Purchase return orders

- Go to Accounts payable > Purchase orders > All purchase orders.

- Create a purchase order.

- In the Purchase type field, select Returned order.

- In the RMA number field, enter a value.

- Select OK.

- Create purchase order lines that have a negative quantity, and then save the record.

- Select Tax information.

- Select the GST FastTab.

- Select the Vendor tax information FastTab.

- Select OK.

Validate the tax details

- On the Action Pane, on the Purchase tab, in the Tax group, select Tax document.

- Select Close, and then select Confirm.

Post the purchase invoice

- On the Action Pane, on the Invoice tab, in the Generate group, select Invoice.

- In the Default quantity for lines field, select Ordered quantity.

- Enter the invoice number.

- On the Action Pane, on the Vendor invoice tab, in the Actions group, select Post > Post.

- On the Action Pane, on the Invoice tab, in the Journals group, select Invoice.

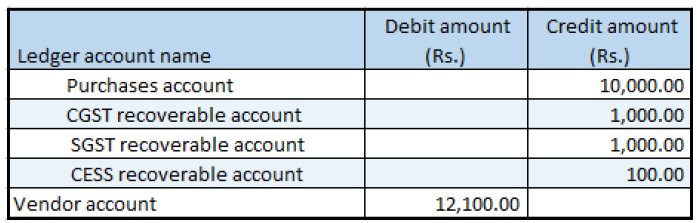

- On the Overview tab, select Voucher.