Sales of taxable goods to consumers

Go to Accounts receivable > Sales orders > All sales orders.

Create a sales order for a taxable item, and save the record.

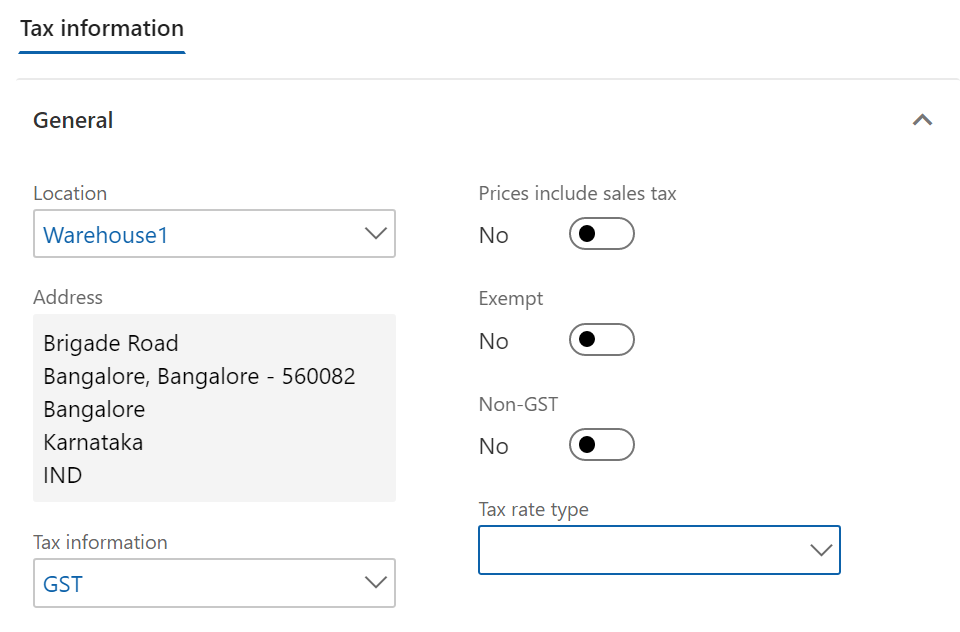

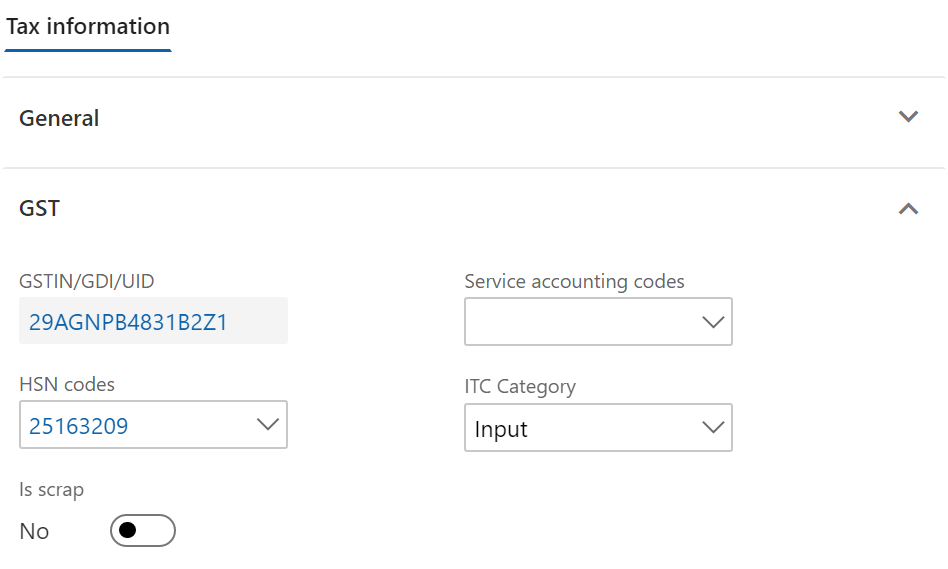

Select Tax information.

Select the GST FastTab.

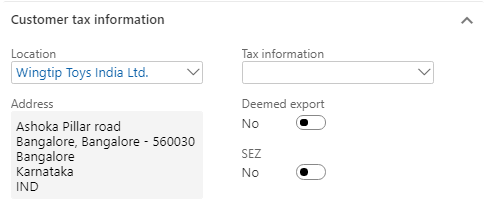

Select the Customer tax information FastTab.

Note

The Tax information field is blank. Therefore, the dealer is an unregistered dealer.

Select OK.

On the Action Pane, on the Sell tab, in the Tax group, select Tax document to review the calculated taxes.

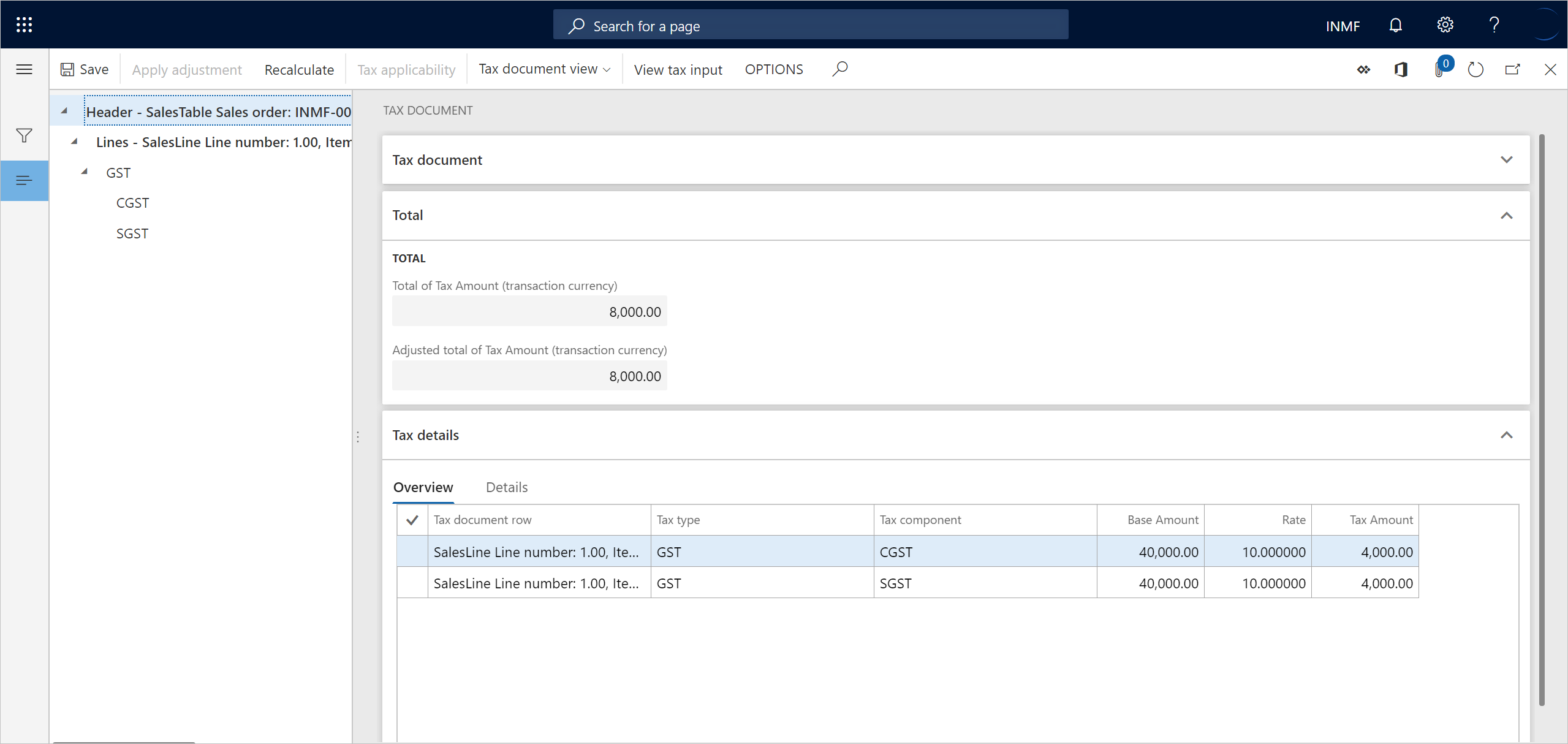

What you see might resemble the following example:

- Taxable value: 40,000.00

- CGST: 10 percent

- SGST: 10 percent

Select Close.

Post the invoice

- On the Action Pane, on the Invoice tab, in the Generate group, select Invoice.

- In the Quantity field, select Packing slip.

- Select the Print invoice check box, and then select OK.

- Select Yes to acknowledge the warning message that you receive.

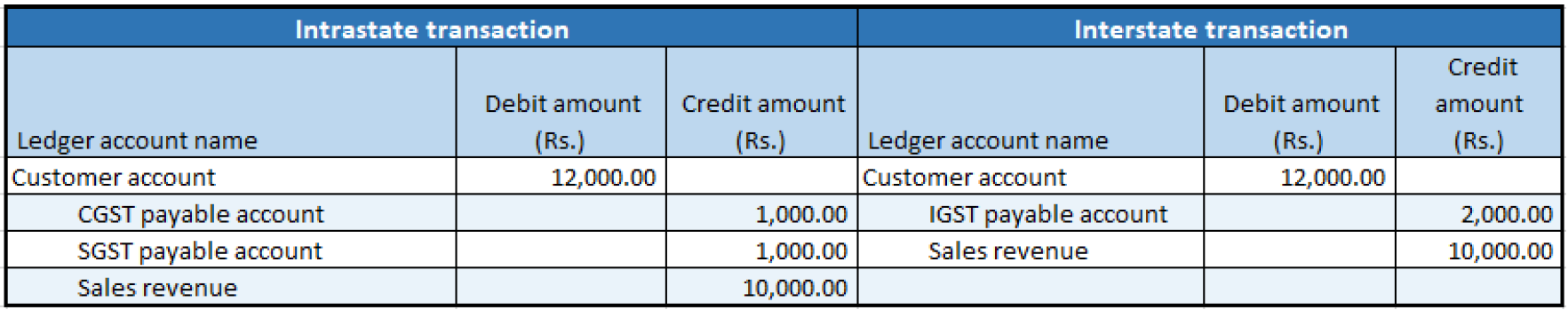

Validate the voucher

- On the Action Pane, on the Invoice tab, in the Journals group, select Invoice.

- Select Voucher.

The following illustration shows the financial entries for both the intrastate transactions and the interstate transactions.