Enable additional exchange rate types for tax currency conversions

Important

This content is archived and is not being updated. For the latest documentation, go to What's new or changed in Dynamics 365 Finance. For the latest release plans, go to Dynamics 365, Power Platform, and Cloud for Industry release plans.

| Enabled for | Public preview | General availability |

|---|---|---|

| Admins, makers, marketers, or analysts, automatically | - |  Jul 14, 2023

Jul 14, 2023 |

Business value

The tax authority usually requires a company to declare a tax amount in the local currency and a specific exchange rate in the import/export business. Currently, Dynamics 365 Finance only allows for the tax amount calculation that's based on the transaction currency. Finance then converts to the tax currency amount through the accounting currency or reporting currency. This feature provides additional tax-specific exchange rate types and converts a transaction currency amount into the tax currency amount directly.

Feature details

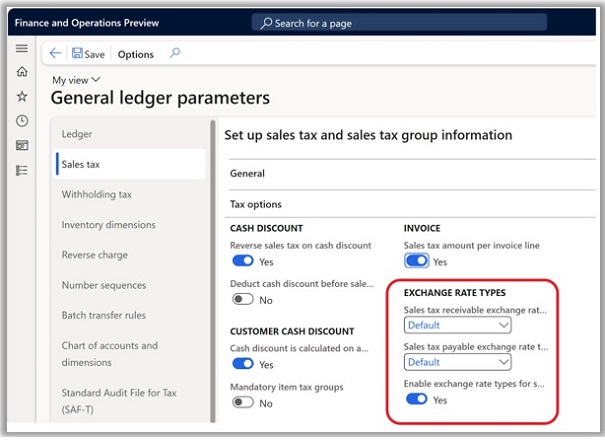

This feature enables additional exchange rate types for tax currency conversions. You can maintain the tax exchange rate types based on the local tax authority requirement. Tax is calculated based on the transaction currency amount of the document and converted to the tax currency amount using this exchange rate type.

Thank you for your idea

Thank you for submitting this idea. We listened to your idea, along with comments and votes, to help us decide what to add to our product roadmap.