Electronic Invoicing service – French e-reporting and e-invoice integration with Chorus Pro

Important

This content is archived and is not being updated. For the latest documentation, go to What's new or changed in Dynamics 365 Finance. For the latest release plans, go to Dynamics 365, Power Platform, and Cloud for Industry release plans.

| Enabled for | Public preview | General availability |

|---|---|---|

| Users by admins, makers, or analysts | - |  May 15, 2023

May 15, 2023 |

Business value

The Electronic Invoicing service in Dynamics 365 Finance allows businesses to fully automate the electronic invoicing clearance process end to end. This automation ranges from issuing sales, free text, and project invoices to submitting electronic invoices to Chorus Pro for clearance purposes and then distributing them to other companies registered in Chorus Pro.

This feature provides compliance with the legal requirements for electronic invoicing in France.

Feature details

Chorus Pro is an electronic invoicing platform in France. This platform became mandatory through a phased approach from 2017-2020 for companies that maintain commercial relations with French public sector companies (B2G). With the updated legislation, the electronic invoicing mandate in France will be expanded to all companies, including all B2B transactions between 2024 and 2026. Consequently, all French companies that are subject to VAT and that operate in B2B relationships will be required to use electronic invoicing with Chorus Pro starting in 2024, depending on company size.

The following functionality is implemented to support enabling new business processes and to address a new set of requirements for electronic invoices:

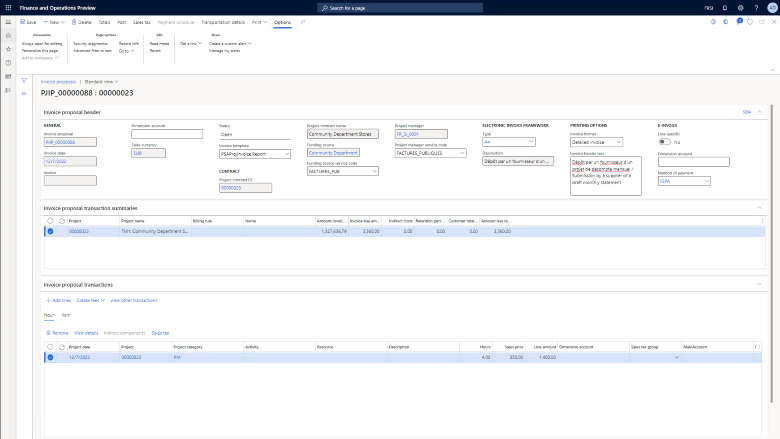

- Generate electronic invoice files in UBL Biz 3 (PEPPOL) format for sales invoice, free text invoice, and project invoice.

- Use different invoice frameworks.

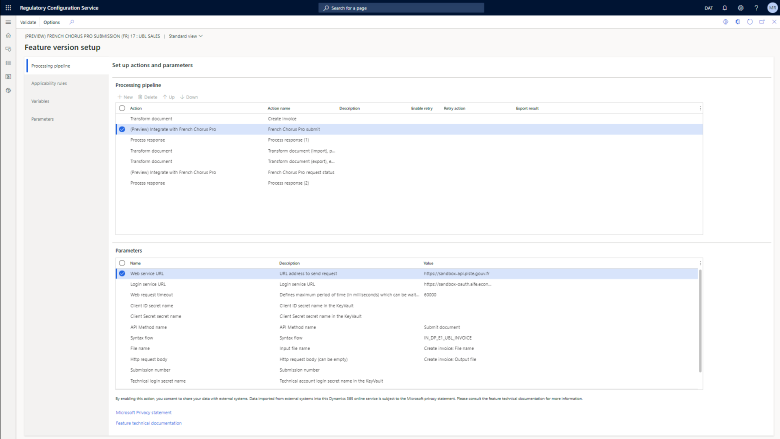

- Submit electronic invoice files to the Chorus Pro public platform and process the statuses.

- Receive electronic invoices from Chorus Pro and import them into Pending vendor invoice workspace

Apart from electronic invoices, there also will be e-reporting requirements enforced as of 2024, mandating reporting to the tax administration the data pertaining to invoice payment and transaction data (payment without invoice). The reporting targets international B2B transactions, B2C transactions, and transactions between organizations not subject to VAT. Information about planned capabilities for French Electronic Reporting will be published in future release plans for 2023 release wave 2.

Note

The French e-invoice integration with Chorus Pro feature is available only as a capability within the Electronic Invoicing service.

See also

Get started with the Electronic invoicing add-on for France (docs)