French Intrastat

Companies in France that are registered for value-added tax (VAT), and that trade with other European Union (EU) countries/regions, must declare the exchange of goods and services to and from France. The Declaration d'exchanges de biens (Declaration of Trade in Goods, or DEB) is a combination of the EU Sales List and the Intrastat report. You must submit this report monthly for all intracommunity sales of goods.

You can generate the DEB report in either of two electronic text file formats: SAISUNIC 330 or INTRACOM format.

The following table shows the fields that are included in the French Intrastat declaration in SAISUNIC 330 format. The table also indicates the report levels of each field. A field can have the following report levels:

- 4 – Tax declaration.

- 1 – Statistical response.

- 5 – Statistical response to shipment and tax declaration, and joint filling.

| Field | Report levels |

|---|---|

| Period Of Reference | 4, 1, 5 |

| Number Of Declaration | 4, 1, 5 |

| Line Number | 4, 1, 5 |

| Country ISO Code (FR) | 4, 1, 5 |

| Complementary Code | 4, 1, 5 |

| Siren Number | 4, 1, 5 |

| VAT Code Of Customer | 4, 1, 5 |

| Direction Code | 4, 1, 5 |

| Transaction Type | 4, 1, 5 |

| Obligation Level | 4, 1, 5 |

| Commodity Code | 1, 5 |

| National NGP | 1, 5 |

| County (Department) | 1, 5 |

| Nature Of Transaction | 1, 5 |

| Country Of Origination | 1, 5 |

| Country Of Origin - Imports | 1, 5 |

| Final Destination - Exports | 1, 5 |

| Invoice Value | 4, 1, 5 |

| Statistical Value | 1, 5 |

| Net Weight | 1, 5 |

| Additional Units | 1, 5 |

| Transport Code | 1, 5 |

The following table shows the fields that are included in the French Intrastat declaration in INTRACOM format. The table also indicates the report levels of each field. A field can have the following report levels:

- 4 – Tax declaration.

- 1 – Statistical response.

- 5 – Statistical response to shipment and tax declaration, and joint filling.

| Field | Report levels |

|---|---|

| Direction code | 4, 1, 5 |

| Number Of Declaration | 4, 1, 5 |

| Number Of Line | 4, 1, 5 |

| Siren | 4, 1, 5 |

| County (Department) | 1, 5 |

| Transport Code | 1, 5 |

| Country Of Origin | 1, 5 |

| Nature Of Transaction | 1, 5 |

| Invoice Value | 4, 1, 5 |

| Modes Of Delivery | 1, 5 |

| Transaction Type | 4, 1, 5 |

| Obligation Level | 4, 1, 5 |

| Commodity Code | 1, 5 |

| National NGP | 1, 5 |

| Net Weight | 1, 5 |

| Statistical Value | 1, 5 |

| Additional Units | 1, 5 |

| Country Of Origin - Imports | 1, 5 |

| Final Destination - Exports | 1, 5 |

| VAT Code Of Customer | 4, 1, 5 |

| Complementary Code | 4, 1, 5 |

| Period Of Reference | 4, 1, 5 |

Set up Intrastat

In Microsoft Dynamics Lifecycle Services, in the Shared asset library, download the latest versions of the following Electronic reporting (ER) configurations for the Intrastat declaration:

- Intrastat model

- Intrastat report

- Intrastat INTRACOM (FR)

- Intrastat SAISUNIC (FR)

For more information, see Download Electronic reporting configurations from Lifecycle Services.

Set up VAT IDs

Set up VAT codes for your company

- Go to Tax > Setup > Sales tax > Tax exempt numbers.

- On the Action Pane, select New.

- In the Country/region field, select FRA.

- In the Tax exempt number field, enter your company's VAT number key.

- Go to Organization administration > Organizations > Legal entities, and select your company.

- On the Foreign trade and logistics FastTab, in the Intrastat section, set the VAT exempt number export and VAT exempt number import fields to the code that you created in step 4.

- On the Tax registration FastTab, in the Tax registration number field, enter your company's tax registration number.

Set up the VAT IDs for trading partners

Create a registration type for the company code

You must create VAT ID registration types for all the countries or regions that your company does business with.

- Go to Organization administration > Global address book > Registration types > Registration types.

- On the Action Pane, select New to create a registration type for the VAT ID.

- In the Enter registration type details dialog box, in the Name field, enter a name for the new registration type. For example, enter VAT ID.

- In the Country/region field, select the country or region of the trading partner.

- Select Create.

Match the registration type with a registration category

- Go to Organization administration > Global address book > Registration types > Registration categories.

- On the Action Pane, select New to create a link between a registration type and a registration category.

- For the registration type for the VAT ID, select the VAT ID registration category.

- Repeat steps 2 and 3 for the other registration types that you created for the countries or regions that your company does business with.

Set up the VAT number of a trading partner

- Go to Accounts receivable > Customers > All customers.

- In the grid, select a customer.

- On the Action Pane, on the Customer tab, in the Registration group, select Registration IDs.

- On the Registration ID FastTab, select Add to create a registration ID.

- In the Registration type field, select the registration type that you created for the company code.

- In the Registration number field, enter the company's VAT number.

- On the Action Pane, select Save, and then close the page.

For more information, see Registration IDs.

Set up foreign trade parameters

Go to Tax > Setup > Foreign trade > Foreign trade parameters.

On the Intrastat tab, on the Electronic reporting FastTab, in the File format mapping field, select Intrastat INTRACOM (FR) or Intrastat SAISUNIC (FR).

In the Report format mapping field, select Intrastat report.

On the Commodity code hierarchy FastTab, in the Category hierarchy field, select Intrastat.

On the General FastTab, in the Transaction code field, select the code that is used for transfers of goods.

In the Credit note field, select the code that is used for returns of goods.

In the Worker field, select the name of the contact person.

On the Contact tab, add information about the contact person:

- In the Telephone field, enter the telephone number of the contact person.

- In the Fax field, enter the fax number of the contact person.

On the Country/region properties tab, in the Country/region field, list all the countries or regions that your company does business with. For each country/region that is part of the EU, select EU in the Country/region type field, so that the country appears on your Intrastat report. For France, select Domestic in the Country/region type field.

Set up compression of Intrastat

Go to Tax > Setup > Foreign trade > Compression of Intrastat, and select the fields that should be compared when Intrastat information is summarized. For French Intrastat, select the following fields:

- Statistics procedure

- Country/region of origin

- Transport

- Correction

- Country/region

- County of origin/destination

- Direction

- Country/region of sender

- Transaction code

- Commodity

Set up product parameters for the Intrastat declaration

- Go to Product information management > Products > Released products.

- In the grid, select a product.

- On the Foreign trade FastTab, in the Intrastat section, in the Commodity field, select the commodity code. The name of the commodity will be printed in the Description of commodities field on the Intrastat report.

- In the Origin section, in the Country/region field, select the product's country or region of origin.

- On the Manage inventory FastTab, in the Net weight field, enter the product's weight in kilograms.

NGP codes

On the DEB report, the codification of products consists of the following elements:

- The eight-digit CN8 code that represents the tariff and statistical nomenclature of the EU.

- If applicable, the one-digit Nomenclature Générale des Produits (NGP) national item code.

In 2022, the NGP applies to only three types of products:

- Some products from cows, sheep, and goats

- Military equipment

- French wines

You must set up the NGP codes and assign them to related products. The NGP field is then automatically set on the Intrastat journal page.

Set up an NGP code

- Go to Tax > Setup > Foreign trade > NGP codes.

- On the Action Pane, select New.

- In the NGP field, enter a single-digit code.

- In the Description field, enter a description for the code.

Assign an NGP code to a product

- Go to Product information management > Products > Released products.

- In the grid, select a product.

- On the Foreign trade FastTab, in the Intrastat section, in the NGP field, select the appropriate NGP code.

Set up warehouse parameters for the Intrastat declaration

- Go to Warehouse management > Setup > Warehouse > Warehouses.

- Select a warehouse, and then, on the Addresses FastTab, select Add or Edit.

- In the dialog box, in the City field, select the warehouse's city. The city's state or province will be used as a county for your DEB report.

Set up the transport method

- Go to Tax > Setup > Foreign trade > Transport method.

- On the Action Pane, select New.

- In the Transport field, enter a unique code. Companies in France use one-digit transport codes.

Intrastat journal

Go to Tax > Declarations > Foreign trade > Intrastat to manage your transactions that are applicable to foreign trade with EU countries/regions. For more information, see Intrastat overview.

The NGP column is specific to France and shows the NGP code for the product. If the NGP isn't applicable to a product, 0 (zero) is shown. To adjust the NGP code, select the transaction, and then, on the General tab, in the Codes section, in the NGP field, select the required NGP code.

Intrastat transfer

On the Intrastat page, on the Action Pane, you can select Transfer to automatically transfer the information about intracommunity trade from your sales orders, free text invoices, purchase orders, vendor invoices, vendor product receipts, project invoices, and transfer orders. Only documents that have an EU country as the country or region of destination (for dispatches) or consignment (for arrivals) will be transferred.

Because the DEB report is a combination of the EU Sales List and the Intrastat report, it also includes triangular transactions, where a direct delivery is made from one EU country/region (party A) to another EU country/region (party C), and a French legal entity (party B) is in the middle of the triangular deal.

Generate a DEB (Intrastat) report

Go to Tax > Declarations > Foreign trade > Intrastat.

On the Action Pane, select Output > Report.

In the Intrastat Report dialog box, set the following fields.

Field Description From date Select the start date for the report. To date Select the end date for the report. Generate file Set this option to Yes to generate a .txt file. File name Enter the name of the .txt file for your Intrastat report. Generate report Set this option to Yes to generate an .xml file. Report file name Enter the required name. Only corrections Set this option to Yes to report only corrections. Set it to No to report both normal transactions and corrections. Direction Select Arrivals for a report about intracommunity arrivals. Select Dispatches for a report about intracommunity dispatches. Select OK to close the Intrastat Report dialog box.

In the Electronic report parameters dialog box, on the Parameters FastTab, in the Report level field, select the report level. The report level can be 1 - statistical response, 4 - tax declaration, or 5 - statistical response to shipment and tax declaration.

Example

The following example shows how to set up French Intrastat and create the DEB report. It uses the DEMF legal entity.

Preliminary setup

In Microsoft Dynamics Lifecycle Services, in the Shared asset library, download the latest versions of the following ER configurations for the Intrastat declaration format:

- Intrastat model

- Intrastat report

- Intrastat INTRACOM (FR)

Set up a product hierarchy:

- Go to Product information management > Setup > Categories and attributes > Category hierarchies.

- In the grid, select Intrastat.

- On the Action Pane, on the Category hierarchy tab, in the Maintain group, select Edit.

- On the Action Pane, select New category node.

- In the Name field, enter Autres Libournais.

- In the Code field, enter 2204 21 42.

- On the Action Pane, select Save.

Set up VAT IDs

Set up VAT codes for your company

- Go to Tax > Setup > Sales tax > Tax exempt numbers.

- On the Action Pane, select New.

- In the Country/region field, select FRA.

- In the Tax exempt number field, enter MS123456.

- Go to Organization administration > Organizations > Legal entities, and select DEMF.

- On the Foreign trade and logistics FastTab, in the Intrastat section, set the VAT exempt number export and VAT exempt number import fields to the code that you created in step 4.

- On the Tax registration FastTab, in the Tax registration number field, enter 123456789.

Set up the VAT IDs for trading partners

Create a registration type for the company code

- Go to Organization administration > Global address book > Registration types > Registration types.

- On the Action Pane, select New to create a registration type for the VAT ID.

- In the Enter registration type details dialog box, in the Name field, enter VAT ID.

- In the Country/region field, select DEU.

- Select Create.

Match the registration type with a registration category

- Go to Organization administration > Global address book > Registration types > Registration categories.

- On the Action Pane, select New to create a link between the registration type and the registration category.

- For the VAT ID registration type of the DEU country/region, select the VAT ID registration category.

Set up the customer's VAT registration number

- Go to Accounts receivable > Customers > All customers.

- In the grid, select DE-016.

- On the Action Pane, on the Customer tab, in the Registration group, select Registration IDs.

- On the Registration ID FastTab, select Add to create a registration ID.

- In the Registration type field, select VAT ID.

- In the Registration number field, enter DE9012.

- On the Action Pane, select Save, and then close the page.

- On the Invoice and delivery FastTab, in the Sales tax section, in the Tax exempt number field, select DE9012.

Set up foreign trade parameters

- Go to Tax > Setup > Foreign trade > Foreign trade parameters.

- On the Intrastat tab, on the General FastTab, in the Transaction code field, select 11.

- On the Electronic reporting FastTab, in the File format mapping field, select Intrastat INTRACOM (FR).

- In the Report format mapping field, select Intrastat report.

- On the Commodity code hierarchy FastTab, in the Category hierarchy field, select Intrastat.

- In the Worker field, select a record.

- On the Contact tab, in the Telephone field, enter the contact's telephone number

- In the Fax field, enter the contact's fax number.

Create NGP code

- Go to Tax > Setup > Foreign trade > NGP codes.

- On the Action Pane, select New.

- In the NGP field, enter 8.

- In the Description name field enter NGP 8.

- On the Action Pane, select Save.

Set up product information

- Go to Product information management > Products > Released products.

- In the grid, select D0001.

- On the Foreign trade FastTab, in the Intrastat section, in the NGP field, select 8.

- In the Commodity field, select 2204 21 42.

- In the Origin section, in the Country/region field, select FRA.

- On the Manage inventory FastTab, in the Weight measurements section, in the Net weight field, enter 2.

- On the Action Pane, select Save, and then close the page.

- In the grid, select D0003.

- On the Foreign trade FastTab, in the Intrastat section, in the Commodity field, select 100 200 30.

- In the Origin section, in the Country/region field, select DEU.

- On the Manage inventory FastTab, in the Weight measurements section, in the Net weight field, enter 5.

- On the Action Pane, select Save.

Set up Regime codes

- Go to Tax > Setup > Foreign trade > Statistics procedure.

- On the Action Pane, select New.

- In the Statistics procedure field, enter 21.

- In the Text 1 field, enter Regime code 21.

Change the site address

- Go to Warehouse management > Setup > Warehouse > Sites.

- In the grid, select 1.

- On the Addresses FastTab, select Edit.

- In the Edit address dialog box, in the Country/region field, select FRA.

- Select OK.

- Go to Warehouse management > Setup > Warehouse > Warehouses, and select a warehouse.

- On the Addresses FastTab, select Add.

- In the New address dialog box, in the Country/region field, select FRA.

- In the City field, select Bordeaux.

- Select OK to close the dialog box.

Set up a transport method

- Go to Tax > Setup > Foreign trade > Transport method.

- On the Action Pane, select New.

- In the Transport field, enter 3.

- In the Description field, enter Road transport.

Assign a transport mode to a mode of delivery

- Go to Procurement and sourcing > Setup > Distribution > Modes of delivery.

- In the grid, select 50.

- On the Foreign trade FastTab, in the Transport field, select 3.

Create a sales order with an EU customer that includes the new product

- Go to Accounts receivable > Orders > All sales orders.

- On the Action Pane, select New.

- In the Create sales order dialog box, in the Customer section, in the Customer account field, select DE-016.

- In the Address section, in the Delivery address field, select the plus sign (+) to create an address.

- In the New address dialog box, in the Name of description field, enter Germany.

- In the Country/region field, select DEU.

- Select OK.

- In the Create sales order dialog box, select OK.

- On the Sales order lines FastTab, in the Item number field, select 0001.

- On the Lines details FastTab, Foreign trade tab, in the Statistics procedure field, select 21.

- In the State of origin field, select AL.

- On the Action Pane, select Save.

- On the Header tab, on the Delivery FastTab, in the Mode of delivery field, make sure that 50 is selected.

- On the Action Pane, on the Invoice tab, in the Generate group, select Invoice.

- In the Posting invoice dialog box, on the Parameters FastTab, in the Parameter section, in the Quantity field, select All. Then select OK to post the invoice.

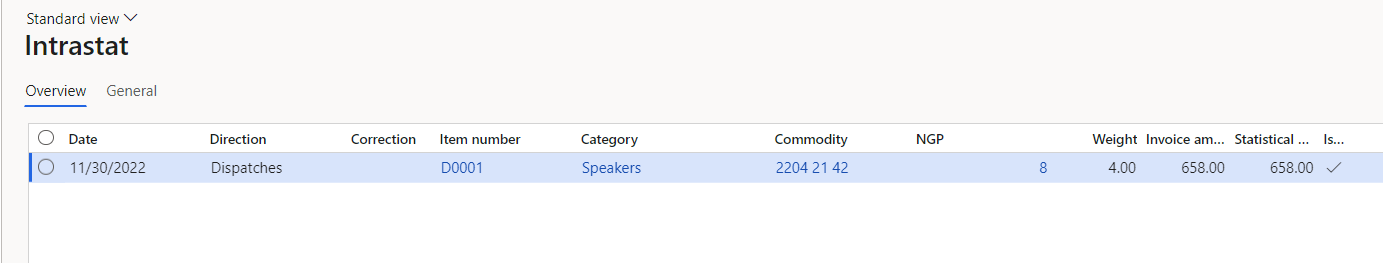

Transfer the transaction to the Intrastat journal and review the result

Go to Tax > Declarations > Foreign trade > Intrastat.

On the Action Pane, select Transfer.

In the Intrastat (Transfer) dialog box, in the Parameters section, set the Customer invoice option to Yes. Then select OK.

Sort transactions by the Date field. The top transaction is the result transaction.

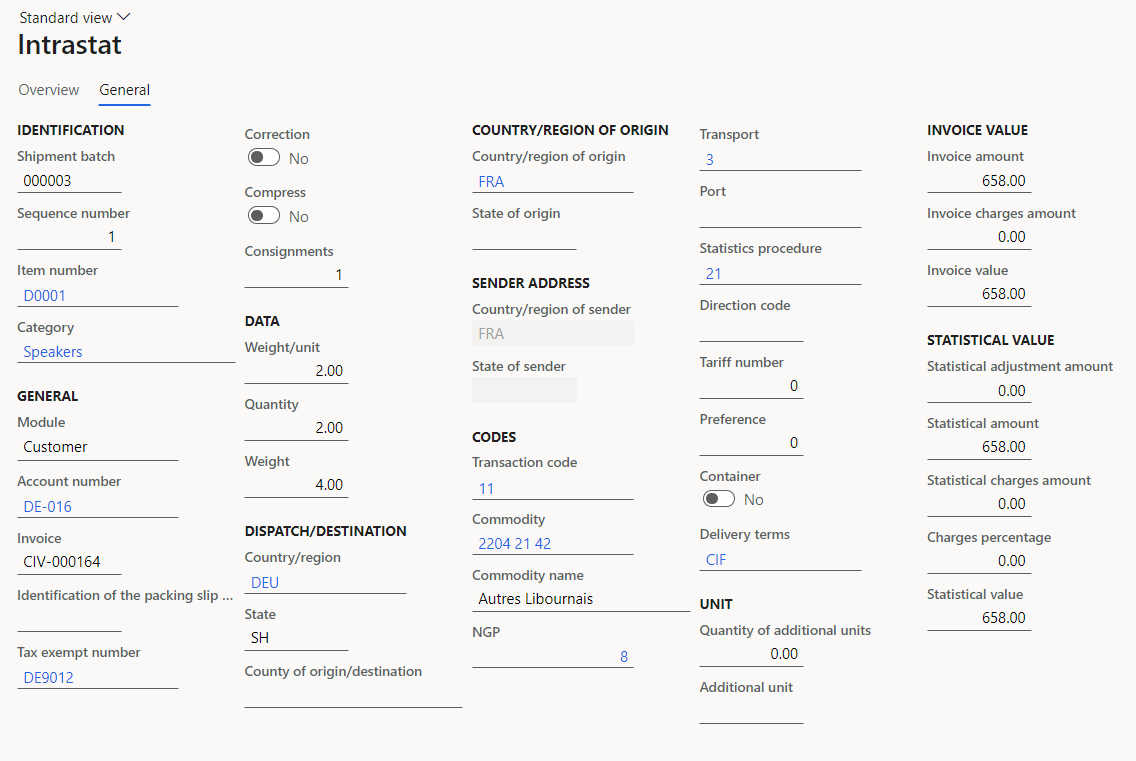

Select the transaction line, and then select the General tab to view more details.

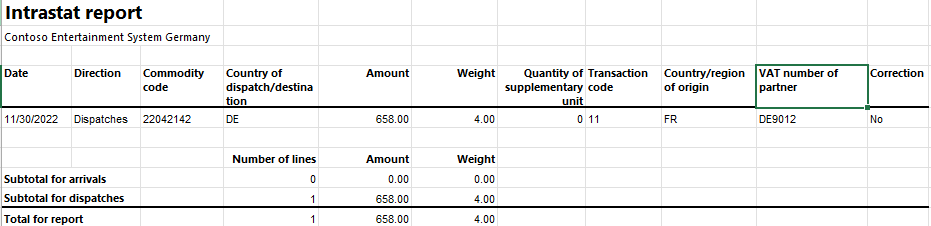

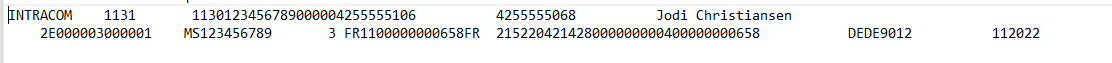

On the Action Pane, select Output > Report.

In the Intrastat Report dialog box, on the Parameters FastTab, in the Date section, select the month of the sales order that you created.

In the Export options section, set the Generate file option to Yes.

In the File name field, enter the required name.

Select OK to close the Intrastat Report dialog box.

In the Electronic report parameters dialog box, on the Parameters FastTab, in the Report level field, select 5 - statistical response to shipment and tax declaration, and review the report.

Review the generated Excel report.