Accounts receivable analytics

To help you manage accounts receivable, Business Central offers standard reports and analytics tools. You can also design various types of reports yourself, such as Power BI, Data Analysis, or Excel.

Analyze accounts receivable with Power BI

The Power BI Finance app has multiple reports for accounts receivable.

| To... | Open in Business Central (CTRL+select) | Learn more |

|---|---|---|

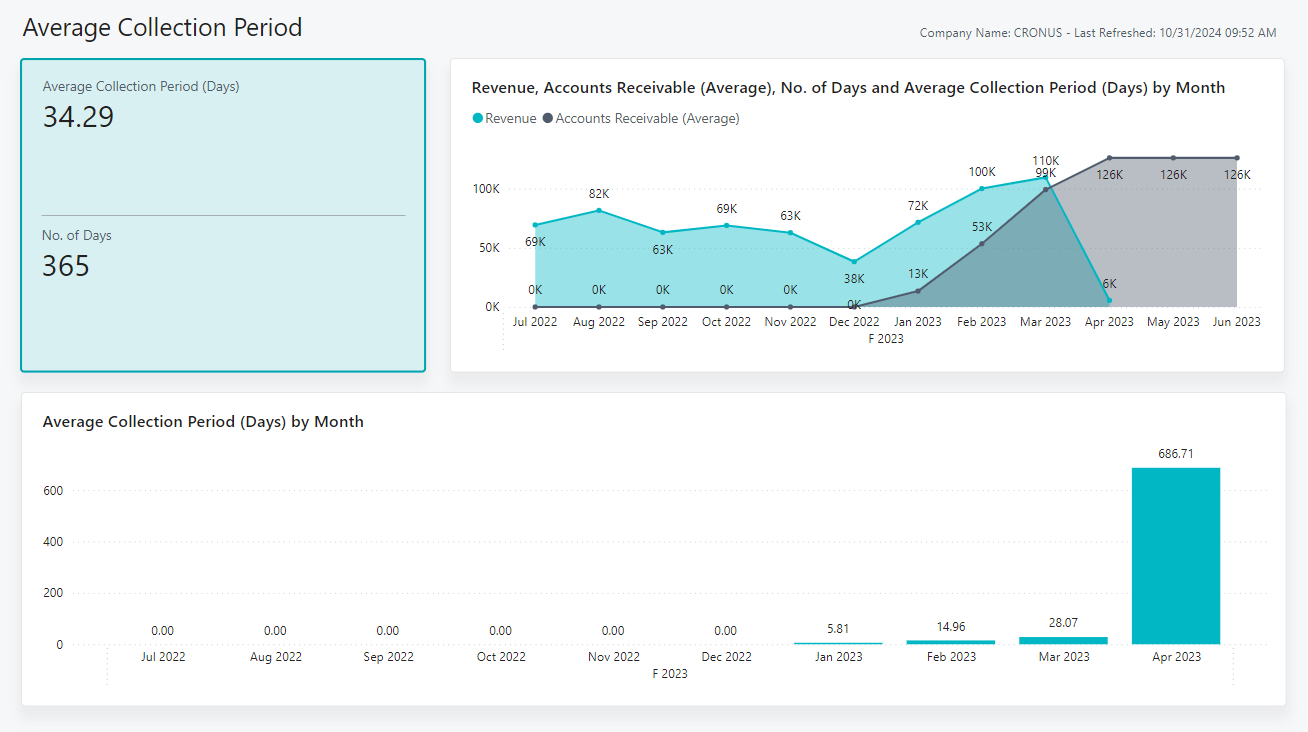

| Analyze how many days it takes to collect accounts receivable. Find trends in the average collection period over time. Details such as the number of days, accounts receivable, and accounts receivable (average) provide context and enhance the analysis. | Average Collection Period | About Average Collection Period |

| Categorize customer balances into aging buckets and see a breakdown by payment terms. Age by document date, due date, or posting date, and customize the aging bucket size by specifying the number of days. | Aged Receivables (Back Dating) | About Aged Receivables (Back Dating) |

To learn more, go to Power BI finance app.

Analyze accounts receivable with Data Analysis

You can use Data Analysis on the Customer Ledger Entries page to explore what your customers owe you. You can break down the information into time intervals for when amounts are due.

To learn more, go to Using data analysis to analyze accounts receivable.

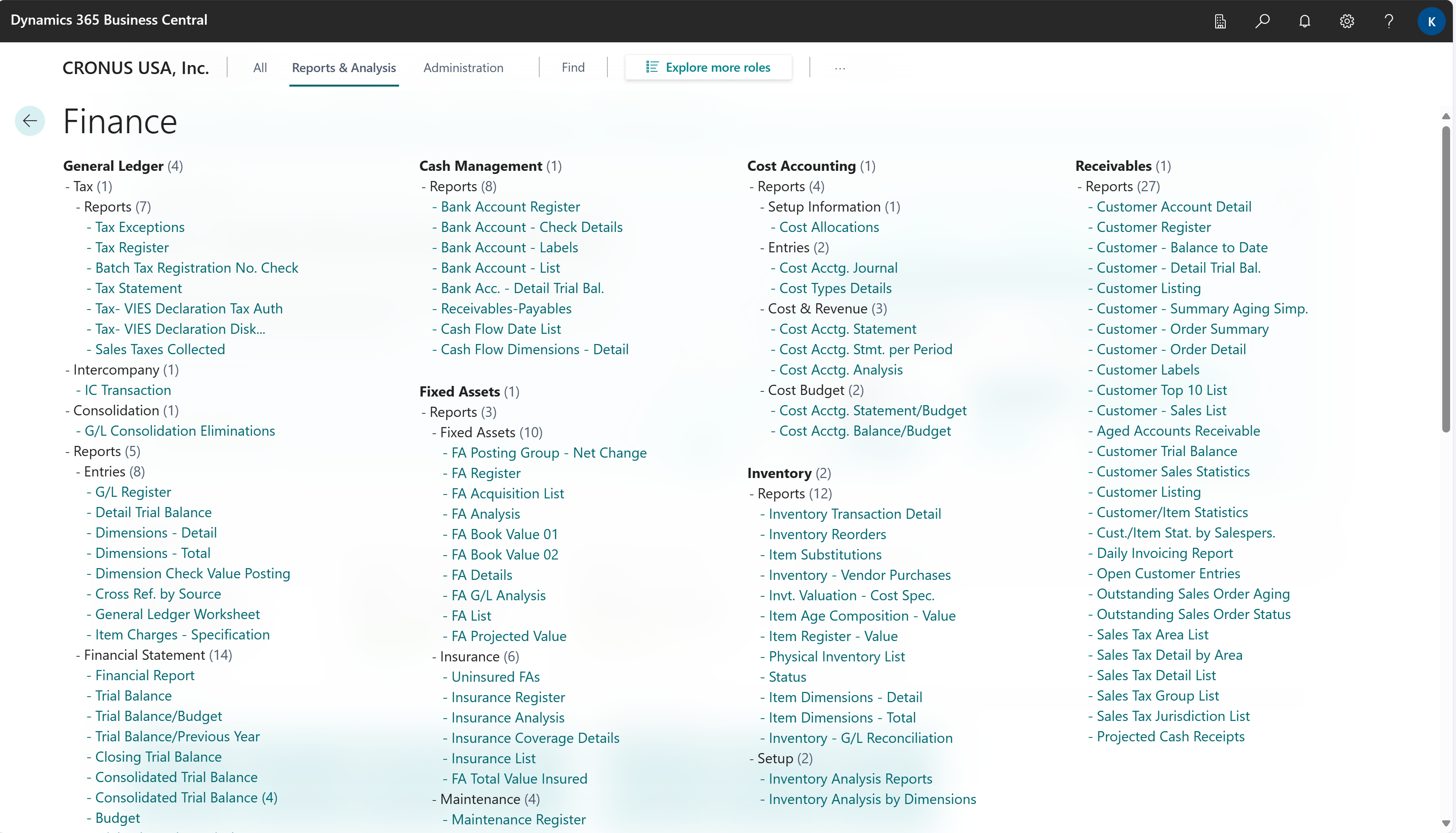

Explore finance reports with Report Explorer

To get an overview of the reports that are available for finance, choose All Reports on your Home page. This action opens the Role Explorer, which is filtered to the features in the Report & Analysis option. Under the Finance heading, choose Explore.

To learn more, go to Finding pages and reports with the role explorer.

Accounts receivable report overview

The following table describes some of the key reports in accounts receivable. The reports are designed to help different roles in finance and collections departments make informed decisions.

| To... | Open in Business Central (CTRL+select) | Learn more | ID |

|---|---|---|---|

| Analyze customer balances at the end of each period, either in local or in foreign currency. Use as a gauge to measure the reliability of debt collections for your customers. Easily reconcile the customer subledger against the receivables accounts in the general ledger, assuming that direct posting is disabled. | Aged Accounts Receivable (Excel) | About Aged Accounts Receivable (Excel) | 4402 |

| Review customers with the most transactions in a selected period directly in Excel. Identify sales trends and manage debt collections. | Customer - Top list Excel | About Customer - Top list Excel | 4409 |

| Get an overview of basic information for your customers. | Customer List | About Customer List | 101 |

| Check whether all entries for a specific customer are accounted for, or for other internal checks on customer ledgers. | Customer - Detail Trial Balance | About Customer - Detail Trial Balance | 104 |

| Analyze unshipped orders to understand your expected sales volume. Forecast your monthly sales revenue. | Customer - Order Summary | About Customer - Order Summary | 107 |

| Analyze outstanding sales orders and understand expected sales volumes for customers. Compare your overall outstanding shipments with the planned shipment date and find overdue back orders. | Customer - Order Detail | About Customer - Order Detail | 108 |

| Analyze earnings from an individual customer or trends in earnings. | Sales Statistics | About Sales Statistics | 112 |

| Analyze item sales per customer to understand sales trends, optimize inventory management, and improve marketing efforts. Assess the relationship between discounts, sales amounts, and volume of item sales. | Customer/Item Sales | About Customer/Item Sales | 113 |

| Generate customer statements to get a clear summary of amounts due. You can share the amounts with customers to follow up on payments. For example, if you need to close an accounting period or fiscal year. | Customer - Balance to Date | About Customer - Balance to Date | 121 |

| Analyze and reconcile customer balances at the end of a period. Explore opening balances, transactions within the period, and closing balances for customers. | Customer Trial Balance | About Customer Trial Balance | 129 |

| Send a report to customers who want documentation for receipt of payment. | Customer - Payment Receipt | About Customer - Payment Receipt | 211 |

| Send customers an overview of outstanding amounts, and also use as a payment reminder about overdue amounts. | Customer Statement | About Customer Statement | 1316 |

| This is a legacy version of an accounts receivables aging report. We recommend you use the Aged Accounts Receivables Excel report instead. | Customer - Summary Aging Simp. | About Customer - Summary Aging Simp. | 109 |

| This is a legacy version of an accounts receivables aging report. We recommend you use the Aged Accounts Receivables Excel report instead. | Aged Accounts Receivables (Legacy) | About Aged Accounts Receivables (Legacy) | 120 |

| This report is a legacy report for sales analysis. See report documentation for alternatives. | Customer - Top 10 list | About Customer - Top 10 list | 111 |

Related information

Using data analysis to analyze accounts receivable

Power BI finance app

Financial analytics

Sales analytics

Accountant Experiences in Dynamics 365 Business Central