Declaración de IVA para Baréin (BH-00002)

Información general

En este artículo se explica cómo configurar y generar el formulario de devolución de IVA para entidades jurídicas en Baréin.

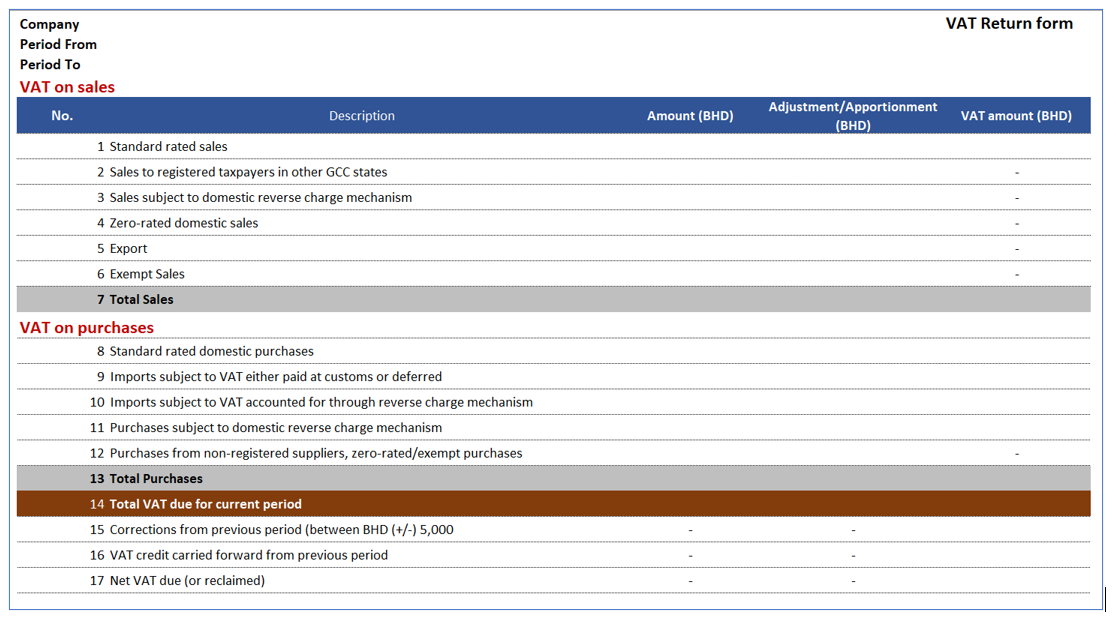

El formulario de declaración de IVA para Baréin es el documento oficial que resume el importe total del impuesto IVA repercutido adeudado, el importe total del impuesto IVA soportado recuperable y el importe del impuesto IVA adeudado relacionado. El formulario se utiliza para todo tipo de contribuyentes y debe completarse manualmente a través del portal de la autoridad tributaria. El formulario de declaración de IVA se conoce comúnmente como presentación de declaración de IVA.

El formulario de devolución de IVA en Dynamics 365 Finance incluye los siguientes informes:

- Formulario de devolución de IVA, que proporciona un desglose de importes, ajustes e importe de IVA por artículo de línea en el formulario de devolución de IVA, tal y como se describe en la legislación.

- Detalles de las transacciones de ventas agrupados por clasificación de caja de Box1 a Box6.

- Detalles de la transacción de compra agrupados por clasificación de caja de Box8 a Box12.

Requisitos previos

- La dirección principal de la entidad jurídica debe estar en Baréin.

En el espacio de trabajo Administración de características, habilite las siguientes características:

- (Bahréin) Jerarquía de categoría para el informe de impuestos sobre las ventas y las compras.

Para obtener más información sobre cómo habilitar las características, consulte Información general sobre la administración de características.

En el Informes electrónicos espacio de trabajo, importe los siguientes formatos Informes electrónicos del repositorio:

- Declaración de IVA Excel (BH)

Nota

Los formatos anteriores se basan en el modelo de declaración de impuestos y utilizan la asignación del modelo de declaración de impuestos. Estas configuraciones adicionales se importarán automáticamente.

Para obtener más información sobre cómo importar configuraciones de Informes electrónicos, consulte Descargar configuraciones de Informes electrónicos desde Lifecycle Services.

Descargar configuraciones de informes electrónicos

La implementación del formulario de declaración de IVA para Baréin se basa en configuraciones de Informes electrónicos (ER). Para obtener más información sobre las capacidades y conceptos de los informes configurables, consulte Informes electrónicos.

Para entornos de producción y pruebas de aceptación de usuario (UAT), seguir las instrucciones Descargar Informes electrónicos configuraciones de Lifecycle Services.

Para generar el formulario de devolución de IVA y los informes relacionados en una entidad jurídica de Baréin, debe cargar las siguientes configuraciones:

- Declaración de impuestos model.version.64.xml

- Modelo de declaración de impuestos mapping.version.64.90.xml

- Declaración de IVA Excel (BH).version.64.6 o una versión posterior

Una vez que haya terminado de descargar las configuraciones de ER desde Lifecycle Services (LCS) o el repositorio global, complete los siguientes pasos.

- Vaya al espacio de trabajo Informes electrónicos. Seleccione el título Configuraciones de informes.

- En la página Configuraciones, en el panel de acciones, seleccione Exchange>Cargar desde archivo XML.

- Cargue todos los archivos en el orden en que aparecen en las viñetas anteriores. Una vez cargadas todas las configuraciones, el árbol de configuración debe estar presente en Finance.

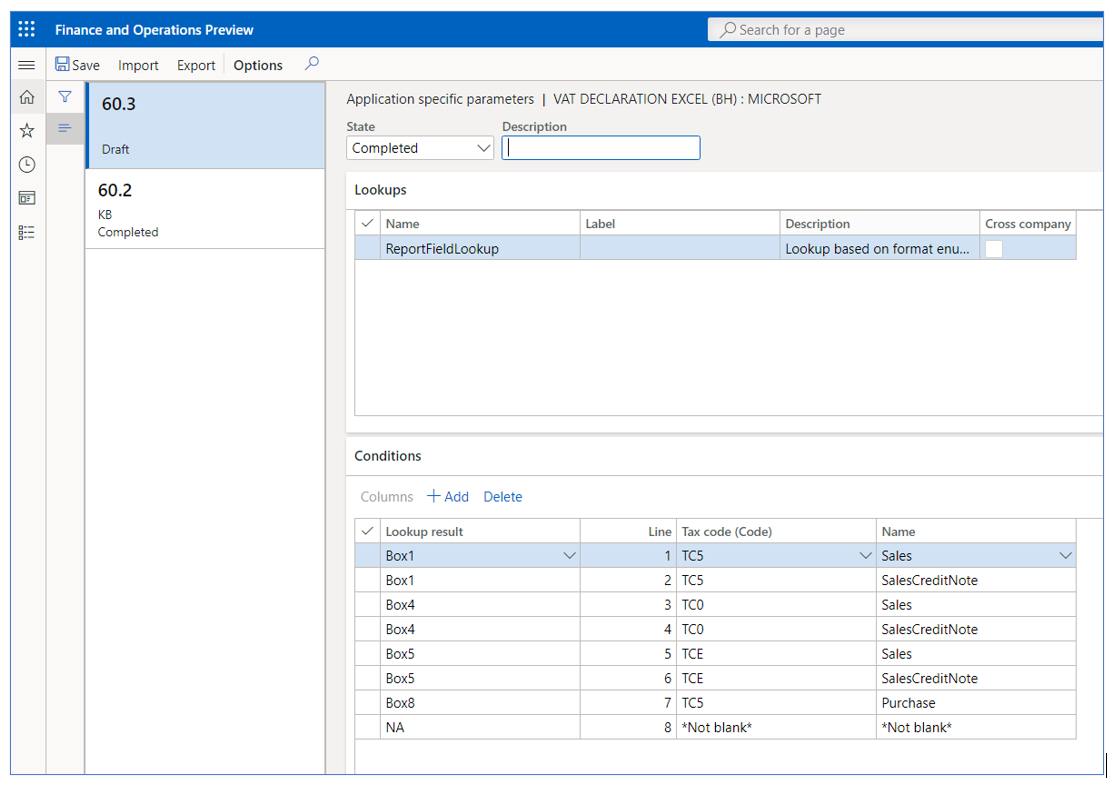

Configurar parámetros específicos de la aplicación

El formulario de declaración de IVA incluye un conjunto de casillas (líneas) que corresponden a partes específicas del proceso de devolución del IVA. Cada casilla debe incluir información sobre los importes de base, ajuste e IVA. Para incluir los requisitos establecidos por el formulario, debe configurar cada casilla con la información que se proporciona automáticamente de las transacciones de impuestos sobre las ventas generadas por ventas, compras u otras operaciones donde el impuesto de IVA se registra a través de la configuración del código de impuestos sobre las ventas.

ejemplo

Línea/Casilla 1 - Ventas con tasación estándar: según la definición legal, esta casilla incluye el importe total de bienes y servicios con tasación estándar (excluido el IVA recaudado) vendidos durante el periodo actual en el Reino de Bahréin, y el IVA recaudado por la venta o los ajustes a ventas similares realizadas en los periodos de informe anteriores. Como ejemplos de ajustes pueden citarse los siguientes:

- La devolución de bienes y servicios por parte de clientes sobre los que haya declarado/pagado IVA a NBR (Oficina Nacional de Ingresos).

- Ventas realizadas a turistas al amparo de un régimen de devolución del IVA para el turista y reembolsadas al operador de reembolso.

- Cancelación de deudas incobrables de cuentas por cobrar con calificación estándar.

En Finance, puede implementar un código de impuesto sobre las ventas específico que represente y calcule las operaciones a una tasa de ventas estándar. En este ejemplo, es necesario configurar Box1 de la siguiente manera.

La opción Parámetros específicos de la aplicación permite a los usuarios establecer los criterios de cómo se recopilarán y calcularán las transacciones de impuestos en cada casilla (línea) del formulario de declaración cuando se genere el informe, en función de la configuración del código de impuestos sobre las ventas.

- En el espacio de trabajo Informes electrónicos, SeleccioneConfiguración de> configuraciones para configurar las reglas para identificar la transacción de impuestos en el cuadro relacionado del formulario de declaración de IVA.

- Seleccione la versión actual. En la ficha desplegable Búsquedas , seleccione el nombre de búsqueda ReportFieldLookup. Esta búsqueda identifica la lista de casillas (líneas) en el formulario de IVA exigido por la autoridad fiscal.

- En la ficha desplegable Condiciones , Seleccionar Agregar y, en la nueva línea de la columna Resultado de la búsqueda, Seleccionar la línea relacionada del formulario de devolución de IVA.

- En la columna Código de impuestos (Código), Seleccione el código de impuestos que se utiliza para calcular la línea relacionada del formulario de devolución de IVA.

- En la columna Nombre , Seleccione la clasificación de transacción de impuestos donde se usa el código de impuestos sobre las ventas.

- Repita los pasos del 3 al 5 para todas las casillas (líneas) del formulario de devolución de IVA y la combinación de códigos de impuestos y tipos de transacciones de impuestos configurados en su entidad jurídica.

- Seleccionar Agregar de nuevo y luego seguir estos pasos para incluir la línea de registro final: a. En la columna Resultado de la búsqueda, SeleccionarNA . b. En la columna Código de impuestos (Código), SeleccionarNo en blanco. c. En la columna Nombre, SeleccionarNo en blanco.

Al agregar este último registro (NA), define la siguiente regla: Cuando el código de impuestos y el nombre que se pasa como argumento no cumplen ninguna de las reglas anteriores, las transacciones no se incluirán en el formulario de declaración de IVA. Aunque esta regla no se utiliza al generar el informe, ayuda a evitar errores en la generación del informe cuando falta una configuración de regla.

- En el campo Estado , SeleccionarCompletado y luego SeleccionarGuardar .

- Cierre la página Parámetros específicos de la aplicación.

La siguiente tabla representa un ejemplo de cómo el usuario necesita configurar estos parámetros para establecer la configuración entre las diferentes casillas en el formulario de declaración y la configuración del código de impuestos sobre las ventas implementada en Finance.

| Resultado de la búsqueda | Etiqueta | Código de impuestos (código) | Name |

|---|---|---|---|

| Recuadro 1 | Ventas calificadas estándar | VAT_ST | Sales |

| Box1Adj | Ajuste de ventas estándar | VAT_STA | Sales |

| Recuadro 1 | Ventas calificadas estándar | VAT_ST | SalesCreditNote |

| Box1Adj | Ajuste de ventas estándar | VAT_STA | SalesCreditNote |

| Recuadro 3 | Ventas sujetas al mecanismo nacional de inversión del sujeto pasivo | VAT_RV | SalesReverseCharge |

| Box3Adj | Ventas sujetas al ajuste del mecanismo de cargo invertido nacional | VAT_RVA | SalesReverseCharge |

| Recuadro 3 | Ventas sujetas al mecanismo nacional de inversión del sujeto pasivo | VAT_RV | SalesReverseChargeCreditNote |

| Box3Adj | Ventas sujetas al ajuste del mecanismo de cargo invertido nacional | VAT_RVA | SalesReverseChargeCreditNote |

| Recuadro 4 | Ventas nacionales coeficiente cero | VAT_0% | Sales |

| Box4Adj | Ajuste de las ventas internas a tasa cero | VAT_0%A | Sales |

| Recuadro 4 | Ventas nacionales coeficiente cero | VAT_0% | SalesCreditNote |

| Box4Adj | Ajuste de las ventas internas a tasa cero | VAT_0%A | SalesCreditNote |

| Recuadro 5 | Exportar | VAT_EXP | Sales |

| Caja5Ajuste | Ajuste de las exportaciones | VAT_EXPA | Sales |

| Recuadro 5 | Exportar | VAT_EXP | SalesCreditNote |

| Caja5Ajuste | Ajuste de las exportaciones | VAT_EXPA | SalesCreditNote |

| Recuadro 6 | Ventas exentas | VAT_EXE | SaleExempt |

| Recuadro6Ajuste | Ajuste de ventas exentas | VAT_EXE | SaleExempt |

| Recuadro 6 | Ventas exentas | VAT_EXE | SaleExemptCreditNote |

| Recuadro6Ajuste | Ajuste de ventas exentas | VAT_EXE | SalesExemptCreditNote |

| Recuadro 8 | Compras nacionales con calificación estándar | VAT_ST | Comprar |

| Recuadro8adj | Ajuste de compras nacionales con calificación estándar | VAT_ST | Comprar |

| Recuadro 8 | Compras nacionales con calificación estándar | VAT_ST | PurchaseCreditNote |

| Recuadro8adj | Ajuste de compras nacionales con calificación estándar | VAT_ST | PurchaseCreditNote |

| Recuadro 9 | Importaciones sujetas a IVA pagadas en aduana o diferidas | VAT_IMP | Comprar |

| Recuadro9Ajuste | Importaciones sujetas a IVA pagadas en aduana o ajuste diferido | VAT_IMPA | Comprar |

| Recuadro 9 | Importaciones sujetas a IVA pagadas en aduana o diferidas | VAT_IMP | PurchaseCreditNote |

| Recuadro9Ajuste | Importaciones sujetas a IVA pagadas en aduana o ajuste diferido | VAT_IMPA | PurchaseCreditNote |

| Recuadro 10 | Importaciones sujetas al IVA contabilizadas mediante el mecanismo de inversión del sujeto pasivo | VAT_IRV | PurchaseReverseCharge |

| Caja10Ajuste | Importaciones sujetas al IVA contabilizadas mediante el ajuste del mecanismo de inversión del sujeto pasivo | VAT_IRVA | PurchaseReverseCharge |

| Recuadro 10 | Importaciones sujetas al IVA contabilizadas mediante el mecanismo de inversión del sujeto pasivo | VAT_IRV | PurchaseReverseChargeCreditNote |

| Caja10Ajuste | Importaciones sujetas al IVA contabilizadas mediante el ajuste del mecanismo de inversión del sujeto pasivo | VAT_IRVA | PurchaseReverseChargeCreditNote |

| Recuadro 11 | Compras sujetas al mecanismo nacional de inversión del sujeto pasivo | VAT_PRV | PurchaseReverseCharge |

| Recuadro11Ajuste | Compras sujetas al ajuste del mecanismo nacional de inversión del sujeto pasivo | VAT_PRVA | PurchaseReverseCharge |

| Recuadro 11 | Compras sujetas al mecanismo nacional de inversión del sujeto pasivo | VAT_PRV | PurchaseReverseChargeCreditNote |

| Recuadro11Ajuste | Compras sujetas al ajuste del mecanismo nacional de inversión del sujeto pasivo | VAT_PRVA | PurchaseReverseChargeCreditNote |

| Recuadro 12 | Compras a proveedores no registrados, compras con tasa cero/exentas | VAT_0% | Comprar |

| Recuadro12Ajuste | Compras a proveedores no registrados, ajuste de compras exentas/coeficiente cero | VAT_0%A | Comprar |

| Recuadro 12 | Compras a proveedores no registrados, compras con tasa cero/exentas | VAT_0% | PurchaseCreditNote |

| Recuadro12Ajuste | Compras a proveedores no registrados, ajuste de compras exentas/coeficiente cero | VAT_0%A | PurchaseCreditNote |

| Recuadro 12 | Compras a proveedores no registrados, compras con tasa cero/exentas | VAT_EXE | PurchaseExempt |

| Recuadro12Ajuste | Compras a proveedores no registrados, ajuste de compras exentas/coeficiente cero | VAT_EXEA | PurchaseExempt |

| Recuadro 12 | Compras a proveedores no registrados, compras con tasa cero/exentas | VAT_EXE | PurchaseExemptCreditNote |

| Recuadro12Ajuste | Compras a proveedores no registrados, ajuste de compras exentas/coeficiente cero | VAT_EXEA | PurchaseExemptCreditNote |

| Recuadro 15 | Correcciones del periodo anterior (entre BHD (+/-) 5.000 | VAT_COR | Sales |

| Recuadro 15 | Correcciones del periodo anterior (entre BHD (+/-) 5.000 | VAT_COR | SalesCreditNote |

| Recuadro 15 | Correcciones del periodo anterior (entre BHD (+/-) 5.000 | VAT_COR | Comprar |

| Recuadro 15 | Correcciones del periodo anterior (entre BHD (+/-) 5.000 | VAT_COR | PurchaseCreditNote |

| No disponible | No aplicable | No en blanco | No en blanco |

Box2 y Box2Ajd representan el importe total de las ventas a los Estados del CCG y todos los ajustes a las ventas a los clientes registrados en los Estados del CCG se tratarán como exportaciones (Casilla 5 y Caja 5Adj) hasta que entre en funcionamiento el sistema aduanero integrado del CCG. Una vez que la autoridad fiscal habilite esta opción, la configuración debe cambiarse para cumplir con el requisito original.

Para evitar problemas cuando se genere el informe, cree todas las asignaciones donde se registran los códigos de impuestos sobre las ventas. Por ejemplo, si la línea tiene SalesCreditNote como nombre de la operación se omite en esta configuración y las transacciones de impuestos se registran utilizando el código de impuestos VAT_ST, encontrará problemas cuando se genere el informe. Le recomendamos que utilice el > menú Impuestos > registrados de consulta de impuestos para revisar todos los códigos de impuestos registrados y aquellos que no están incluidos en esta asignación de la configuración.

La tabla siguiente proporciona los valores disponibles en la columna Nombre . Esta información le ayudará a entender cómo se clasifican y asignan las transacciones de impuestos al código de impuestos relacionado.

| Valor del clasificador | Condición |

|---|---|

| PurchaseCreditNote |

|

| Comprar |

|

| SalesCreditNote |

|

| Sales |

|

| PurchaseExemptCreditNote |

|

| PurchaseExempt |

|

| SalesExemptCreditNote |

|

| SaleExempt |

|

| UseTaxCreditNote |

|

| Impuesto sobre el uso |

|

| PurchaseReverseChargeCreditNote |

|

| PurchaseReverseCharge |

|

| SalesReverseChargeCreditNote |

|

| SalesReverseCharge |

|

Configurar los parámetros de Contabilidad general

Para generar el informe del formulario de devolución de IVA en Microsoft Excel formato, debe definir un formato ER en la página Parámetros de contabilidad general.

- Vaya a Impuesto>Configuración>Parámetros del libro mayor.

- En la pestaña Impuesto de venta, en la sección Opciones de impuestos, en el campo Asignación de formato de declaración de IVA, Seleccionar Declaración de IVA Excel (BH). Si deja el campo en blanco, el informe estándar de impuestos sobre las ventas se generará en formato SSRS.

- Seleccione la Jerarquía de categoría. Esta categoría habilita el código de mercancía C en las transacciones de la pestaña Comercio exterior para permitir a los usuarios Seleccionar y clasificar bienes y servicios. La descripción de esta clasificación se detalla en los informes de transacciones de compra y venta.

Generar un informe de devolución de iVA

El proceso de preparación y envío de un informe de devolución de IVA para un período se basa en las transacciones de pago de impuestos sobre las ventas que se registraron durante el trabajo de liquidación y registro de impuestos. Para obtener más información acerca de la liquidación y la generación de informes de impuestos sobre las ventas, consulte Resumen de impuestos.

Complete los pasos siguientes para generar un informe de declaración de impuestos.

- Vaya a Declaraciones de impuestos > ,>Impuesto sobre las>ventas, Notificar impuestos sobre las ventas para el período de liquidación o Liquidar y registrar impuestos.

- Seleccione el Período de liquidación.

- Seleccione la fecha de inicio.

- Seleccione la versión de pago de impuestos.

- Seleccionar Aceptar para confirmar los pasos anteriores.

- Ingrese la cantidad de crédito del período anterior, si corresponde, o deje la cantidad en cero.

- En el campo Generar detalles , Seleccione una de las siguientes opciones disponibles. El formulario de devolución de IVA siempre se genera en este proceso.

- Todos : genere informes de detalles de transacciones de impuestos sobre las ventas y las compras.

- Ninguna : genera solo el formulario de declaración de IVA.

- Transacciones de compra

- Transacciones de ventas