German Intrastat

The Intrastat page is used to generate and report information about trade among European Union (EU) countries/regions. The German Intrastat declaration contains information about the trade of goods for reporting. The report is formatted according to the guidelines of the German authorities.

The following table shows the fields that are included in the German Intrastat declaration.

| Fields | Dispatches | Arrivals |

|---|---|---|

| Reference period | X | X |

| Direction code | X | X |

| Currency of the Intrastat declaration Note: This currency is the accounting currency. |

X | X |

| Commodity code | X | X |

| Commodity name | X | X |

| Supplementary unit code | X | X |

| Member State of consignment/destination | X | X |

| Net mass | X | X |

| Quantity in supplementary units | X | X |

| Country of origin | X | |

| Invoice amount | X | |

| Statistical value | X | X |

| Nature of transactions | X | X |

| Mode of transport | X | X |

| Region code Note:

|

X | X |

| Port/Airport/Inland port code | X | X |

| Delivery terms | X | X |

Set up Intrastat

Set up the company's codes.

- Go to Organization administration > Organizations > Legal entities.

- On the Foreign trade and Logistics FastTab, in the Identification section, in the DVR field, enter the Interchange agreement ID. This ID will be included on the report.

- In the VAT exempt number export field, enter your company's value-added tax (VAT) number for export.

- In the VAT exempt number import field, enter your company's VAT number for import.

- In the Intrastat code field, enter the Intrastat code that is assigned to the legal entity.

- On the Tax registration FastTab, in the Tax registration number field, enter your company's tax registration number.

Note

If you generate an Intrastat report for affiliates, in the Tax registration number field, enter the tax registration number of your parent company.

In Microsoft Dynamics Lifecycle Services (LCS), in the Shared asset library, download the latest versions of the following Electronic reporting (ER) configurations for the Intrastat declaration.

- Intrastat model

- Intrastat report

- INSTAT XML

- INSTAT XML (DE)

Set up foreign trade parameters:

In Dynamics 365 Finance, go to Tax > Setup > Foreign trade parameters.

On the Intrastat tab, on the Electronic reporting FastTab, in the File format mapping field, select Intrastat XML (DE).

In the Report format mapping field, select Intrastat report.

On the Commodity code hierarchy FastTab, in the Category hierarchy field, select Intrastat.

In the Transaction code field, select the transaction code for property transfers. You use this code for transactions that produce actual or planned transfers of property against compensation (financial or other). You also use it for corrections.

In the Credit note field, select the transaction code for the return of goods.

In the Worker field, select the contact person for Intrastat report. Alternatively, on the Contact tab enter or select values in the Name, Telephone, Fax, Email, and Internet address fields. These fields are included in the report.

In the Authority field, select the Intrastat authority.

Go to Tax > Indirect taxes > Sales tax > Sales tax authorities, and enter the following information for the Intrastat authority that you selected in the previous step:

- Authority identification

- Address

- Contact information

On the Country/region properties tab, in the Country/region field, list all the countries or regions that your company does business with. For each country or region, in the Country/region type field, select EU, so that the country or region appears on your Intrastat report.

Set up region codes.

- Go to Organization administration > Global address book > Addresses > Address setup.

- On the State/province tab, in the Country/region field, select DEU, and then select Apply filter.

- In the grid, select the state. Then, in the Intrastat code field, enter the unique Intrastat code.

Set up the address of origin for a product.

- Go to Product information management > Products > Released products.

- In the grid, select the product.

- On the Foreign trade FastTab, in the Intrastat section, in the Country of origin field, select DEU.

Go to Tax > Setup > Foreign trade > Compression of Intrastat, and select the fields that should be compared when Intrastat information is summarized. For German Intrastat, select the following fields:

- Commodity

- Country/region

- Correction

- Direction

- Delivery terms

- Invoice

- Country/region of origin

- Port

- Country/region of sender

- State of sender

- Statistical procedure

- Transaction code

- Transport

- Tax exempt number

Intrastat transfer

On the Intrastat page, on the Action Pane, select Transfer to automatically transfer the information about intracommunity trade from your sales orders, free text invoices, purchase orders, vendor invoices, vendor product receipts**,** project invoices, and transfer orders. Only documents that have an EU country as the country or region of destination (for dispatches) or consignment (for arrivals) will be transferred.

Alternatively, you can manually enter transactions by selecting New on the Action Pane.

Generate an Intrastat report

Go to Tax > Declarations > Foreign trade > Intrastat.

On the Action Pane, select Output > Report.

In the Intrastat Report dialog box, set the following fields.

Field Description From date Select the start date for the report. To date Select the end date for the report. Generate file Set this option to Yes to generate an .xml file. File name Leave this field blank. The file name is automatically generated and consists of the value of the <envelopeId> XML tag plus the file name extension .xml.

The <envelopeId> value is a concatenation of the following elements, in this order:- The value of the <interchangeAgreementId> tag

- A hyphen (-)

- The value of the <referencePeriod in YYYYMM> tag

- A hyphen (-)

- The value of the <Envelope/DateTime/date in YYYYMMDD> tag

- A hyphen (-)

- The value of the <Envelope/DateTime/time in hhmm> tag

Direction - Select Arrivals to report on intracommunity arrivals.

- Select Dispatches to report on intracommunity dispatches.

- Select Both to report on both arrivals and dispatches.

Tax registration number Enter the registration number to use to generate the identification code of the sender, if the number differs from the tax registration number of the legal entity.

Example

This example shows how to post arrivals and dispatches for Intrastat. It uses the DEMF legal entity.

In LCS, in the Shared asset library, download the latest versions of the following ER configurations for the Intrastat declaration format:

- Intrastat model

- Intrastat report

- Intrastat XML

- Intrastat XML (DE)

Create transaction codes.

- Go to Tax > Setup > Foreign trade > Transaction codes.

- On the Action Pane, select New.

- In the Transaction code field, enter 21.

- In the Name field, enter Return of goods.

- On the Action Pane, select Save.

Set up the authority identification number.

- Go to Tax > Indirect taxes > Sales tax > Sales tax authorities.

- In the list, select TA.

- In the Authority identification field, enter 123.

Set up region codes.

- Go to Organization administration > Global address book > Addresses > Address setup.

- On the State/province tab, in the Country/region field, select DEU, and then select Apply filter.

- In the grid, select BE, and then, in the Intrastat code field, enter 11.

- On the Action Pane, select Save.

Set up foreign trade parameters.

- Go to Tax > Setup > Foreign trade > Foreign trade parameters.

- On the Intrastat tab, on the General FastTab, in the Transaction code field, select 11.

- In the Credit note field, select 21.

- In the Authority field, select TA.

- On the Electronic reporting FastTab, in the File format mapping field, select INSTAT XML (DE).

- In the Report format mapping field, select Intrastat Report.

- On the Commodity code hierarchy FastTab, in the Category hierarchy field, make sure that Intrastat is selected.

- On the Country/region properties tab, select New.

- In the Party country/region field, select FRA.

- In the Country/region type field, select EU.

Assign a commodity code to a product, and set the product's origin. The Commodity code, Country/region of origin, and State of origin fields will then automatically be set on sales orders and purchase orders when you select the product.

- Go to Product information management > Products > Released products.

- In the grid, select D0001.

- On the Foreign trade FastTab, in the Intrastat section, in the Commodity field, select 920 20 34.

- In the Origin section, in the Country/region field, select DEU.

- On the Manage inventory FastTab, in the Weight measurements section, in the Net weight field, enter 12.

- On the Action Pane, select Save.

Assign transport to a mode of delivery. The transport code will then automatically be set on orders when you select the mode of delivery.

- Go to Procurement and sourcing > Setup > Distribution > Modes of delivery.

- In the list, select 10.

- On the Foreign trade FastTab, in the Transport field, select 01.

Create a sales order with an EU customer.

- Go to Accounts receivable > Orders > All sales orders.

- On the Action Pane, select New.

- In the Create sales order dialog box, on the Customer FastTab, in the Customer section, in the Customer account field, select DE-012.

- On the General FastTab, in the Storage dimensions section, in the Site field, select 1.

- In the Warehouse field, select 11.

- Select OK.

- On the Header tab, on the Foreign trade FastTab, in the Port field, select 53.

- In the Statistical procedure field, select 31710.

- On the Lines tab, on the Sales order lines FastTab, in the Item number field, select D0001. Then, in the Quantity field, enter 10.

- On the Line details FastTab, on the Foreign trade tab, make sure that the Transaction code, Transport, Commodity, and Country/region of origin fields are automatically set.

- On the Action Pane, select Save.

- On the Action Pane, on the Invoice tab, in the Generate section, select Invoice.

- In the Posting invoice dialog box, on the Parameters FastTab, in the Parameter section, in the Quantity field, select All.

- Select OK to post the invoice.

Transfer the transaction to the Intrastat journal, and review the result.

Go to Tax > Declarations > Foreign trade > Intrastat.

On the Action Pane, select Transfer.

In the Intrastat (Transfer) dialog box, in the Parameters section, set the Customer invoice option to Yes.

Select Filter.

In the Intrastat Filter dialog box, on the Range tab, select the first line, and make sure that the Field field is set to Date.

In the Criteria field, select the current date.

Select OK to close the Intrastat Filter dialog box.

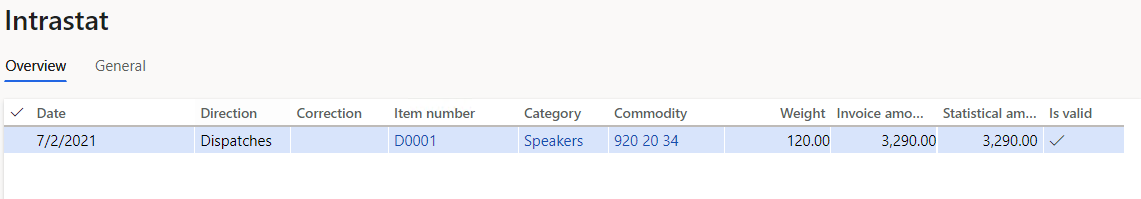

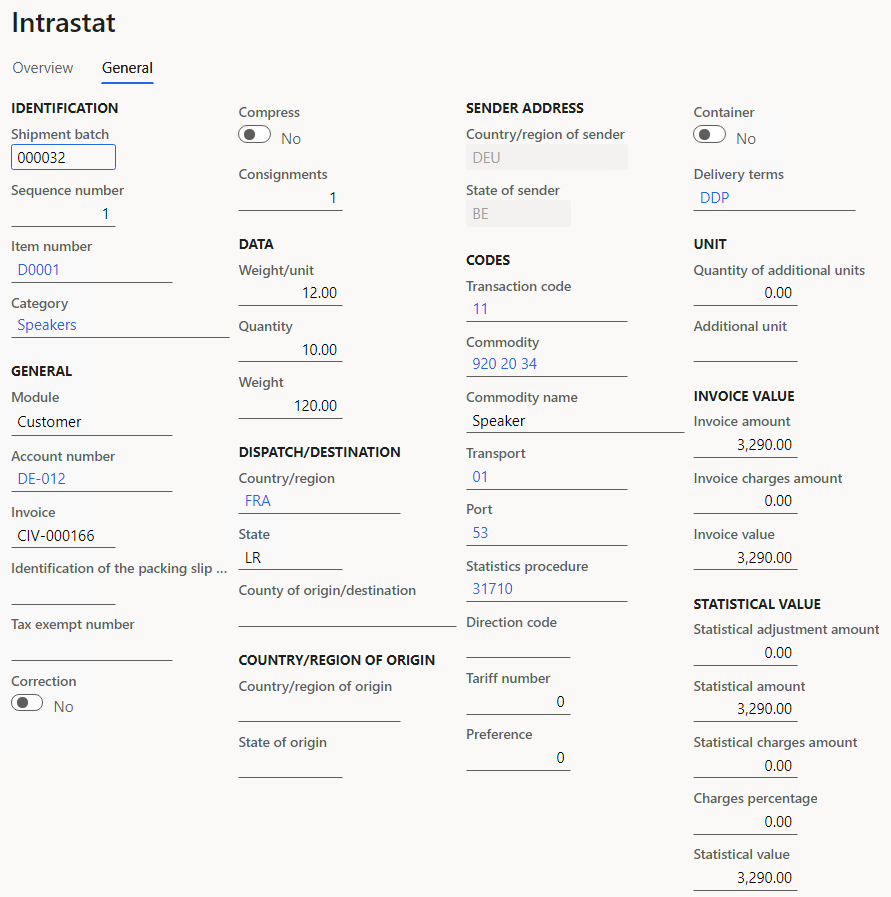

Select OK to close the Intrastat (Transfer) dialog box, and review the result. The line represents the sales order that you created earlier.

Select the transaction line, and then select the General tab to view more details.

Create a credit note by using a sales order.

- Go to Accounts receivable > Orders > All sales orders.

- On the Action Pane, select New.

- In the Create sales order dialog box, on the Customer FastTab, in the Customer section, in the Customer account field, select DE-012.

- On the General FastTab, in the Storage dimensions section, in the Site field, select 1.

- In the Warehouse field, select 11.

- On the Header tab, on the Foreign trade FastTab, in the Port field, select 53.

- In the Statistical procedure field, select 31710.

- On the Lines tab, on the Sales order lines FastTab, in the Item number field, select D0001. Then, in the Quantity field, enter -2.

- On the Line details FastTab, on the Foreign trade tab, in the Transaction code field, select 21.

- Make sure that the Transport, Commodity, and Country/region of origin fields are automatically set.

- On the Action Pane, select Save.

- On the Action Pane, on the Invoice tab, in the Generate section, select Invoice.

- In the Posting invoice dialog box, on the Parameters FastTab, in the Parameter section, in the Quantity field, select All.

- Select OK to post the invoice.

Transfer the transaction to the Intrastat journal, and review the result.

Go to Tax > Declarations > Foreign trade > Intrastat.

On the Action Pane, select Transfer.

In the Intrastat (Transfer) dialog box, in the Parameters section, set the Customer invoice option to Yes.

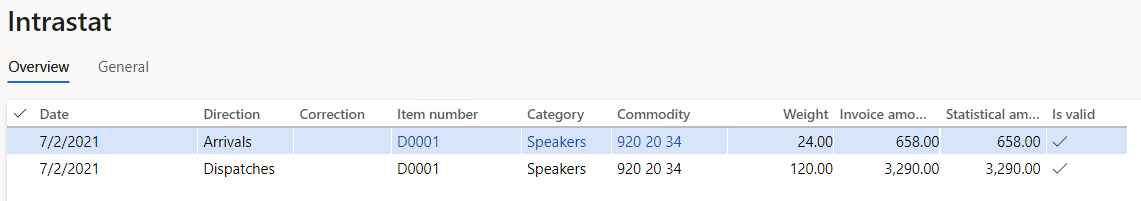

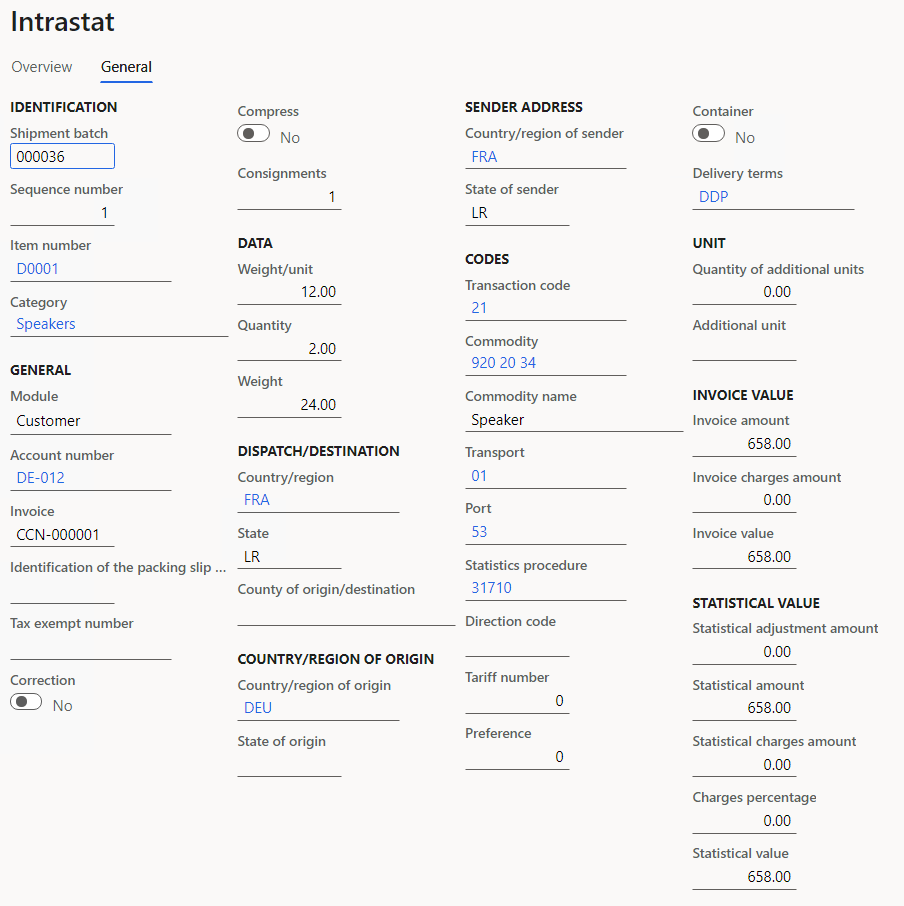

Select OK to close the Intrastat (Transfer) dialog box, and review the result. A new line where the Direction field is set to Arrivals has been added.

This line represents the physical return of goods.

Select the transaction line, and then select the General tab to view more details.

Create a correction by using a sales order:

- Go to Accounts receivable > Orders > All sales orders.

- On the Action Pane, select New.

- In the Create sales order dialog box, on the Customer FastTab, in the Customer section, in the Customer account field, select DE-012.

- On the General FastTab, in the Storage dimensions section, in the Site field, select 1.

- In the Warehouse field, select 11.

- On the Header tab, on the Foreign trade FastTab, in the Port field, select 53.

- In the Statistical procedure field, select 31710.

- On the Lines tab, on the Sales order lines FastTab, in the Item number field, select D0001. Then, in the Quantity field, enter -3.

- On the Line details FastTab, on the Foreign trade tab, in the Transaction code field, select 11.

- Make sure that the Transport, Commodity, and Country/region of origin fields are automatically set.

- On the Action Pane, select Save.

- Make sure that the Transaction code field is set to 11.

- On the Action Pane, on the Invoice tab, in the Generate section, select Invoice.

- In the Posting invoice dialog box, on the Parameters FastTab, in the Parameter section, in the Quantity field, select All.

- Select OK to post the invoice.

Transfer the transaction to the Intrastat journal, and review the result:

Go to Tax > Declarations > Foreign trade > Intrastat.

On the Action Pane, select Transfer.

In the Intrastat (Transfer) dialog box, in the Parameters section, set the Customer invoice option to Yes.

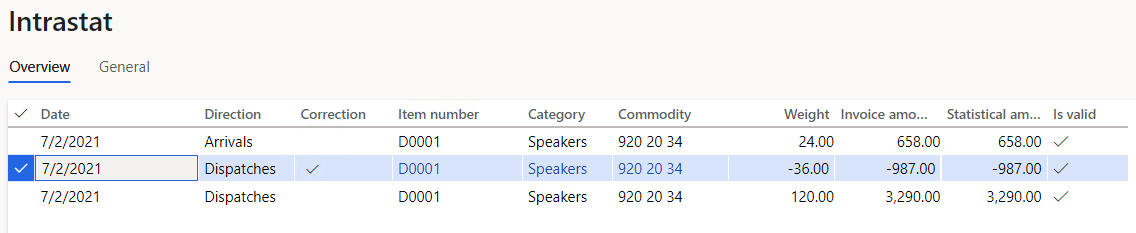

Select OK to close the Intrastat (Transfer) dialog box, and review the result. A new line where a check mark appears in the Correction column has been added.

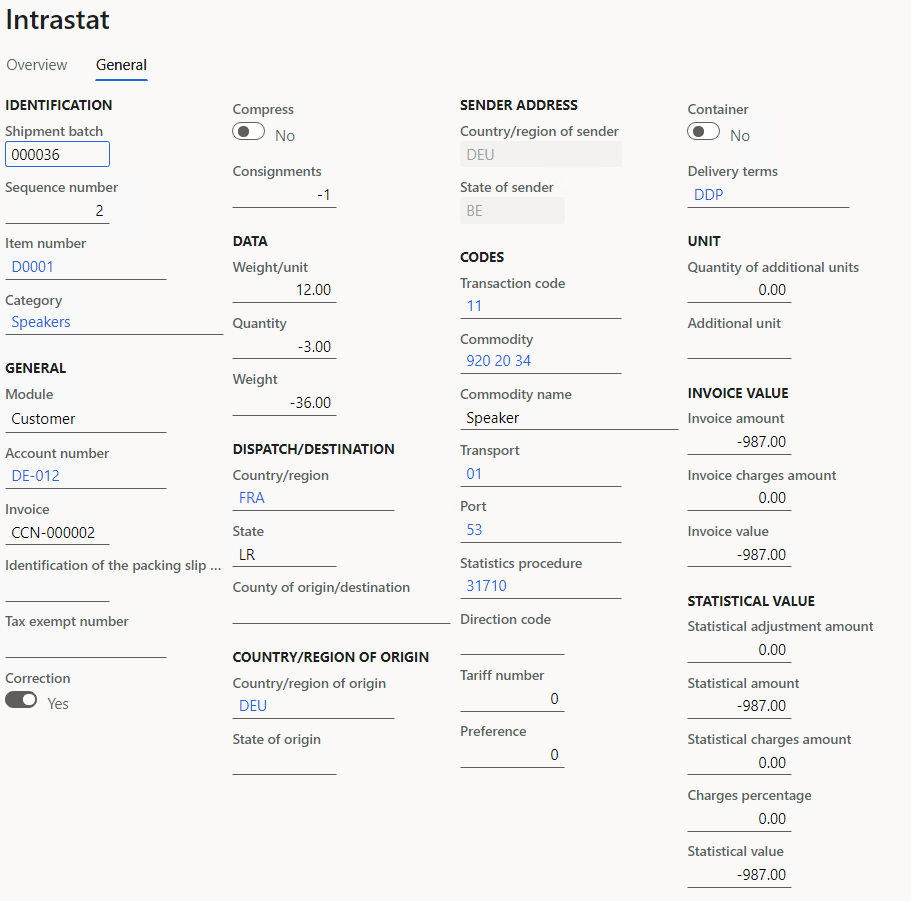

Select the transaction line, and then select the General tab to view more details.

On the Action Pane, select Output > Report.

In the Intrastat Report dialog box, on the Parameters FastTab, in the Date section, select the month of the sales order that you created.

In the Export options section, set the Generate file option to Yes.

In the File name field, enter the required name.

Select OK, and review the report that is generated. The following table shows the values in the example report.

Name Sales invoice Correction Credit note declarationId 2021-07-D 2021-07-A referencePeriod 2021-07 2021-07 PSIId 11203/118/12345000 11203/118/12345000 functionCode O O flowCode D A CurrencyCode EUR EUR itemNumber 0000362 0000362 0000361 CN8Code 9202034 9202034 9202034 goodsDescription Speaker Speaker Speaker MSConsDestCode FR FR FR countryOfOriginCode - - DE netMass 120 -36 24 invoicedAmount 3290 -987 - StatisticalValue 3290 -987 658 natureOfTransactionACode 1 1 2 natureOfTransactionBCode 1 1 1 modeOfTransportCode 01 01 01 regionCode 11 11 11 portAirportInlandportCode 53 53 53