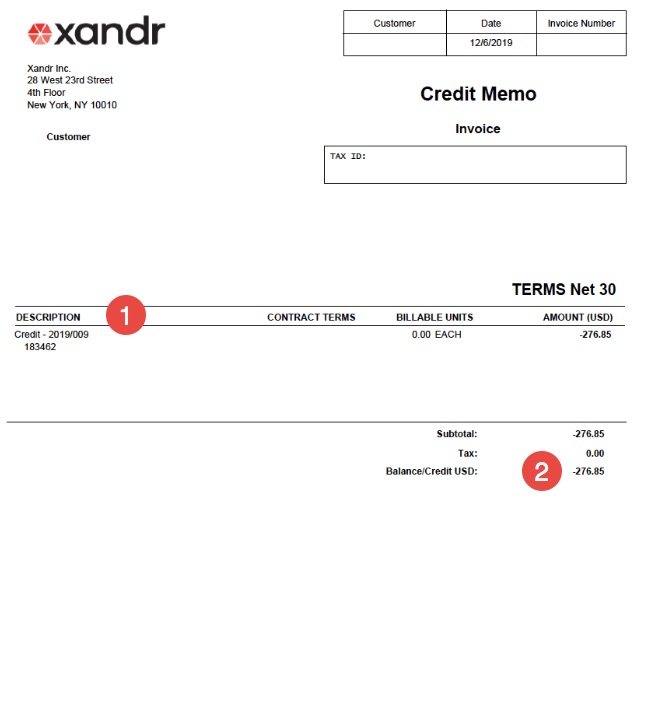

Xandr Credit Note

If Microsoft Advertising issues you a credit or debit, you will receive a credit memo listing the credit/debit amount. If a credited amount can be applied to an outstanding balance, it will be applied. If it is not clear where to apply this credit, the amount will be listed on your account as a credit. Note that invoices will not be reissued when a credit amount is agreed upon. Instead, you will receive a separate credit memo once the credit is processed.

- Description - The list of items for which you are receiving a credit. The original invoice number for which the credit memo is being generated will also be shown. If that invoice is still open (i.e., not yet fully paid), the credit memo will be applied to that invoice. If the invoice is fully paid, Microsoft Advertising can apply the amount of the credit to another invoice (after receiving your approval to do so).

- Balance/Credit - The amount that has been credited to your account.

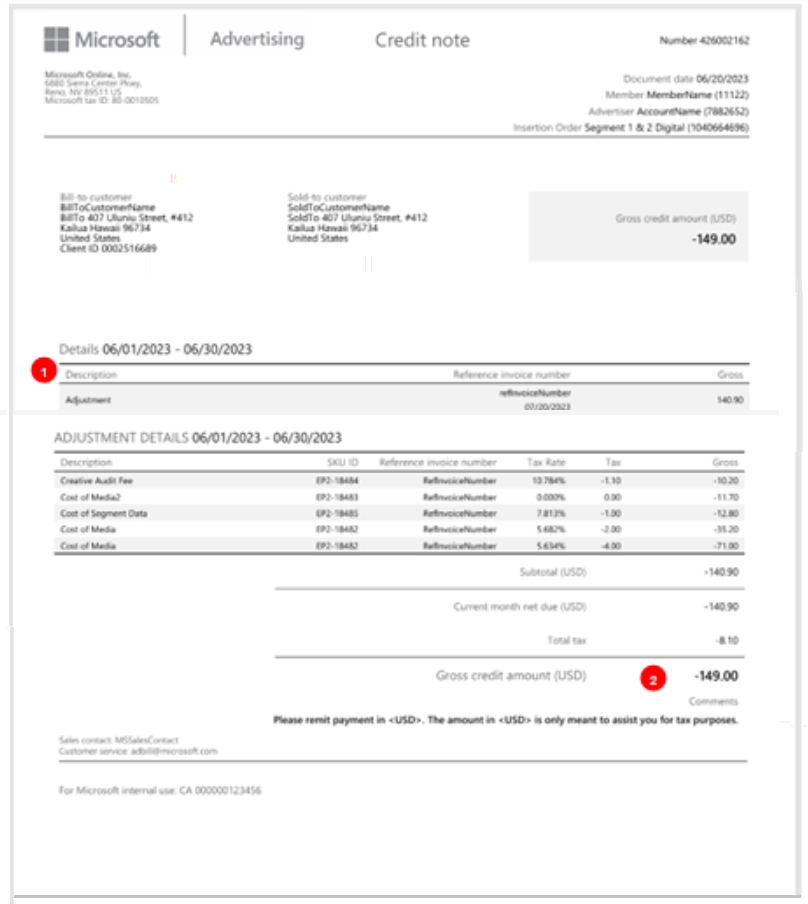

Microsoft Credit Note

If you are a customer who has signed a new contract with Microsoft Advertising, your billing documents will be issued by a Microsoft entity. Below is an example of a credit note for a customer who has transitioned to Microsoft Advertising:

| Number | Name | Description |

|---|---|---|

| 1 | Credit note description | The first line shows the total amount to be credited and the original invoice number. The adjustment details field provides the breakdown of the line items for which you are being credited. |

| 2 | Gross credit amount | The amount for which you are receiving a credit. |