Create a tax settlement period

To make the India localization solution for Goods and Services Tax (GST) in Microsoft Dynamics 365 Finance available, you must complete the following master data setup:

- Define a business vertical.

- Update the state code and union territory.

- Create a Goods and Services Tax Identification Number (GSTIN) master.

- Define GSTINs for the legal entity, warehouse, vendor, or customer masters.

- Define Harmonized System of Nomenclature (HSN) codes and Service Accounting Codes (SACs).

- Create main accounts for the GST posting type.

- Create a tax settlement period.

- Attach the GSTIN to a tax registration group.

Follow these steps to create a tax settlement period.

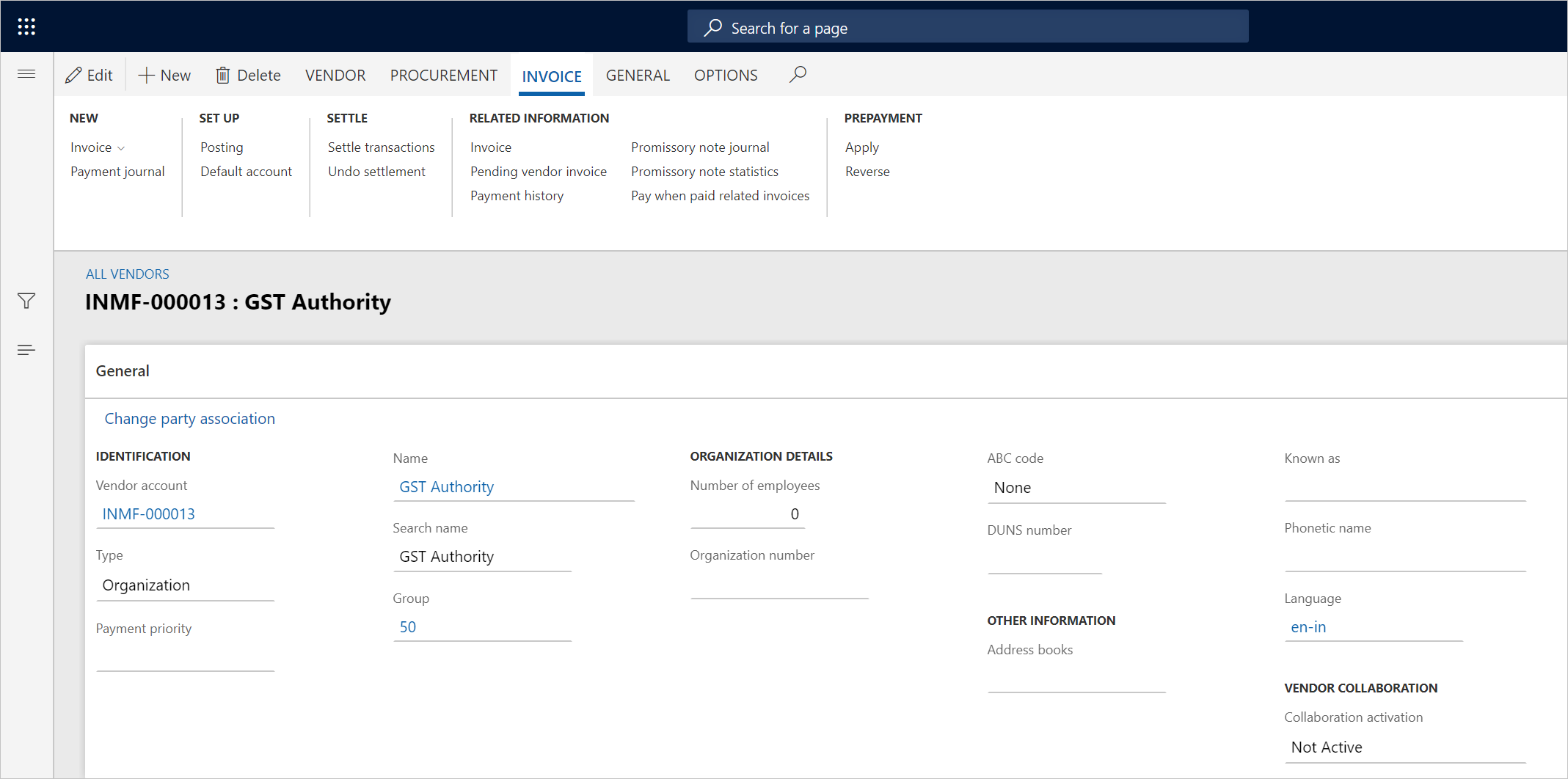

Go to Accounts payable > Vendors > All vendors, and create a vendor GST authority.

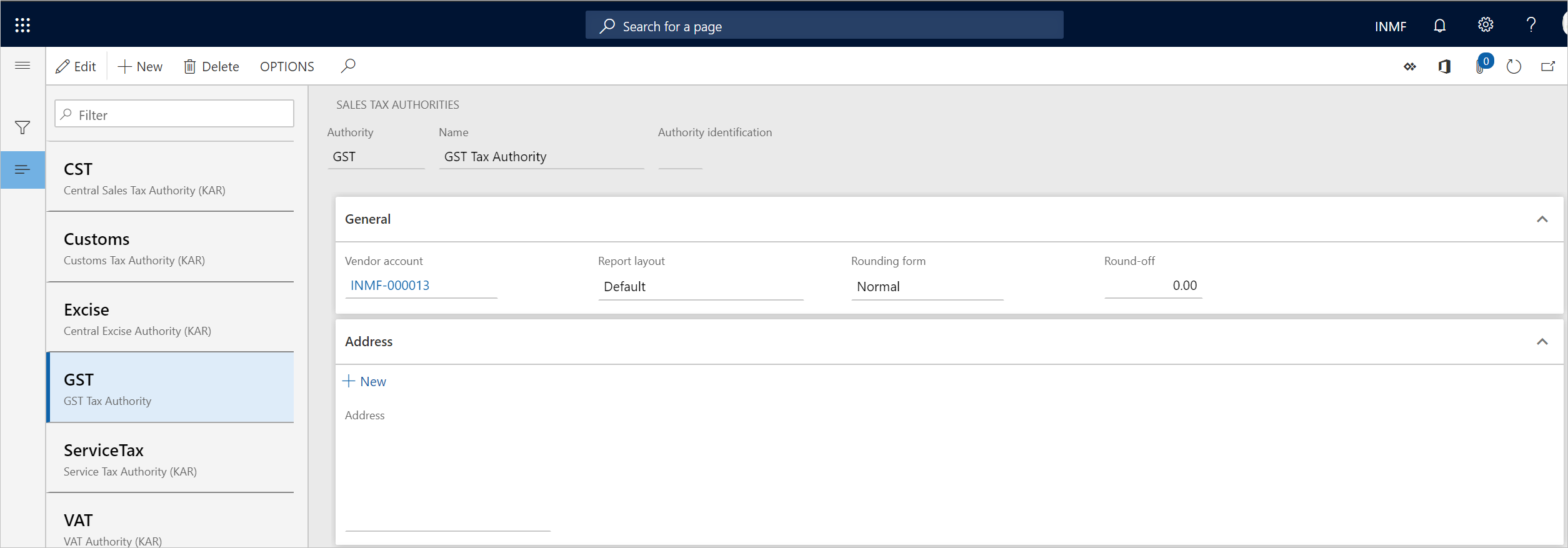

Go to Tax > Indirect tax > Sales tax > Sales tax authorities, create a tax authority, and assign the vendor account that you created in the previous step.

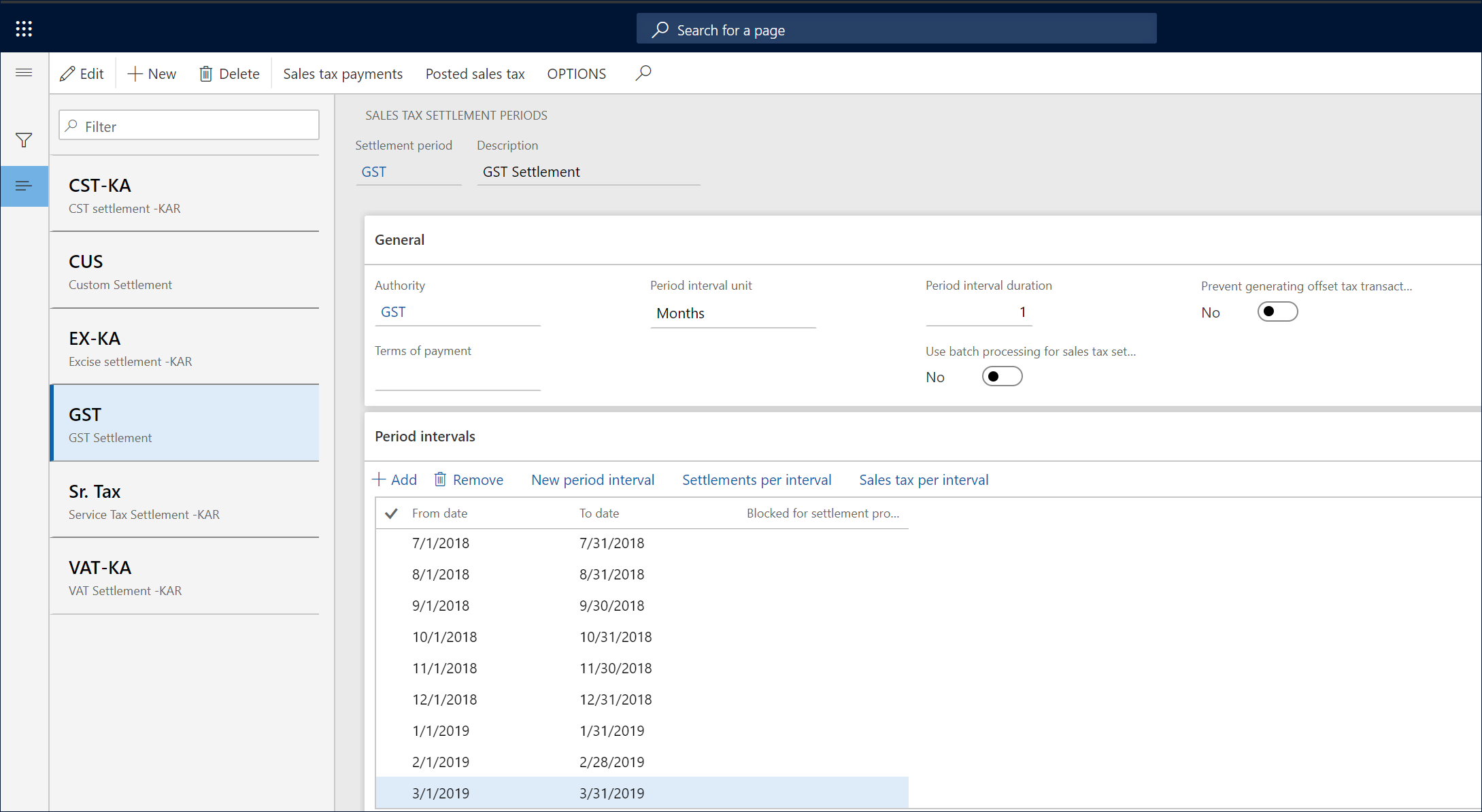

Go to Tax > Indirect tax > Sales tax > Sales tax settlement periods, and create a tax period for GST.