Use Order to Cash data model to gain insights and analyze sales transactions

| Enabled for | Public preview | General availability |

|---|---|---|

| Users by admins, makers, or analysts |  Apr 28, 2023

Apr 28, 2023 |

Oct 30, 2024

Oct 30, 2024 |

Business value

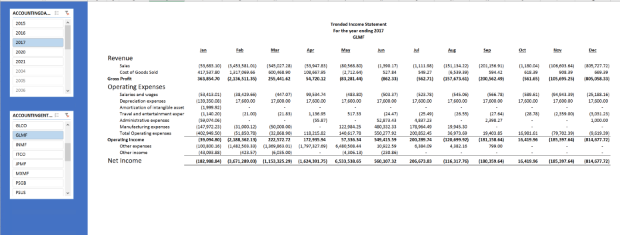

The Order to Cash data model in Business performance analytics streamlines sales reporting and analytics, ensuring accurate invoicing and payment processing while providing comprehensive financial visibility. By offering detailed data on sales orders, picking lists, packing slips, invoices, payments, and the accounts receivable subledger, the Order to Cash model enhances revenue management, reduces operational costs, and improves customer relationships. Incorporating various dimensions across the order-to-cash value chain, this feature drives operational excellence and business growth.

Feature details

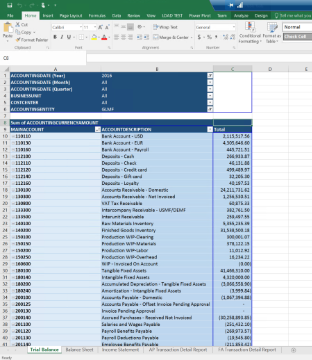

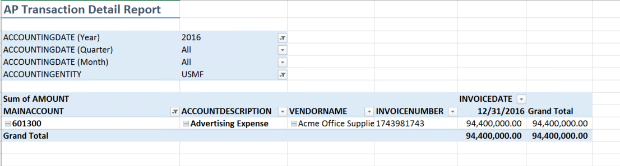

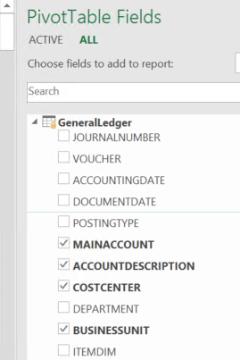

The Order to Cash data model in Business performance analytics provides an end-to-end view of the sales process, ensuring accurate invoicing and efficient payment processing. By supporting key business processes such as sales orders, picking lists, packing slips, invoices, payments, taxes, charges, and the Accounts Receivable subledger, the Order to Cash data model enhances the accuracy and timeliness of sales data, facilitating better strategic planning and decision-making.

The Order to Cash data model delivers granular data that enables end users to create custom reports and perform detailed analysis, incorporating various dimensions across the order to cash value chain. This capability allows businesses to gain deeper insights into sales performance, customer behavior, and revenue trends. With dimension-based analysis, organizations can easily identify sales patterns, optimize pricing strategies, and enhance product offerings, leading to increased sales and customer satisfaction.

By streamlining the entire order to cash process, the Order to Cash data model improves operational efficiency, reduces errors in invoicing and payment processing, and ensures timely revenue recognition. This enhanced efficiency contributes to better cash flow management, reduced days sales outstanding (DSO), and stronger financial stability. Additionally, the Order to Cash model supports effective tax management and accurate charge allocation, further improving financial compliance and reporting.

Furthermore, the comprehensive visibility provided by the Order to Cash data model strengthens customer relationships by enabling prompt and accurate order fulfillment and billing. This reliability fosters trust and loyalty among customers, driving repeat business and long-term growth. By leveraging the Order to Cash data model, businesses can optimize their sales processes, improve financial performance, and achieve sustainable growth and competitive advantage.