Import goods that have GST

Complete the procedures in this article to import goods that have Goods and Services Tax (GST).

Go to Accounts payable > Purchase orders > All purchase orders.

Create a purchase order for a foreign vendor account, and save the record.

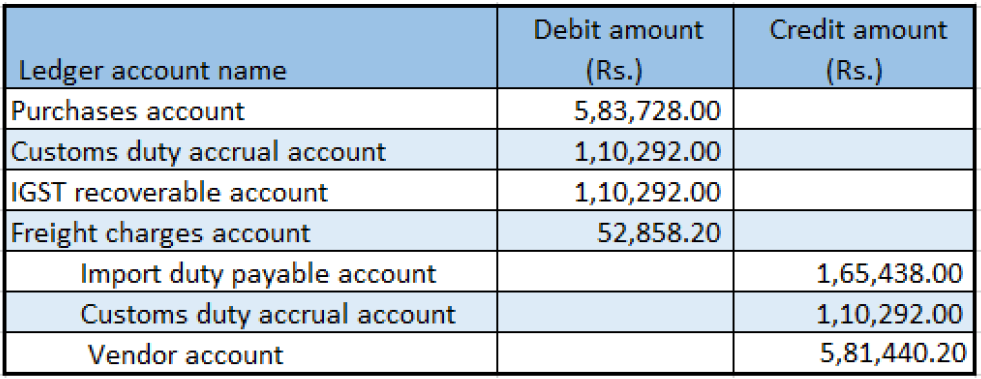

Select Tax information.

Select the GST FastTab.

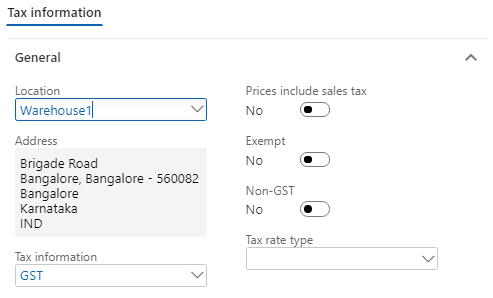

Select the Customs FastTab.

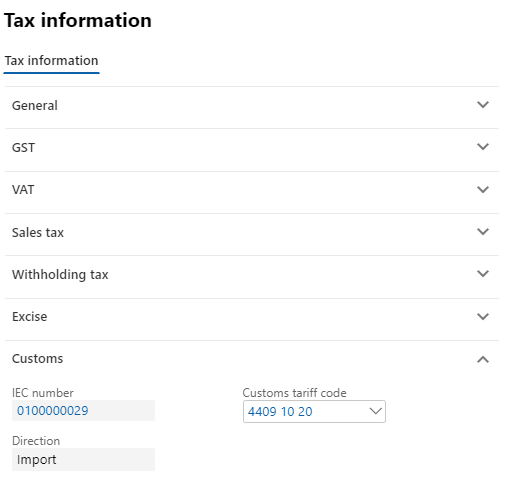

Select the Vendor tax information FastTab.

Select OK.

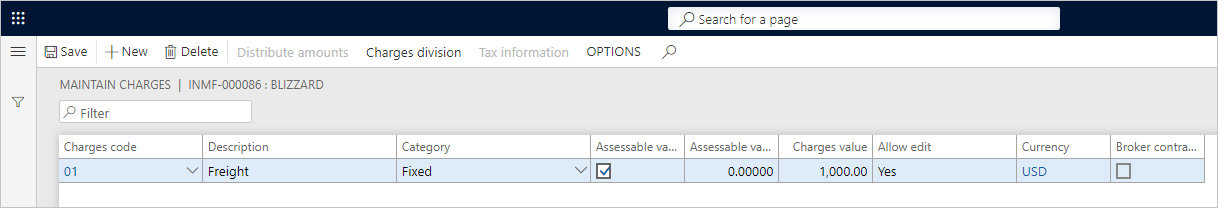

Select Functions > Maintain charges.

In the Charges code field, select a charges code.

Select the Assessable value check box.

In the Charges value field, enter a value.

Save the record, and then select Close.

Note

The assessable value is calculated as Net amount + Miscellaneous charges + 1 percent of the landing charges that are defined in Accounts payable parameters.

Validate the tax details

On the Purchase orders page, on the Action Pane, on the Purchase tab, in the Tax group, select Tax document.

On the Tax details FastTab, review the tax calculation.

Here is an example:

- BCD: 10 percent

- LOI: 100 percent

- IGST: 20 percent

- Import exchange rate: 1 USD = 52 INR

Note

By extending the configuration, you can have Integrated Goods and Services Tax (IGST) calculated on Assessable value + Basic Custom Duty (BCD) tax amount.

Select Close.

Select Confirm.

Update the invoice registration

- On the Purchase orders page, on the Action Pane, on the Customs tab, in the Maintain group, select Invoice registration.

- In the Import invoice number field, select a value.

- Select Update.

Post the bill of entry

- On the Purchase orders page, on the Action Pane, on the Customs tab, in the Generate group, select Bill of entry.

- In the Import invoice number field, select a value.

- In the Bill of entry number field, select a value.

- On the Lines tab, in the Quantity field, enter a value.

- Close the message that you receive.

- Select Tax document.

- Select Close.

- Select OK.

Post the product receipt

- On the Purchase orders page, on the Action Pane, on the Receive tab, in the Generate group, select Product receipt.

- In the Quantity field, select Bill of entry quantity.

- In the Product receipt field, enter the product receipt.

- Select OK.

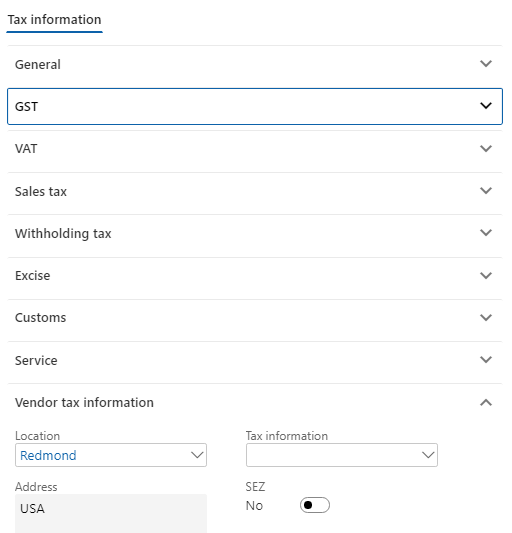

The following illustration shows an example of a journal entry for an import purchase order that has GST.