New Financial Services OBA

My visit to Australia had many surprises. One was a new OBA that was developed by one of our partners Dataract. This is truly a "Diamond in the Rough". I have to give them a "plug" because they are offering a great new OBA that leverages both our MOSS platform and the financial services vertical business processes. Look for them on OBA Central as well, they will be added shortly.

Dataract is a smaller Australian ISV that focuses on primarily on Workflow and .Net 3.0 development. There claim to fame is not necessarily augmenting WF but rather building the business processes and surfacing them through OBA's.

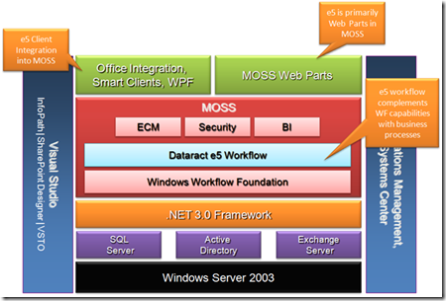

They have built both a Lending OBA and an Insurance OBA. Craig van Zeyl (CEO of Dataract) and I were both speakers at the Financial Services Roundtables in Sydney. They have a strong commitment to the OBA architecture paradigm. From what I seen of the product they are following "lock-step" with our strategy moving forward. As you can see below the architecture is in line with the OBA strategy. They are web parts and office integration extensively.

Within WF they augment it with their business rules as well. Making it less about development and more about configuration.

It was also good to see them focus on the Financial Services vertical. This is a key for them as a company. They can offer a great framework + business processes further accelerating the business. This is what OBA's are all about!

Dataract shared with me a scalability test between them, Intel and HP which resulted in:

- e5 configured to support administrative workflow across 5 departments within a single organization

- MOSS document libraries contained a total of 7 million in-process scanned documents

- e5 database contained 7 million active work items

- 1000 administrative users, with 2 – 10 minute work completion rates simulating real world processing scenarios

Tags: OBA

Comments

- Anonymous

August 20, 2007

PingBack from http://msdnrss.thecoderblogs.com/2007/08/20/new-financial-services-oba/