Extending the OR-LOS Lending Framework

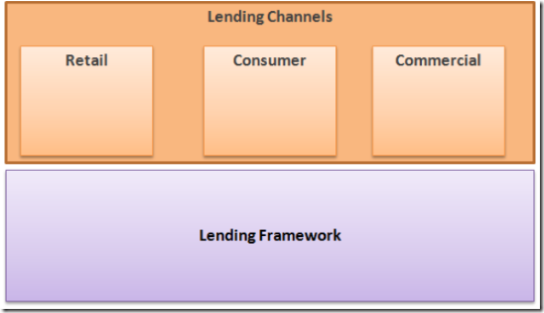

I get asked all the time, is this just for consumer mortgage? The answer is, no. The OR-LOS solution provides a robust lending framework that can be used to unite the lending channels and reach into other processes in the bank.

As shown below the base OR-LOS architecture is expected to be extended. OR-LOS was architected in a manner that allows for multi-channel integration. OR-LOS ensures this by providing an architecture that can clearly separate business functionality into one management system. Thus, we can still keep specific implementation of rules separate to the channel it belongs but also re-use those rules and invoke them in other manners of other channels.

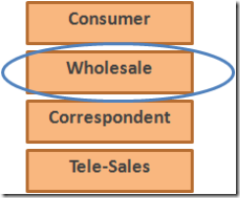

You hear me talk a bit about consumer mortgage when I present OR-LOS. The rational for this is that consumer lending relates to so many people. When developing the solution it was important not to build yet another framework. I wanted to make sure we have a set of business scenarios that we expose.

As I thought through this I decided to pick a lending channel that exposed a set of scenarios to make this designate with the FSI community. So I picked the consumer channel that has many sub channels.

As a result of this architecture I have helped lead several other projects to extend this architecture.

- Loan Origination will now be part of the Industry Priority Solution Scenario sets for Financial Services. This means that you will get more and more support for lending solutions in the future.

- MCS has built a practice around OR-LOS and created a set of assets that will significantly help your lending operations.

- Finally, we have increased participation with the industry standards such as MISMO

Comments

Anonymous

July 23, 2007

This past week seems to be the week for the call to action for Enterprise Architects to start blogging.Anonymous

December 28, 2007

I am very excited to announce that we have finally released the Virtual Lab for The Microsoft LendingAnonymous

December 28, 2007

I am very excited to announce that we have finally released the Virtual Lab for The Microsoft Lending