Intercompany expenses

A worker who is employed by one legal entity in an organization might perform work for another legal entity in the same organization. In this situation, you can use the intercompany expense feature to assign the worker’s expenses to the legal entity for which the work was performed.

The legal entity that employs the worker is referred to as the loaning legal entity. The legal entity for which the worker incurs expenses is referred to as the borrowing legal entity.

To create an intercompany expense, follow these steps:

Go to Expense management > Workspaces > Expense management.

Select New expense report.

In the Title/Purpose field, enter or select the purpose for the expense report.

Enter the Location where the expenses were incurred.

Select Create.

In the Expenses tab, select New expense.

In the Category field, select the category of the expense.

In the Amount field, select the total on the receipt for the expense.

In the Currency field, select the currency on the receipt.

Enter the Date of the expense.

In the Merchant field, enter the business that the expense was incurred at.

Select Save.

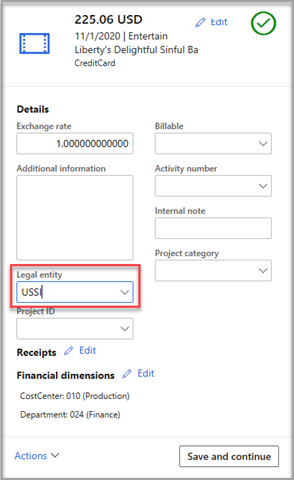

In the expense line details, select the Legal entity for that expense.

Select Save and continue.