Generate receipts

Important

Fundraising and Engagement is being retired. Support for Fundraising and Engagement will end at 11:59 PM Pacific Time on December 31, 2026. For more information, go to What’s new in Fundraising and Engagement.

You can generate receipts in Fundraising and Engagement. A receipt is a financial statement that shows the amount a donor has paid, split into the amounts that are tax deductible and aren't tax deductible. Each receipt has a receipt record that's linked to donors, transactions, and event registrations.

The Receipts section appears in the Gifts area of the navigation pane, and contains these entities:

- Receipt stacks let you define receipt ranges based on the year and configuration record. For example, a receipt stack lets you program 2020 gifts or 2021 gifts to pull from the correct receipt identifiers.

- Receipts contain all of the receipt information for Transactions and Event Registration packages, including a unique receipt number for each receipt.

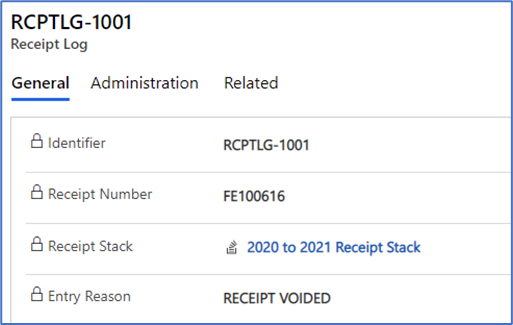

- Receipt Logs provide audit trails for receipts within the solution. The solution automatically updates each record based on user activity.

Generate a receipt

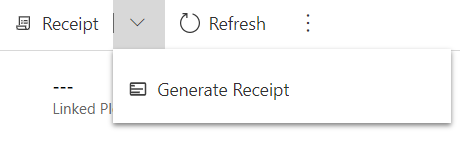

With a gift record open, select Generate Receipt on the action pane.

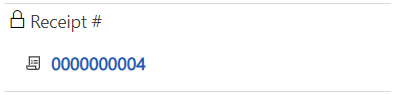

When the receipt is ready, the Receipt # field displays the receipt number as a link to the new receipt record.

Note

Generating a receipt may take a few moments, and your browser may think the page has stopped responding. If prompted, wait for the page to finish.

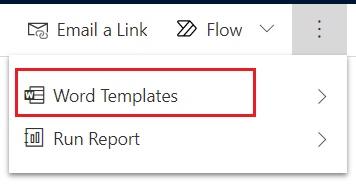

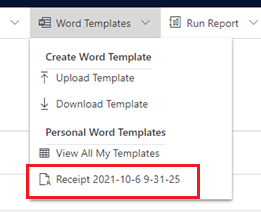

Select the receipt number to open the record, then select Word Templates from the action pane.

Under Personal Templates select the new receipt, and edit as needed.

Sample printed receipt

Produce a thank-you letter

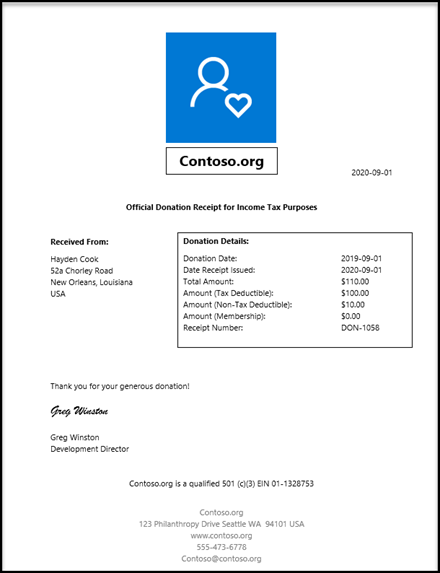

After selecting Print Thank You, Fundraising and Engagement will download the letter in Word format.

Sample printed Thank You letter

Receipt stacks

A receipt stack record controls the generation of receipts for transactions that share a configuration record. You can also include the year in a receipt stack record, so you can easily see which receipts were generated that year. When you generate a receipt, the Fundraising and Engagement solution determines which receipt stack the receipt belongs to and writes a new row in that receipt stack record.

Receipt stacks let you:

Clearly identify gifts receipted in each calendar or fiscal year by beginning each calendar or fiscal year with a new, predefined starting receipt number. This action is helpful when receipting gifts for the previous calendar or fiscal year overlaps with the new calendar or fiscal year.

Identify which location produced the receipt. For institutions with multiple offices or locations, having a unique receipt stack for each location is helpful in tracing specific gifts for audit or requests for reprinting or reissuing a receipt. For example, an institution with both a California office and a New York office might choose to add a prefix of CA or NY before the receipt number.

The receipt stack functionality allows users to manage receipts generated by Fundraising and Engagement. Receipt Stacks can be located by following these steps:

- In the navigation pane, select Gifts from the Change area menu.

- Under Receipts, select Receipt Stacks.

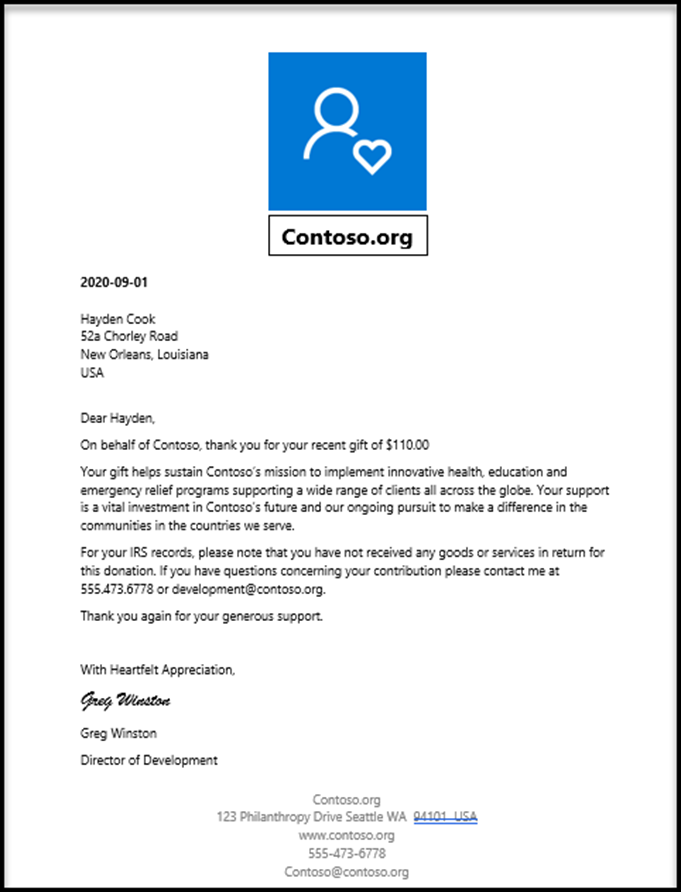

In a receipt stack record, you can set the following values:

| # | Field | Description |

|---|---|---|

| 1 | Internal Display Name | A user-generated, descriptive display that identifies this record. |

| 2 | Configuration | This receipt stack only applies to records that share this configuration record. |

| 3 | Prefix (up to five characters) | Allows you to add a prefix to the generated receipt number. For example, you might add the year or the business unit name. Limited to five characters. |

| 4 | Receipt Year | The receipt year this stack applies to, for example, when the date of a gift is in the year 2020 it searches for a receipt stack in that year. |

| 5 | Starting Range | Enter the first number the solution should use when receipting gifts from this receipt stack; when left blank it increments from 0. |

| 6 | Current Range | Generally displays the most recent receipt number used in the solution. Can be manually updated when taking over from an existing stack or process. |

| 7 | Number Range | A drop-down menu to select from 6, 8, or 10-digit receipt number ranges. Select the range that matches the serial numbers your institution uses for receipting. |

Note

Typically, new Receipt Stacks should be created before the beginning of each fiscal year. We recommend creating a Task to remind you to create new receipt stacks.

Receipt logs

The receipt log provides an audit trail of what has been done with receipts within the solution. The solution automatically updates the receipt log based on user activity, including when a receipt is voided or reissued. Receipt logs serve as a source of truth within the solution and shouldn't be edited.