Add gift aid declarations (UK only)

Important

Fundraising and Engagement is being retired. Support for Fundraising and Engagement will end at 11:59 PM Pacific Time on December 31, 2026. For more information, go to What’s new in Fundraising and Engagement.

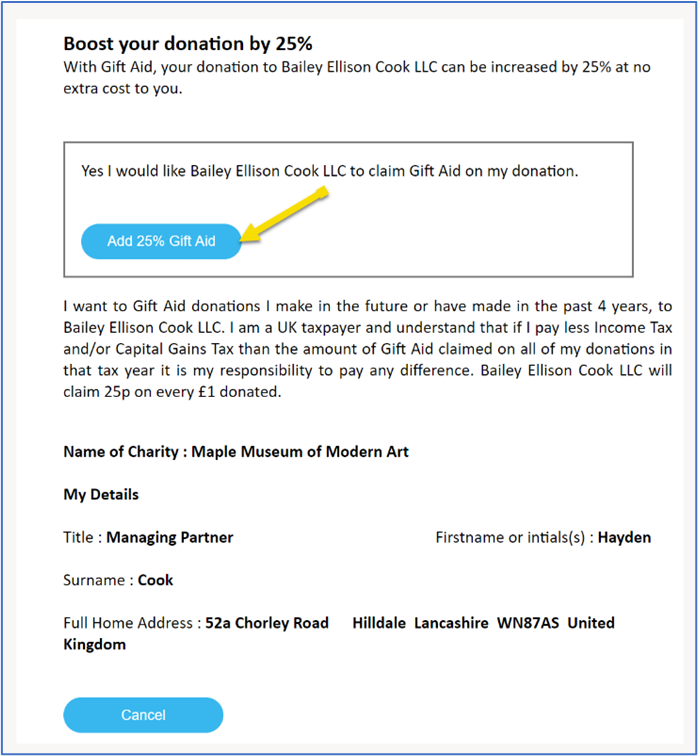

A gift aid declaration allows charities to claim up to 25% of the donations collected for the past four years as an extra donation from HM Revenue and Customs (HMRC). A declaration by a donor can be made in writing, verbally, or online. Whichever format you use, donors must provide the required information for your gift aid claim to be valid.

Gift aid declarations apply only to Contact records.

Add a gift aid declaration

To add a new gift aid declaration, select a contact.

On the action pane, select Add Declaration. The declaration form opens.

Select Add 25% Gift Aid to save the gift aid declaration.

Confirm or change the declaration

- Open the contact record that has the declaration you want to review.

- On the Related menu, select Gift Aid Declarations.

- Select the Identifier of the gift aid declaration you want, and then confirm or edit it as needed.

View declaration

- Open the gift aid declaration.

- On the action pane, select View Declaration.

Alter the declaration

From within the gift aid declaration record, you can edit how the declaration was delivered. You can also change the date it was updated.

On the General tab, edit the value for either or both of these fields:

Declaration Delivered:

- Verbal: This option is selected by default and represents that the declaration was delivered verbally to the contact/constituent.

- Online: This option represents that the declaration was delivered via online to the contact/constituent.

- Email: This option represents that the declaration was delivered via email to the contact/constituent.

Updated: This field can be manually updated to represent the date of the latest change.

On the action pane, select Save & Close.

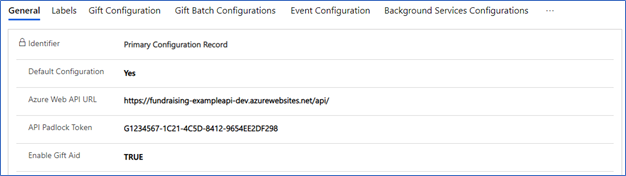

Enable Gift Aid must be TRUE in the configuration record

To enable a gift aid declaration, you need to be assigned a configuration record that has Enable Gift Aid set to TRUE.