Use customer payment predictions

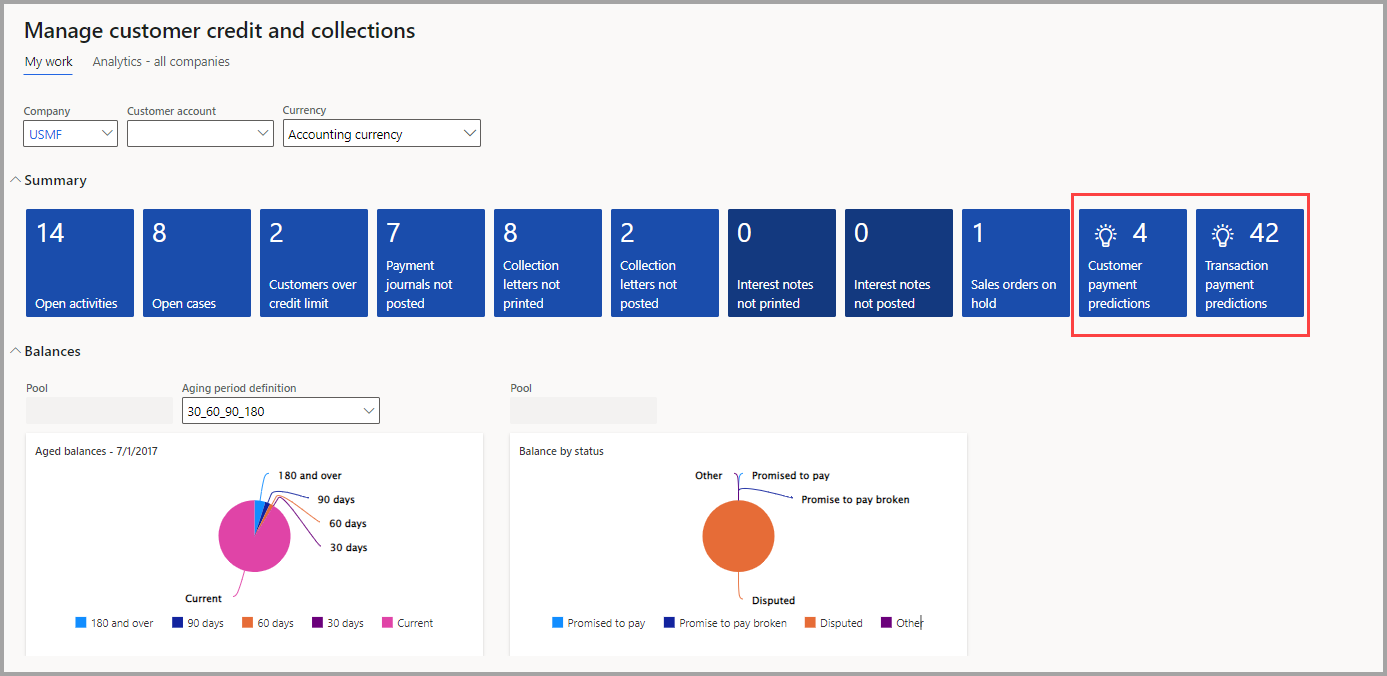

You can view customer payment predictions that are created by the model in the Customer credit and collections workspace. On the Manage customer credit and collections page, you can view intelligent predictions on two tiles:

- Transaction payment predictions

- Customer payment predictions

Transaction payment predictions

On the Transaction payment predictions page, you can view customer invoices and the probability that the invoices are paid on time. If the invoice has less than 50 percent probability, then a red circle appears to the right of the percentage located in the On time probability column.

In the Related information pane on the right side of the Transaction payment predictions page, you can view more details about specific transactions. After selecting a transaction, you can view the following FastTabs:

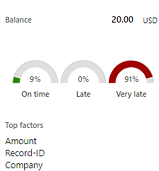

Payment prediction – Shows the probability that payments are made On time, Late, or Very late based on the prediction model. Additionally, you can view the Top factors area, which shows the factors that influence the predictions the most. Top factors are attributes of the selected transaction and/or the customer for that transaction.

Customer insights – Shows the current invoice, payment, and collection statistics for the customer for the selected transaction.

Customer history – Shows the customer’s payment history in the On time, Late, and Very late categories.

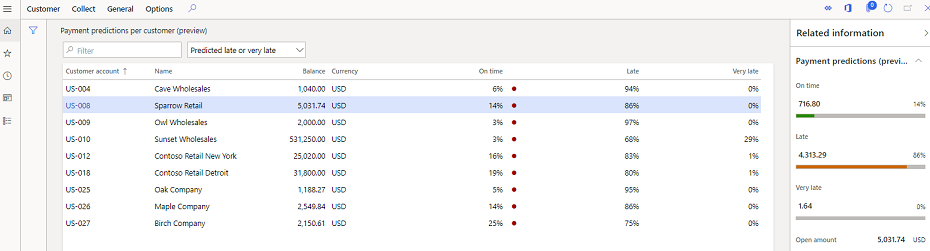

Customer payment predictions

On the Customer payment predictions page, you can view customers, the open balance of your customers, and the amount that’s predicted to be paid On time, Late, or Very late. If the probability that the customer pays on time is less than 50 percent, a red circle appears next to the probability in the On time column.

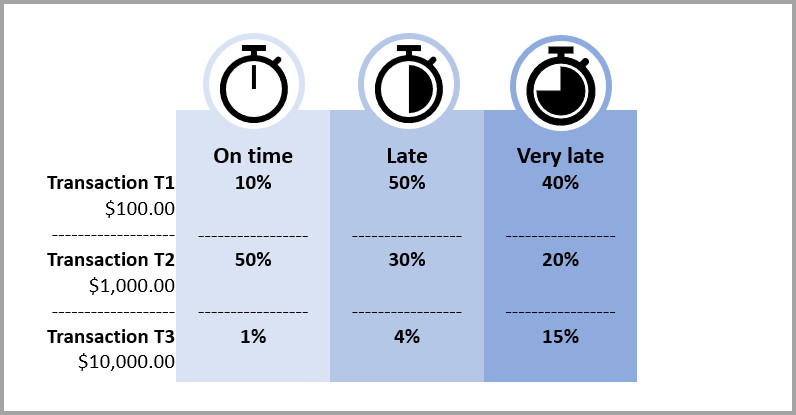

The following image shows an example of a customer who has three open transactions and how payments are projected.

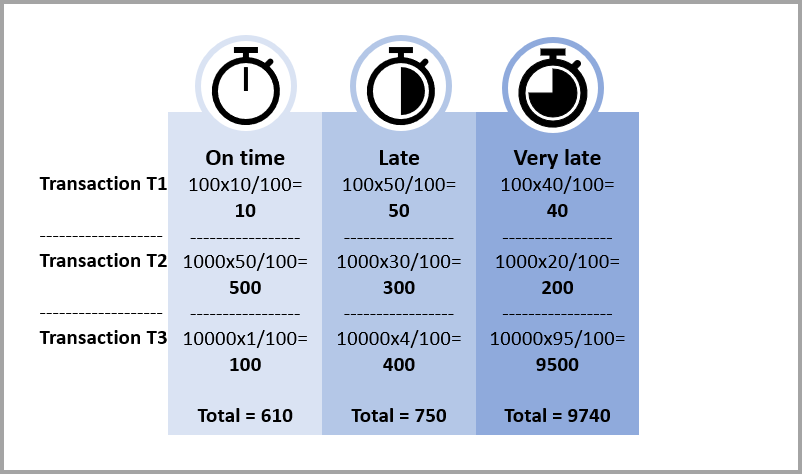

In this case, payments are projected for each category, as shown in the following graphic.

After generating your Customer payment predictions model, you see an accuracy score that tells you how accurate your model is. You can view this score in Credit and collections > Setup > Finance insights > Customer payment predictions.

If you want to improve the accuracy of your model, you can select Improve model accuracy, which opens AI Builder. In AI Builder, you can add more fields or remove fields to improve the accuracy of the model. When satisfied with your model’s accuracy score, you can publish your changes, which is picked up automatically for predictions in Finance.