Vendor advance payments where there are reverse charges

- Go to Accounts payable > Payments > Vendor Payment journal.

- Create a record.

- In the Name field, select a value.

- Select Lines.

- Create a vendor advance payment journal, and then save the record.

- Select Tax information.

- On the GST FastTab, in the HSN code field, select a value.

- Select the Vendor tax information FastTab.

- Select OK.

Validate the tax details

On the Action Pane, on the Purchase tab, in the Tax group, select Tax document.

What you see should resemble the following example:

- CGST: 10 percent

- SGST: 10 percent

- CESS: 1 percent

- Reverse charge percentage: 70 percent for all the three components

Select Close.

Select Post > Post.

Close the message that you receive.

Update the transaction ID

- Select Functions > GST transaction ID.

- In the Date field, enter a value.

- In the Text field, enter a value.

- Select Close.

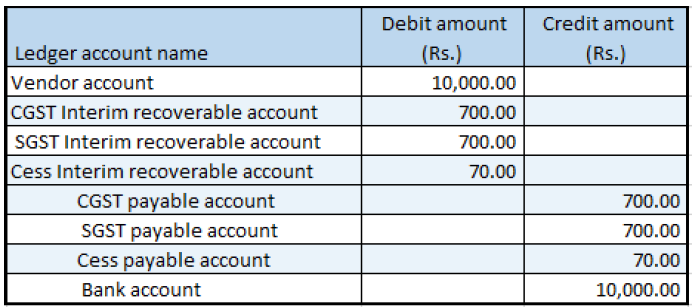

Validate the financial entries

To validate the financial entries, select Inquiries > Voucher.