Comply with e-invoicing requirements in Poland

Important

Some of the functionality described in this release plan has not been released. Delivery timelines may change and projected functionality may not be released (see Microsoft policy). Learn more: What's new and planned

| Enabled for | Public preview | General availability |

|---|---|---|

| Users by admins, makers, or analysts | - | Sep 2025 |

Business value

The Electronic Invoicing service offers a no-code/low-code e-invoicing solution that allows businesses to fully automate the electronic invoicing process end-to-end. This includes issuing Sales, Free text, Project, and Advance electronic invoices, submitting them to the authorities for clearance purposes, and receiving incoming Vendor invoices from the authorities.

This feature ensures the compliance with new legal requirements for electronic invoicing in Poland.

Feature details

Poland is introducing legislation to establish the continuous transaction control (CTC) system. The Polish CTC system, called Krajowy System of e-Faktur (KSeF), was made available for all taxpayers in 2022 for voluntary adoption.

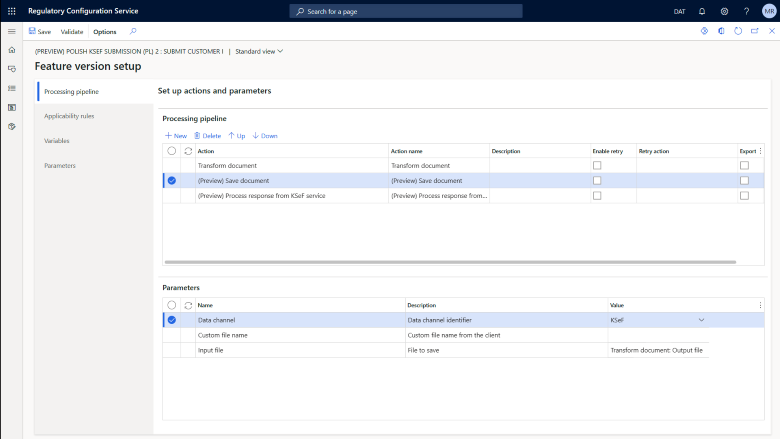

To comply with these legal requirements, the following functionality is implemented and available as public preview: Electronic invoicing for Poland

- Generation of XML files of Sales, Project, and Advance electronic invoices in the legally required format provided by KSeF.

- Automatic submission of generated electronic invoices to KSeF.

- Import of incoming Vendor electronic invoices issued and available for recipients on the KSeF platform.

The legal requirements are not fully finalized yet. As of now, the KSeF system will be rolled out as mandatory, in phases, depending on a company's size, following this implementation timeline:

- February 1, 2026, for large taxpayers (over PLN 200 million per annum).

- April 1, 2026, for all taxpayers.