What's new or changed for India GST in 10.0.03 (June 2019)

This article includes a summary of the new features and critical bug fixes released in Dynamics 365 Finance version 10.0.03 for India GST localization.

New features and updates

GST solution document is updated

Updates have been made to the following article, India Goods and Services Tax (GST) overview.

GSTR report performance improvement

GSTR report generation time reduced 30% because of the replacement of line-by-line data fetch with dataset operation.

Delete the selected (multiple) tax lookup condition record

In addition to deleting one or all records, you can now delete multiple selected records.

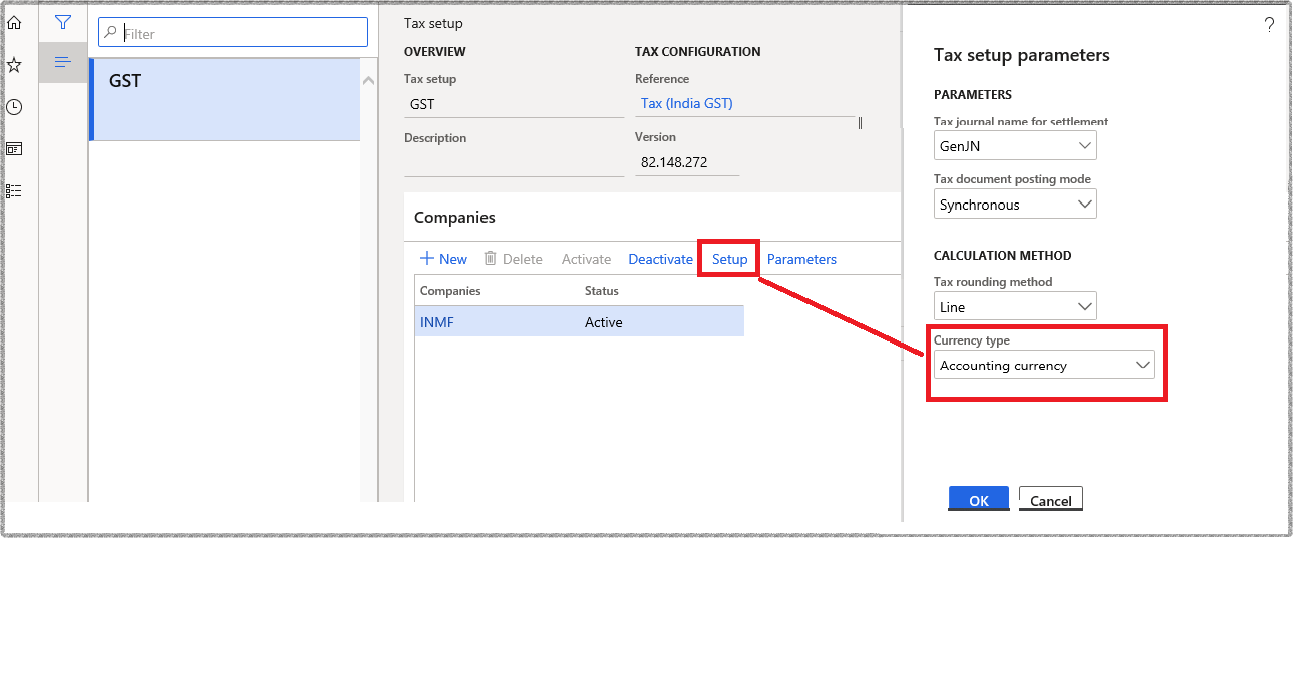

Enable tax calculation based on the accounting currency for import and export orders

For more information about calculating tax in the accounting currency for import and export orders, see What's new or changed in finance and operations version 10.0.3 (June 2019).

Use Tax transaction inquiry

With the release of 10.0.04, use the Tax transaction inquiry functionality for TDS/TCS instead of post withholding tax.

Critical fixes

When you create an export order, there is Basic Custom Duty (BCD) and Social Welfare Surcharge (SWS). When the export order is posted, only BCD is posted. The following configurations are needed to resolve this issue:

- Taxable Document .version.81.xml

- Taxable Document (India) .version.81.138.xml

- Tax (India GST) .version.81.138.248.xml

GST-related accounts are posted without financial dimensions in the project invoice proposal.

The subtotal amount value is incorrect on the Adjustment page for settling and posting sales tax.

The adjusted withholding tax origin amount isn't reflected on the Posted withholding tax inquiry page.

Adjust project transactions isn't working properly.

The invoice amount is incorrect in the Invoice journal report when posted through an invoice journal with TDS.

The Tax column isn't updated with the tax value in the Invoice journal report.

The delivery address does not populate on the Tax information page for the sales order lines.

HSN or SAC code isn't editable in the tax information sales return order after delivery.

Can't post a free text invoice (FTI) and confirm the purchase order because one or more accounting distributions are over distributed.

Assessable value isn't updated in a sales order after the Personalized field is updated.

Charges on the header level don’t calculate the sales tax amount for the India entity.

The invoice number doesn't show in the posted withholding tax inquiry after posting the Withholding tax adjustment journal.

Upcoming fixes in 10.0.4

- GSTR-2 mismatch in figures when the invoice journal is posted with a multi-line transaction.

- Standard sales tax doesn't get calculated in Accounts payable.

- Proforma invoices consume a number from the invoice number sequence.