Set up fixed assets

A robust fixed asset accounting module requires several different fixed asset transaction types and detailed methods for recording those transactions. Finance offers several types of transactions to categorize and track fixed assets.

For the acquisition, depreciation, value adjustment, and disposal fixed asset transactions, Finance offers the following detailed transaction types:

Acquisition and acquisition adjustment

Depreciation and depreciation adjustment

Extraordinary depreciation

Value adjustments - Write-up, Write-down, and Revaluation

Disposal - sale, scrap, and Provision for reserve

Set up assets

You need to have an asset to record transactions, such as acquisitions, depreciation, and disposals, and you need to have many more assets that you can post against.

The first step is to know how to set up the asset based on the type and characteristics, which help you determine how to group assets in a fixed asset group. Then, you need to define books and perform operations, such as create, purchase, receive, deprecate, write up or write down, reevaluate, and more.

You can create and set up a fixed asset in different ways, such as:

Manually, by using integration with Accounts payable or procurement and sourcing.

By using a vendor invoice on posting or a purchase order on product receipts.

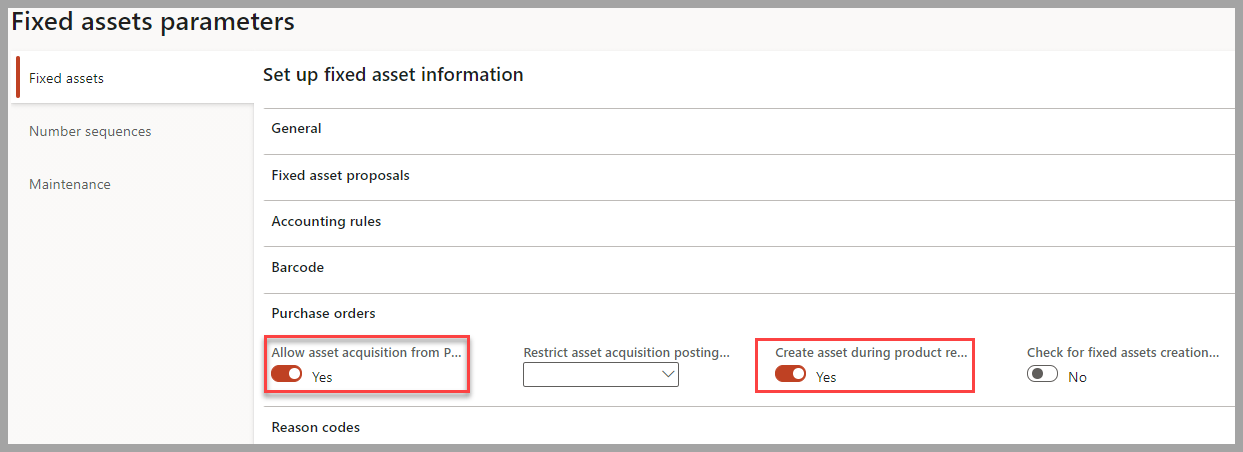

Before you create the fixed asset, go to Fixed assets > Setup > Fixed assets parameters > Fixed assets > Purchase orders.

On the Fixed assets parameters page, you can select the following options:

Allow asset acquisition from Purchasing - Select to post a fixed asset acquisition transaction when someone posts a vendor invoice that includes a new or existing fixed asset.

Restrict asset acquisition posting to user group - Select to restrict access to the ability to post fixed asset acquisition transactions. With this selection, members of a group can't post when someone posts a vendor invoice containing a new or existing fixed asset.

Create asset during product receipt or invoice posting - Select to create a new fixed asset when you post a product receipt or vendor invoice if one wasn't created when the product receipt was posted. If the Create a new fixed asset checkbox is already selected on the lines of a product receipt or vendor invoice before you post it, the system creates the new fixed asset.

Check for fixed assets creation during line entry - Select to confirm that a fixed asset meets the existing fixed asset eligibility requirements. When this option is selected, the system creates the purchase order line's fixed asset group according to the defined fixed asset rules.

The following video demonstrates how to create an asset.

Regardless of how you want to create an asset, selecting a Fixed asset group, which is a mandatory field, streamlines the process of setting up many fields in the asset record. However, you can still enter most information or you can maintain it manually.

Fixed assets > Fixed assets > Fixed assets > +New

When you enter transactions, the system only records entries for books with the same posting layer as defined on the Journal name.