EU Sales list for Czech Republic

This article provides information about the EU sales list report for the Czech Republic. The Czech Republic EU sales list report contains information about the sale of goods and services for reporting in XML format. The following fields are included on the Czech Republic EU sales list report:

EU sales list header:

- Reporting period

- Date of the report creation

- Existence of a correction

- Tax authority ID

- Company's tax registration number

- Taxpayer type identification

- Company country/region name

- Name and title of a natural person

- Company name

- Company name appendix

- Company street and street number

- Company building complement

- Company postcode

- Company location

- Name and role of the person authorizing the report

- Name and telephone number of the person submitting the report

EU sales list lines:

- Customer VAT ID

- Transaction type

- Number of all invoices by transaction type per customer

- Amount of all invoices by transaction type per customer

Setup

For general setup information, see EU Sales list reporting.

Note

The value from the Tax registration number field on the Tax registration FastTab of the Legal entities page is used in the .xml and .xlsx files for the EU sales list report.

Set up the address format

- In Microsoft Dynamics 365 Finance, go to Organization administration > Global address book > Addresses > Address setup.

- On the Country/region tab, in the Country/region field, select CZE.

- Select the address format in the Address format field.

- On the Address format tab, set cursor on the line with the address format selected earlier.

- In the Configure address component section, add a Building complement line after the ZIP/postal code line.

- Add a Street number line after the Street line.

- For the Street number and Building complement lines, select the New line checkbox.

- On the Action Pane, select Save.

Set up information about the company

- Go to Organization administration > Organizations > Legal entities.

- In the grid, select your company.

- On the Addresses FastTab, set the city, ZIP/postal code, street, street number, and building complement for the primary address that should be shown on the EU sales list report.

Import Electronic reporting configurations

In Microsoft Dynamics Lifecycle Services (LCS), import the latest versions of the following Electronic reporting (ER) configurations for the EU sales list:

- EU Sales list model

- EU Sales list by columns report

- EU Sales list by rows report

- EU Sales list (CZ)

For more information, see Download Electronic reporting configurations from Lifecycle Services.

Set up a sales tax authority

- In Finance, go to Tax > Indirect taxes > Sales tax > Sales tax authorities.

- Create a sales tax authority.

- In the Authority identification field, enter the code of the tax authority. This value is reported in the c_ufo field in the VetaP section of the report.

- On the Action Pane, select Save.

Set up foreign trade parameters

Go to Tax > Setup > Foreign trade > Foreign trade parameters.

On the EU sales list tab, set Report cash discount option to Yes if a cash discount should be included in the value when a transaction is included in the EU sales list.

On the Electronic reporting FastTab, in the File format mapping field, select EU Sales list (CZ).

In the Report format mapping field, select EU Sales list by rows report or EU Sales list by columns report.

On the Other FastTab, set the following fields:

- In the Authorized by field, select the person who is authorizing the report.

- In the Role field, enter the role of the person who is authorizing the report.

- In the Filled by field, select the person who is submitting the report. Note that the main telephone number of the person submitting the report will be shown in the EU sales list report.

On the Country/region properties tab, select New, and specify the following information:

- In the Country/region column, select CZE.

- In the Country/region type column, select Domestic.

List all the countries or regions that your company does business with. For each country that is part of the EU, in the Country/region type field, select EU.

On the Company information FastTab, set the following fields:

- In the Legal entity field, select your company.

- In the Authority field, select the tax authority that you created earlier.

- In the Company name appendix field, enter an appendix of the company name.

- In the Legal entity address field, select the address that you created earlier.

On the Action Pane, select Save.

Set up general ledger parameters

Go to General ledger > Ledger setup > General ledger parameters.

On the Sales tax tab, on the VAT statement FastTab, set the following fields. The values will be shown in the XML EU sales list report:

- In the Taxpayer type field, select Corporation or Individual.

- In the Natural person title field, enter the title of the natural person.

- In the Natural person first name field, enter the first name of the natural person.

- In the Natural person last name field, enter the last name of the natural person.

Work with the EU sales list

For general information about which types of transactions are included in the EU sales list, how to generate the EU sales list report, and how to close the EU sales list reporting period, see EU Sales list reporting. When you create a customer invoice, in addition to using the main codes in the List code field, you can use the Property movement code for sale items.

Generate the EU sales list report

Go to Tax > Declarations > Foreign trade > EU sales list.

Transfer transactions. In addition to the main codes in the List code column, you can use the Property movement code for sale items.

On the Action Pane, select Reporting.

In the EU sales list reporting dialog box, on the Parameters FastTab, set the following fields.

Field Description Reporting period Select Monthly or Quarterly. From date Select the start date for the report. Generate file Set this option to Yes to generate an .xml file for your EU sales list report. File name Enter the name of the .xml file. Generate report Set this option to Yes to generate an .xlsx file for your EU sales list report. Report file name Enter the name of the .xlsx file. Tax authority code to file the report Enter the Tax authority code that's reported in the c_pracufo field, in the VetaP section of the report. Select OK, and review the generated reports.

Generate a corrective EU sales list report

- Go to Tax > Declarations > Foreign trade > EU sales list.

- For each corrected line where the reporting status is set to Reported or Closed, select Copy lines > To adjusted lines with status Included on the Action Pane to create corrective lines. Two corrective lines appear. One has a positive invoice amount, and the other has a negative invoice amount.

- On the line that has a positive amount, enter a new (correct) amount. Leave the line that has a negative amount as it is.

- On the Action Pane, select Reporting.

- In the EU sales list reporting dialog box, on the Parameters FastTab, in addition to setting the general fields for generating a report, set the Correction option to Yes.

Example

For information about how to create a general setup, create postings, and transfer transactions by using the DEMF legal entity for the Czech Republic, see Example for generic EU Sales list. However, for this example, create CZ100200300 as the company's VAT ID.

Set up the address format

- Go to Organization administration > Global address book > Addresses > Address setup.

- On the Country/region tab, in the Country/region field, select CZE.

- Select 0010 in the Address format field.

- On the Address format tab, set cursor on the line with the address format selected earlier.

- On the Action Pane, select Save.

Set up information about the company

Go to Organization administration > Organizations > Legal entities.

Select the DEMF legal entity.

In the Name field, enter Contoso Entertainment System Czech Republic.

On the Addresses FastTab, select Edit.

In the Edit address dialog box, set the following fields.

Field Value Name or description Primary address Purpose Business Country/region CZE ZIP/postal code 19800 Street Ulitsa Street number 10 Building complement 50 City Gorod Primary Yes Select OK.

Set up foreign trade parameters

Go to Tax > Setup > Foreign trade > Foreign trade parameters.

On the EU sales list tab, on the Other FastTab, set the following fields:

- In the Authorized by field, select Charlie Carson.

- In the Role field, enter Accountant.

- In the Filled by field, select Jodi Christiansen.

On the Company information FastTab, set the following fields:

- In the Legal entity field, select DEMF.

- In the Authority field, select TA.

- In the Company name appendix field, enter CNAppendix.

- In the Legal entity address field, select the address that you created earlier.

On the Action Pane, select Save.

Set up general ledger parameters

Go to General ledger > Ledger setup > General ledger parameters.

On the Sales tax tab, on the VAT statement FastTab, set the following fields:

- In the Taxpayer type field, select Corporation.

- In the Natural person title field, enter Natural person title.

- In the Natural person first name field, enter Aaron.

- In the Natural person last name field, enter Con.

Set up a sales tax authority

- Go to Tax > Indirect taxes > Sales tax > Sales tax authorities.

- On the Action Pane, select New.

- In the Authority field, enter TA.

- In the Authority identification field, enter 23.

- On the Action Pane, select Save.

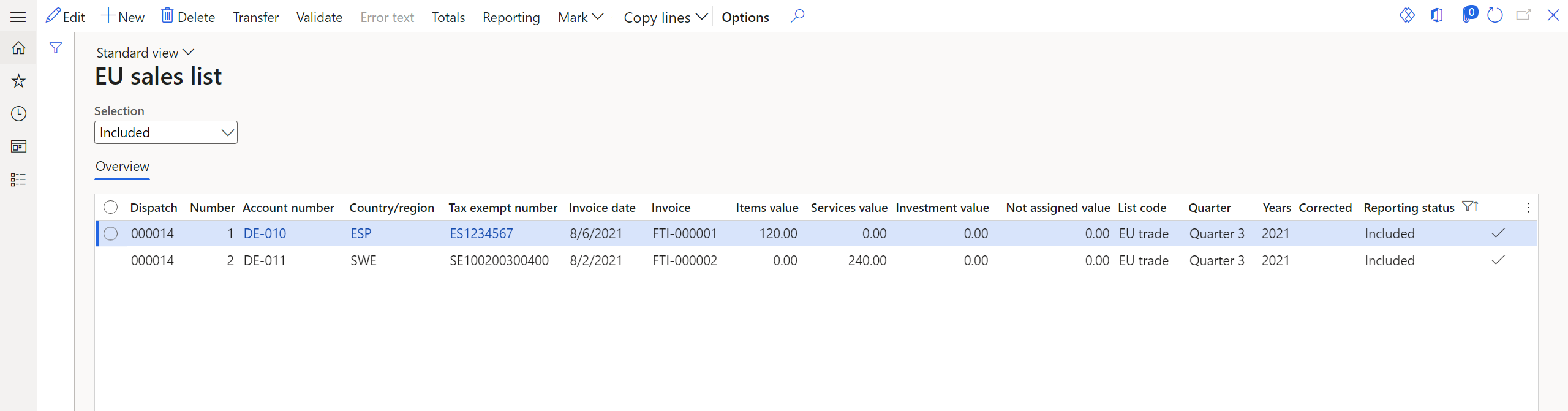

Create an EU sales list report

Go to Tax > Declarations > Foreign trade > EU sales list.

On the Action Pane, select Reporting.

In the EU sales list reporting dialog box, on the Parameters FastTab, set the following fields:

- In the Reporting period field, select Monthly.

- In the From date field, select 8/1/2021 (August 1, 2021).

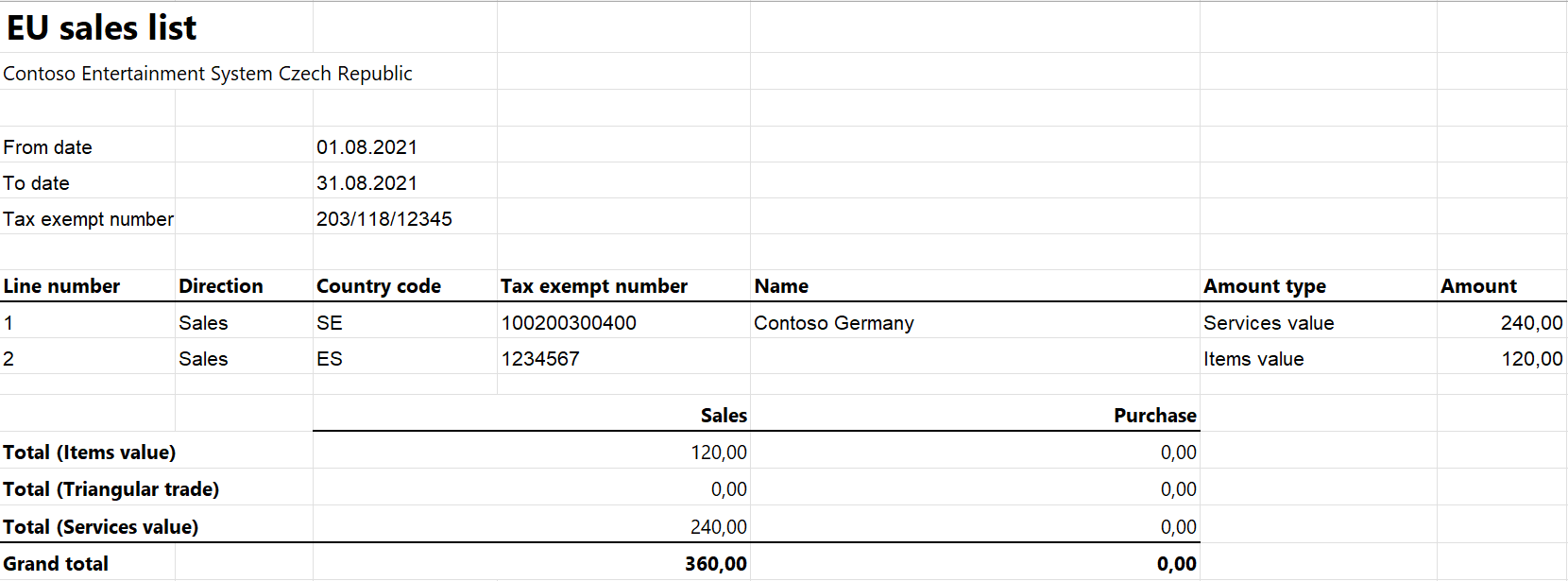

Select OK, and review the report in XML format that is generated. The following tables show the values on the example report.

EU sales list header

Field Value Comment k_uladis DPH dokument SHV rok 2021 The reporting year. Mesic 08 The reporting period. Note: If the reporting period is Quarter, this field is named ctvrt instead of mesic. shvies_forma R If the Correction option is set to No, this field is set to R. If the Correction option is set to Yes, this field is set to N. d_poddp 24.09.2021 The date when the report was created. c_ufo 451 The code related to the tax authority ID. c_pracufo 2012 The tax authority ID. dic 203/118/12345 The company's tax registration number. typ_ds P If the Taxpayer type field is set to Individual, this field is set to F. If the Taxpayer type field is set to Corporation, this field is set to P. stat Czech Republic The name of the company's country/region. prijmeni Con The last name of the natural person. jmeno Aaron The first name of the natural person. titul Natural person title The title of the natural person. zkrobchjm Contoso Entertainment System Czech Republic The company's name. dodobchjm CNAppendix The value from the Company name appendix field. naz_obce Gorod The company's city. ulice Ulitsa The company's street. c_pop 50 The company's Building complement. If the Building complement field on the Address page of the Legal entity is blank, this field is set to 0. c_orient 10 The company's Street number. psc 19800 The company's ZIP/postal code. opr_prijmeni Carson The last name of the person who is authorizing the report. opr_jmeno Charlie The first name of the person who is authorizing the report. opr_postaveni Accountant The role of the person who is authorizing the report. sest_prijmeni Christiansen The last name of the person who is submitting the report. sest_jmeno Jodi The first name of the person who is submitting the report. sest_telef 425-555-5049 The telephone number of the person who is submitting the report. EU sales list lines

Field Line 1 value Line 2 value Comment k_stat ES SE The country/region code. c_vat 1234567 100200300400 The customer's VAT ID without the country/region code. k_pln_eu 0 3 The transaction type. The value is 0 for item records, 3 for service records, 1 for triangular records, and 2 for records where the List code field is set to Property movement. pln_pocet 1 1 The number of all invoices by transaction type per customer. pln_hodnota 120 240 The amount of all invoices by transaction type per customer. Review the report in Excel format that is generated.

Create a corrective EU sales list report

Go to Tax > Declarations > Foreign trade > EU sales list.

Verify that the grid includes one service line and one item line.

Select a service line, and then, on the Action Pane, select Mark > Mark as reported.

In the Criteria field, enter 8/2/2021 (August 2, 2021). Then select OK.

In the Selection field, select Reported.

Select a service line, and then, on the Action Pane, select Copy lines > To adjusted lines with status Included.

In the Selection field, select Included.

On the corrective line that has a positive amount, in the Services value field, enter 25.

On the Action Pane, select Reporting.

In the EU sales list reporting dialog box, on the Parameters FastTab, set the following fields:

- In the Reporting period field, select Monthly.

- In the From date field, select 8/1/2021 (August 1, 2021).

- Set the Correction option to Yes.

Select OK, and review the report in XML format that is generated. The following tables show the values on the example report.

EU sales list header

Field Value k_uladis DPH dokument SHV shvies_forma N d_poddp 24.09.2021 c_ufo 451 c_pracufo 2012 dic 203/118/12345 typ_ds P stat Czech Republic prijmeni Con jmeno Aaron titul Natural person title zkrobchjm Contoso Entertainment System Czech Republic dodobchjm CNAppendix naz_obce Gorod ulice Ulitsa c_pop 50 c_orient 10 psc 19800 opr_prijmeni Carson opr_jmeno Charlie opr_postaveni Accountant sest_prijmeni Christiansen sest_jmeno Jodi sest_telef 425-555-5049 EU sales list lines

Field Line 1 value Line 2 value Comment k_storno A The source (corrected) line identifier. K_stat SE SE The country/region code. C_vat 100200300400 100200300400 The customer's VAT ID without the country/region code. k_pln_eu 3 3 The transaction type. The value is 0 for item records, 3 for service records, 1 for triangular records, and 2 for records where the List code field is set to Property movement. pln_pocet 1 1 The number of sources and corrective lines per customer. pln_hodnota 240 25 The amount of sources and corrective lines per customer.