Submit withholding tax

Appropriate roles: Account admin | Billing admin

What is withholding tax (WHT)?

Certain countries or regions might require Cloud Solution Provider (CSP) program partners to pay taxes both to Microsoft and their local government, leading to double taxation. However, you can avoid double taxation by following specific steps to offset the taxes paid locally by submitting a withholding tax (WHT) request.

Key points:

- Double taxation issue: Cloud Solution Provider (CSP) program partners might receive invoices from Microsoft that include taxes. If these partners also pay taxes to their local government, they face double taxation unless they take action.

- Offset taxes via withholding tax request: To avoid double taxation, verify if the taxes on your Microsoft invoices match the taxes you paid to your local government. Then, submit a withholding tax (WHT) request. Include the following documents in your request:

- A signed or scanned copy of the tax certificate/receipt from the local authority where the taxes were paid.

- A completed withholding tax credit form (if applicable).

- Important considerations: Submit WHT requests for partially paid invoices only. Make sure your WHT request is for invoices that are only partially paid. For more information about submitting WHT, see the step-by-step process. Different procedures are required for fully paid or unpaid invoices.

How do I avoid double taxation?

- Identify eligible invoices:

- Check your invoices to determine which ones are eligible for a withholding tax request.

- Gather required documents:

- Complete the withholding tax credit form.

- Obtain a signed or scanned copy of your local tax certificate/receipt.

- Submit the withholding tax request:

- For partially paid invoices, submit the withholding tax request directly.

- For fully paid or unpaid invoices, open a support ticket with Microsoft and attach the required documents. For more information, see how to submit withholding tax for fully paid or unpaid invoices.

- Monitor the process:

- Track the status of your withholding tax request through Partner Center.

- Verify the cleared amounts on the billing history or billing overview (NCE) pages.

How do I submit a tax withholding request?

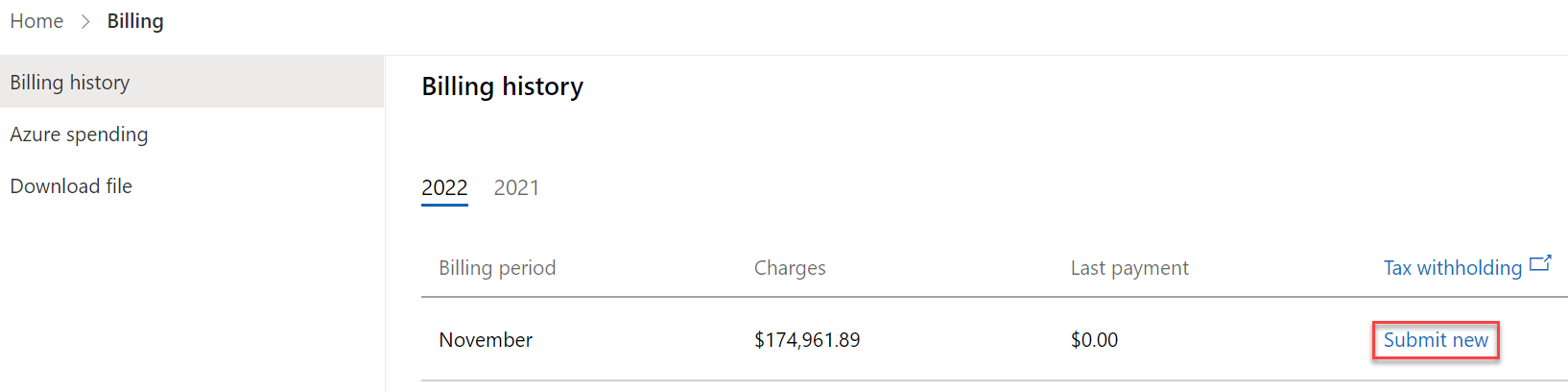

Sign in to Partner Center and select the Billing workspace.

To upload a withholding tax receipt for legacy invoices:

To upload a withholding tax receipt for new commerce invoices:

Review the invoice details before you submit it.

Enter the Withholding total under Tax withholding details. Withholding total is the amount you expect to be credited.

Attach a tax certificate.

To request tax withholding, attach a digital copy of your tax certificate. Your local tax agency issues this certificate when you pay your taxes. The invoice tax amount on the certificate must match the amount on your request.

Send a paper copy of your tax withholding request if you're located in Germany. See German tax withholding.

Important

- Amount totals must match the invoice line item from the attached tax certificate.

- The attached digital copy of tax certificate must be a .pdf, .jpeg, .png, or .gif file.

- File names must not contain spaces or special characters.

- File sizes can't exceed 1 MB.

Submit the tax withholding request.

Note

- If your request is approved:

- You don't need to take further action.

- The withholding tax is offset, allowing you to continue operations without the worry of double taxation.

- If your request is returned for corrections:

- Make necessary adjustments to the withholding tax amount or replace the tax certificate if there are issues.

- Resubmit the updated request after making corrections.

- Checking the status of your requests:

- To monitor the progress of your withholding tax requests:

- Navigate to the Withholding tax page of the invoice.

- Access this page from either:

- The Billing overview (NCE) page for new commerce.

- The Billing history page for legacy.

- The Billing history page displays the status of your requests, allowing you to track whether they're approved, pending, or returned for corrections.

- To monitor the progress of your withholding tax requests:

How do I submit WHT receipt for fully paid or unpaid invoices?

For invoices that are either fully paid or unpaid, follow these steps:

- Open a support ticket: To initiate the process, open a support ticket.

- Provide necessary documentation:

- Complete the withholding tax credit form and include it in your support ticket.

- Attach a signed or scanned copy of the withholding tax certificate or receipt issued by the local tax authority.

How do I verify my WHT request status?

Once the process is completed and your withholding tax request is approved, view the adjusted amounts in Partner Center:

- Billing history page: Check under

Last paymentof the legacy invoice to see the cleared amounts. - Billing overview (NCE) page: Look under

Paid amountof the new commerce invoice for the adjustments made.

By following these steps and providing the required documents, you can manage your tax responsibilities, avoid paying taxes twice, and ensure smooth operations. This process not only helps you stay financially compliant but also builds a clear and efficient business relationship with Microsoft.

How do I update a WHT request and resubmit it?

Sometimes, the review team might need you to correct and resubmit your request if there's missing information or errors. In such cases, the status changes to Pending partner action.

To correct and resubmit the request, follow these steps:

- Sign in to Partner Center and select the Billing workspace.

- To review or update a request for a legacy invoice:

- Select Billing history page.

- Look for the tax withholding requests.

- Requests needing your attention is marked as "Pending partner action."

- Select the tax withholding request ID and status.

- To review or update a request for a new commerce invoice:

- Go to Billing overview (NCE) page.

- Select the invoice you want to update.

- Select New request to see the request details.

- Under Status, select Update and resubmit.

- Read the reviewers' comments to see what changes are needed for the certificate or the tax amounts.

- Make the corrections by either submitting an updated certificate or adjusting the tax amounts accordingly.

- Submit the request.

The review team evaluates your resubmitted request promptly. They either approve it or ask for more changes. If more changes are needed, they update the status of your request accordingly.

How can I view the approved requests?

You see the approved amounts on the "Billing history" or "Billing overview (NCE)" page, depending on whether your invoice is legacy or new commerce. These amounts appear in the Paid amount or Last payment column next to the corresponding invoice.

Remember these points:

- Approved tax withholding requests are applied to your invoice.

- Completed requests are processed within 10 business days.

We aim to provide a seamless and clear experience throughout this process.

Important

Invoices aren't created again to account for the withholding tax. Instead, the amount cleared is directly subtracted from the payment balance of the invoices, reducing the total amount due.

Processing requests for withholding tax usually takes 10 business days if the tax certificate and amount are correct. If corrections are needed, the time might be longer, depending on how quickly the changes are made and sent again.

If you have questions about withholding tax credit requests, contact Partner Support with the request ID.

What are the special requirements for German tax withholding?

Partners who submit German tax withholding requests must mail hard copies of their withholding tax certificate to the following address:

ATTN: EOC Tax Team Marianne Gannon Microsoft EMEA Operations Centre One Microsoft Place, South County Business Park Leopardstown, Dublin 18, Ireland

Need help?

If you have questions about WHT receipt, you can submit a support request. When sending a new support request, make sure to include the Request ID.

Important

Partners shouldn't contact support if their request status shows Completed. You can find this status on the Withholding tax page. The Paid amount or Last payment shows the tax withholding amount within 10 business days after the request is Completed.

Important

If you get more than one invoice in a month, put their withholding tax receipts together into one document and submit it as one receipt in Partner Center. Make sure to include a note in the comments section to help with processing.