Note

Access to this page requires authorization. You can try signing in or changing directories.

Access to this page requires authorization. You can try changing directories.

Important

This content is archived and is not being updated. For the latest documentation, go to What's new and planned for Dynamics 365 Business Central. For the latest release plans, go to Dynamics 365 and Microsoft Power Platform release plans.

| Enabled for | Public preview | General availability |

|---|---|---|

| Users, automatically |  Sep 1, 2022

Sep 1, 2022 |

Oct 1, 2022

Oct 1, 2022 |

Business value

Bank reconciliation is a key task in every company, and performing the task efficiently is important to every finance department. Better matching rules improve the speed with which bank reconciliation is done.

Feature details

In bank reconciliation, we now match check entries from the bank based on information from the check ledger. This gives a much higher degree of match confidence than only using information from the bank ledger. The matching rules are also made more clear, and more rules are added to increase matching success rates.

The test report has been changed so the G/L Account Balance field now shows the balance on the real G/L account at the statement ending balance date. This lets you easily detect direct postings to the G/L account. Direct posting to G/L accounts often leads to errors in bank reconciliation.

The G/L Acc. Balance (LCY) field will be calculated if you're using a bank denominated in currency. In some cases, this can lead to differences in actual bank balances due to rounding, but it still allows you to detect direct postings to the G/L account.

The Sum of Differences field is the same as the total in the Difference column for the reconciled entries. It's convenient to also have the sum in the header.

The Bank Statement report now includes payments that were outstanding when the bank reconciliation was posted.

Note

The report compares closing dates for bank ledger entries to the statement date to determine which entries were open when the bank reconciliation was posted. If you do bank reconciliation in reverse chronological order and you omit entries from a prior period (for example, and you also manipulate statement ending balances), entries might show as outstanding in the test report but not in the statement report. This is by design. If bank reconciliations are done consistently, both reports will show the correct entries.

The new features are available on the Bank Reconciliation page, where the test report is found, and on Bank Acc. Statement reports.

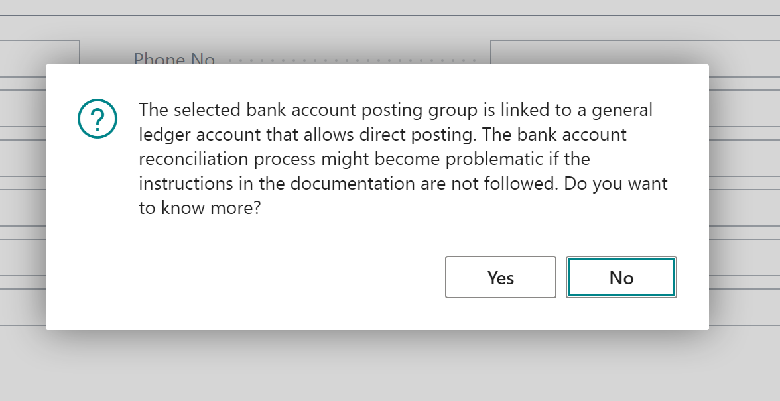

When you add a G/L account to a bank posting group on the Bank Account card, you will get a warning if the G/L account allows direct posting. This lets you decide whether to leave direct posting turned on, such as if you need to manage an opening balance. For more information, see Entering an opening balance.

Tell us what you think

Help us improve Dynamics 365 Business Central by discussing ideas, providing suggestions, and giving feedback. Use the forum at https://aka.ms/bcideas.