Create a credit note against a purchase invoice

- Go to Accounts payable > Purchase orders > All purchase orders.

- Create a purchase order.

- On the Action Pane, on the Purchase tab, select Create credit note.

- Select the invoice to issue a credit note against, and then select OK.

- Verify that the Original invoice number and Original invoice date fields are automatically set on the order line.

- Select Tax information.

- Select the GST FastTab.

- Select the Vendor tax information FastTab.

- Select OK.

Validate the tax details

- On the Action Pane, on the Purchase tab, in the Tax group, select Tax document.

- Select Close, and then select Confirm.

Post the purchase invoice

On the Action Pane, on the Invoice tab, in the Generate group, select Invoice.

In the Default quantity for lines field, select Ordered quantity.

Enter the invoice number.

On the Lines FastTab, verify that the Invoice type field is set to Original.

Note

You can post a revised credit note by selecting Revised in the Invoice type field and then adding a reference to the original credit note.

On the Action Pane, select Post > Post.

On the Action Pane, on the Invoice tab, in the Journals group, select Invoice.

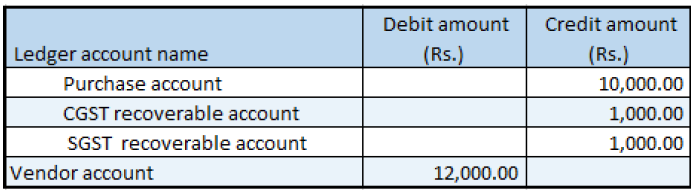

On the Overview tab, select Voucher.

Note

The general journal also lets you create a purchase credit note that has details of the original invoice.