Global Tax Engine (India) - Enabling tax configuration with tax currency and sales tax codes

Important

This content is archived and is not being updated. For the latest documentation, see Microsoft Dynamics 365 product documentation. For the latest release plans, see Dynamics 365 and Microsoft Power Platform release plans.

Note

These release notes describe functionality that may not have been released yet. To see when this functionality is planned to release, please review What’s new and planned for Dynamics 365 for Finance and Operations. Delivery timelines and projected functionality may change or may not ship (see Microsoft policy).

Note

Currently, Global Tax Engine is available for India only.

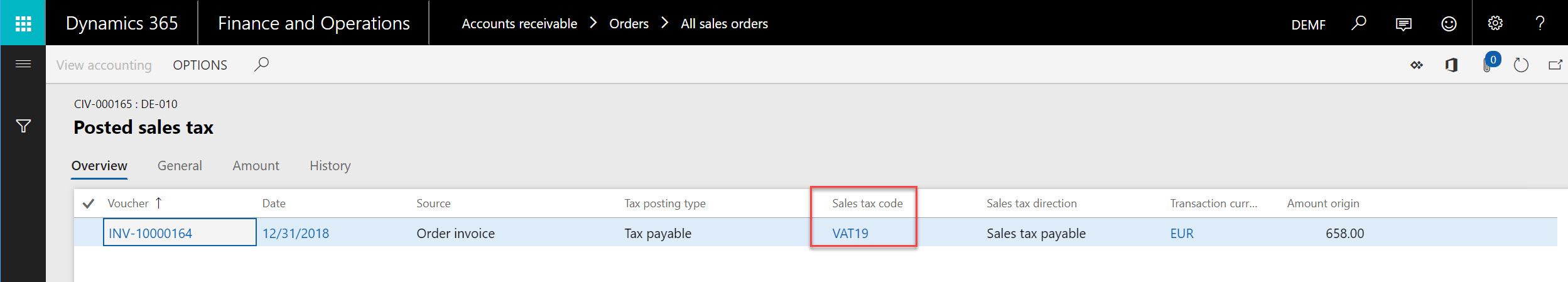

Sales tax code is a mandatory setup for Global Tax Engine (GTE) to integrate with Dynamics 365 for Finance and Operations. Previously, GTE created sales tax code with the same name as the tax component when synchronizing the tax configuration, and it used the accounting currency for the auto-create sales tax codes.

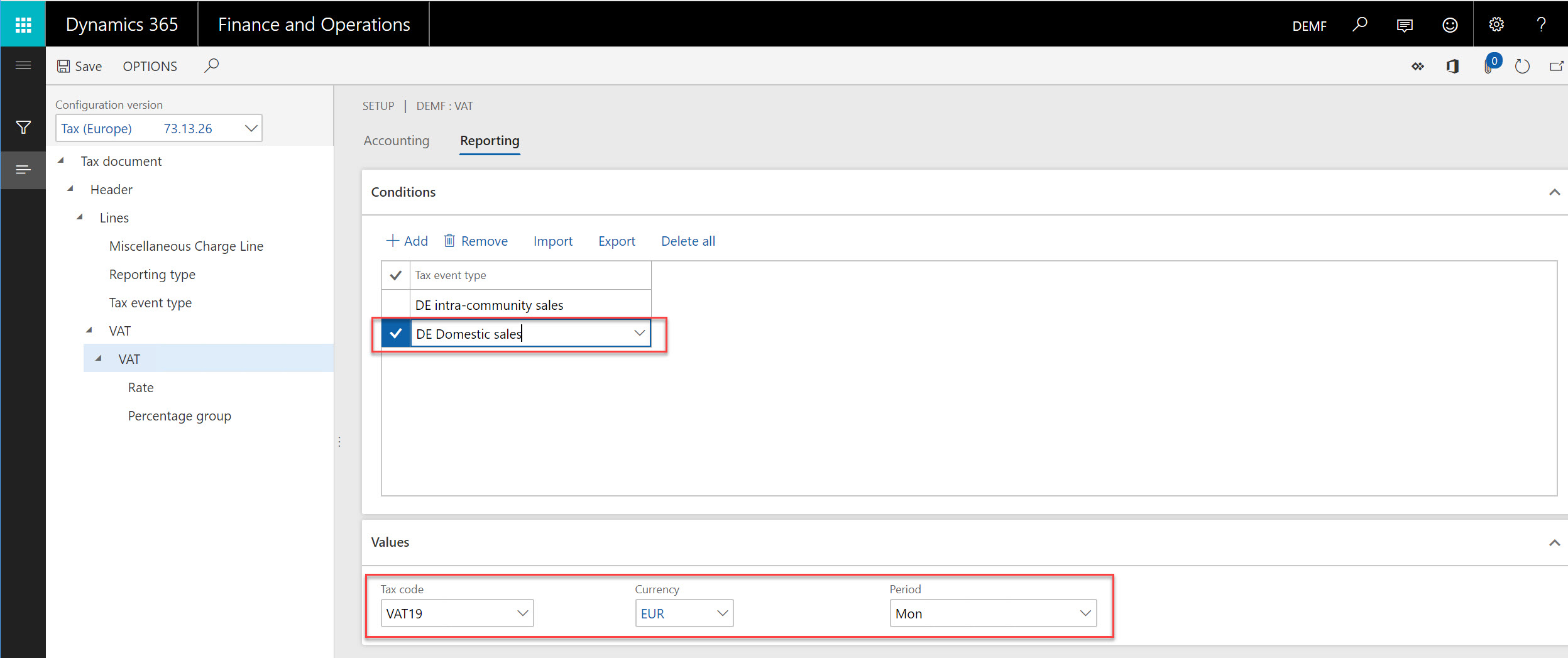

Companies with multiple tax registration across the world need to maintain different tax currencies for tax components used in different countries. With the release of this feature, users can maintain the sales tax code in tax setup, map the tax component to sales tax code in lookup tables, and maintain tax currency and settlement period of these sales tax codes.

With the tax setup, GTE will use the mapped sales tax code, tax currency, and settlement period for posting the tax transactions.