UK VAT Rate Changes and How to deal with them in Office Accounting

As you may have seen in the news and as reported on the HMRC website, the standard VAT rate will be lowered temporarily by the government: “ In his Pre-Budget Report on 24 November 2008 the Chancellor announced that the standard rate of VAT will be reduced to 15% on 1 December 2008.”

The government has posted a number of FAQ documents. See the post here: https://www.hmrc.gov.uk/pbr2008/measure1.htm.

Being a user of Office Accounting, how do you deal with this?

Fortunately Office Accounting was designed with changing VAT rates in mind. This is what you do:

1. Open your company.

2. On the Company menu, select VAT, Manage VAT Codes, or as an alternative, select Preferences on the Company menu, select the VAT tab and click on the VAT Codes button.

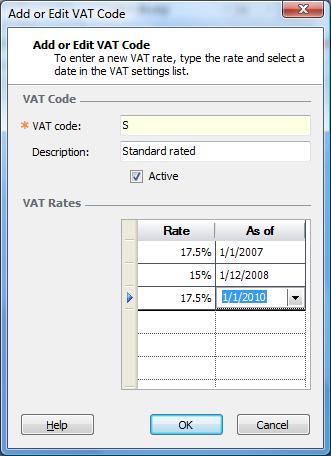

3. Select VAT code S (Standard rated), Click Edit.

4. In the VAT Rates section add two lines: 15% as of 1. December 2008 and 17.5% as of 1. January 2010. Click OK.

5. You are now ready for the VAT change. Your VAT return will be calculated correctly regardless of whether you are using the cash accounting scheme as long as you use the correct dates for the sales and purchase invoices.

The next time the VAT rate changes, just add an additional line to deal with that.

So you may ask - why don't I just change the existing rate? Well, having multiple rates are better as they will handle backdated transactions correctly.

Comments

- Anonymous

November 29, 2008

The comment has been removed