Knowledge is Power: To Sell or To Rent My House? Calculator provided…

I created an application that allows you to calculate and compare the future estate value given two scenarios:

- Sell a house and reinvest the proceeds at a fixed percentage for specified number of years and re-investing earned interest

- Keep the house, and invest the cash flow from rent minus expenses

The code accounts for capital gains taxes paid annually, income tax from rent paid quarterly, property tax paid annually, and management fees paid monthly. It also deducts the property taxes and management fees from the amount used to calculate income tax.

The application is provided as an attachment to this post and was written in .NET 2.0 C#.

Important Disclaimer: I created this application in the matter of couple of hours, so it may have some bugs. If you find any, feel free to report them via feedback entry.

Usage instructions:

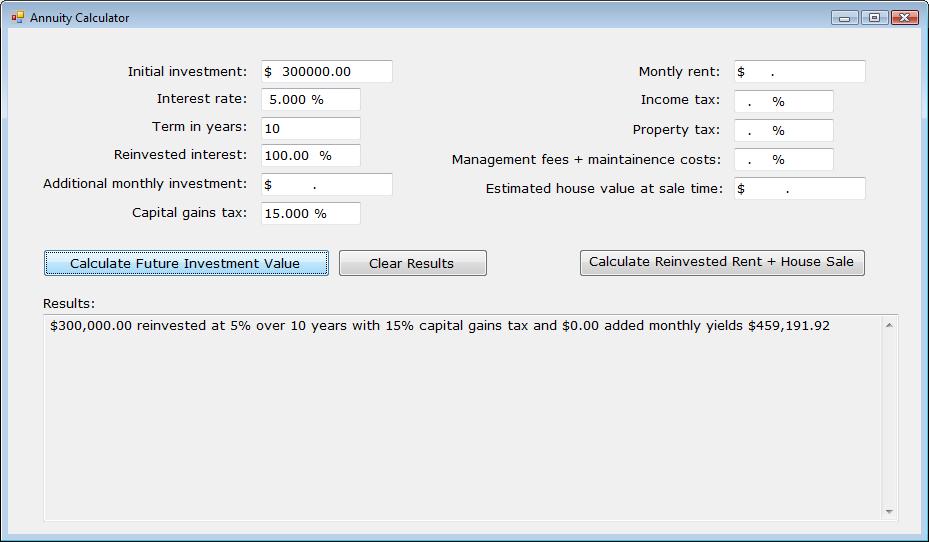

1. Fill out the left column and press ‘Calculate Future Investment Value’ button. This is your ‘sell the house’ scenario.

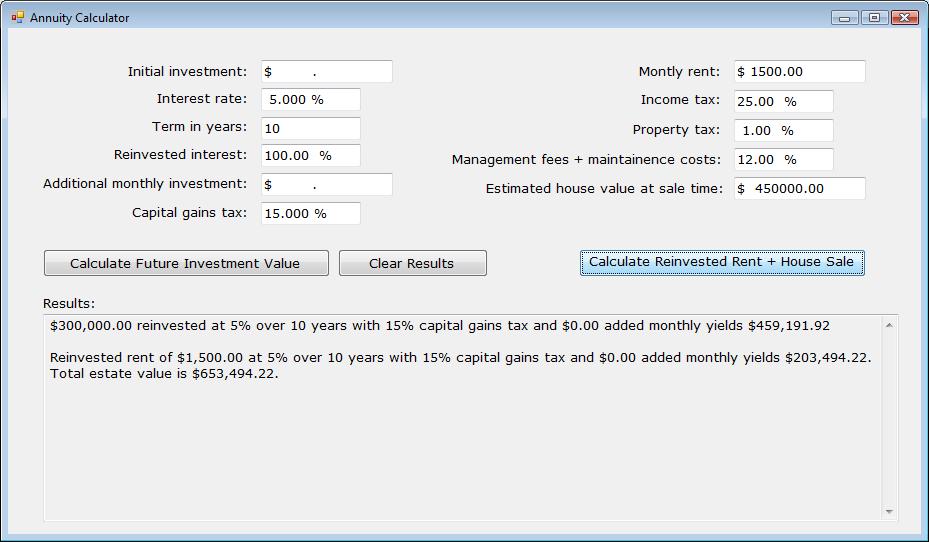

2. Fill out the right hand column (this is your ‘keep the house’ scenario) and modify the left hand column as needed. Note: if you have a mortgage, subtract it from the monthly rent amount. Click on ‘Calculate Reinvested Rent + House Sale’ button:

Have fun! But even more importantly, make smart financial decisions J

Comments

Anonymous

April 11, 2007

http://www.nytimes.com/2007/04/10/business/2007_BUYRENT_GRAPHIC.htmlAnonymous

April 18, 2007

Don't forget additional benefits of RE:

- Property taxes are themselves tax deductable as is the interest and insurance.

- Depreciation (within limitations) can be written off against active income, or accumulated until the time of sale.

- Principal paid off over the course of the mortgage term should be taken into account as well.

- Instead of selling the house and paying capital gains, the investor could just refinance the house pulling money out of it...LOANS are non-taxable. If possible, it is almost always better to cash-out refinance than to sell.

- With a rental, it is pretty much always someone else's money (the renter) that is accomplishing this instead of your own...with the exception, perhaps, of the initial down payment and closing costs.

- Income from rent (aka passive income) is not paid on a quarterly basis. Being passive and not active (like interest or stock dividends) means no quarterly drudgery, and because depreciation writeoffs are usually much larger than rent income - expenses, any extra is essentially "free" money. That's why "Real Estate" literally is the last poor man's tax shelter.

- Anonymous

April 18, 2007

The application takes into account the property tax deduction, but not interest or insurance.