Note

Access to this page requires authorization. You can try signing in or changing directories.

Access to this page requires authorization. You can try changing directories.

Important

This content is archived and is not being updated. For the latest documentation, go to What's new or changed in Dynamics 365 Finance. For the latest release plans, go to Dynamics 365, Power Platform, and Cloud for Industry release plans.

| Enabled for | Public preview | General availability |

|---|---|---|

| Users by admins, makers, or analysts | - |  Jun 30, 2024

Jun 30, 2024 |

Business value

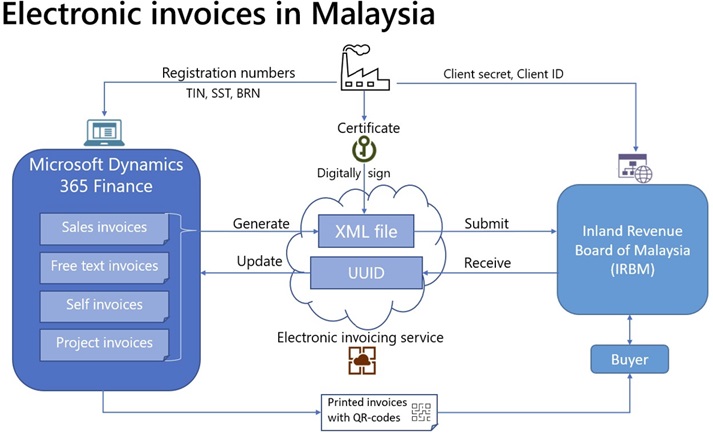

The Electronic invoicing service in Dynamics 365 Finance allows businesses to fully satisfy e-invoicing requirements that will be mandatory in Malaysia starting in August 2024.

Feature details

The Electronic invoicing feature supports e-invoice file generation and submission in the format required in Malaysia starting in August 2024.

E-invoicing will be mandated in phases, taking into account the turnover or revenue thresholds to provide taxpayers with sufficient time to prepare and adapt to the e-invoice implementation. The phases are as follows:

- August 1, 2024: For taxpayers with an annual turnover or revenue of more than RM100 million.

- January 1, 2025: For taxpayers with an annual turnover or revenue of more than RM25 million and up to RM100 million.

- July 1, 2025: For all taxpayers.

With this functionality, you'll be able to generate, digitally sign, submit the XML files of electronic invoices, and embed QR codes according to the regulatory requirements in Malaysia.