Global Tax Engine (India) - Simplifying tax setup maintenance with Excel integration

Important

This content is archived and is not being updated. For the latest documentation, see Microsoft Dynamics 365 product documentation. For the latest release plans, see Dynamics 365 and Microsoft Power Platform release plans.

Note

These release notes describe functionality that may not have been released yet. To see when this functionality is planned to release, please review What’s new and planned for Dynamics 365 for Finance and Operations. Delivery timelines and projected functionality may change or may not ship (see Microsoft policy).

Note

Currently, Global Tax Engine is available for India only.

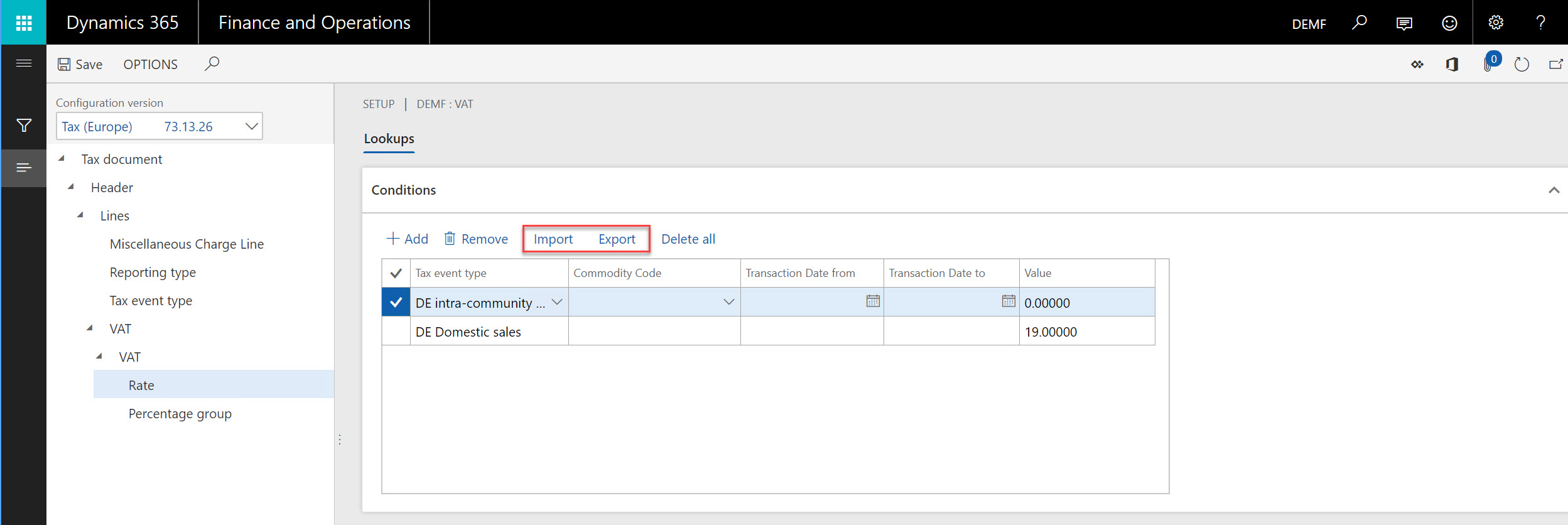

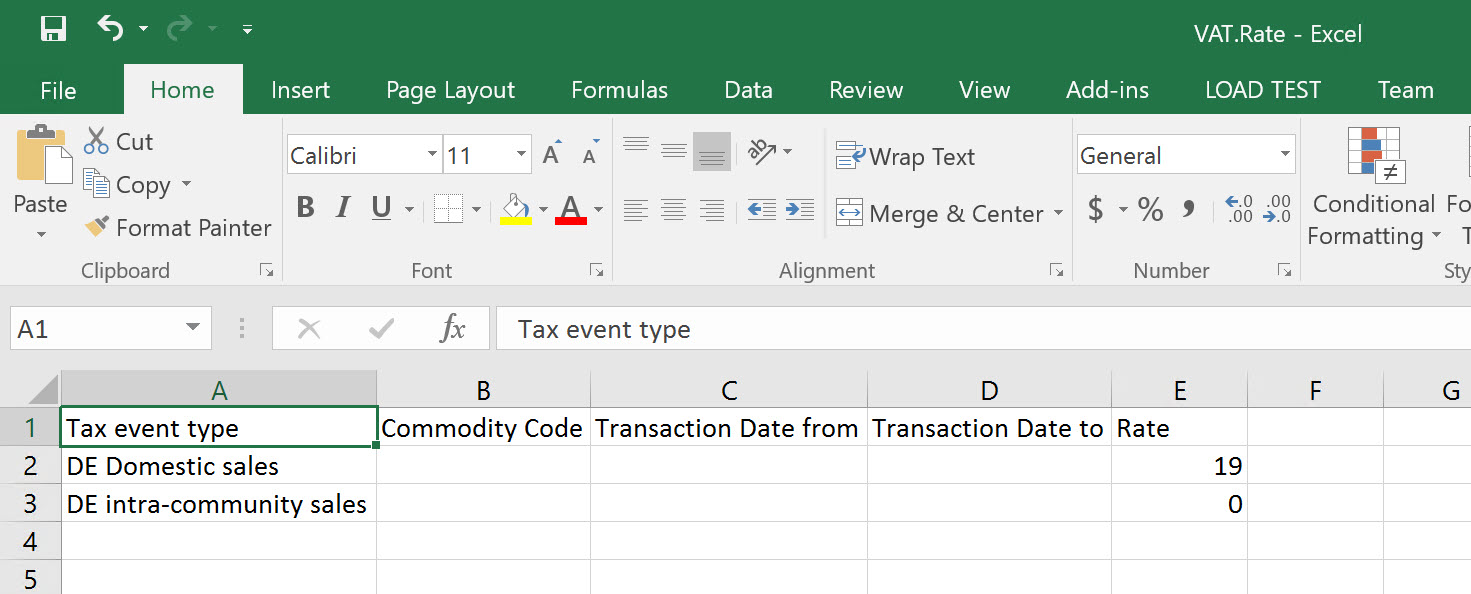

Maintaining tax setup parameters (tax rates, non-deductible percentages, and so on) for tax configurations can be a very effort-intensive task for some countries/regions and types of businesses. Now users can maintain these parameters in Microsoft Excel files automatically generated based on tax lookup tables and integrated with the tax setup.