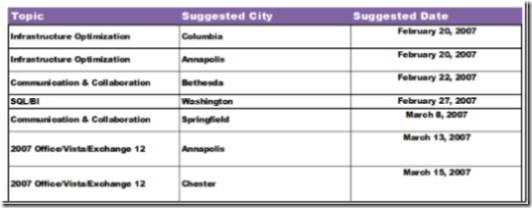

Smart Placement of Partner Events...

At one time or another, you have seen a list of event slots that we are trying to fill.

These are not random allocations based on gut feel. There is data behind this to support why we are advocating (and supporting) events in these cities (dates are just to ensure that partners do not overlap with each other).

We start off with a tool called Klondike. It tell us, by customer and by product, what the upgrade opportunity may be. It's not perfect, but it helps narrow the field down. (Note: there is a further filter called a "cluster" through which we refine the types of customers, but I'll address that in another post-and link from here when I do.)

For example, if a customer purchased 10 Windows 2000 servers, but 0 Windows 2003 servers, it estimates the value of that customer in terms of potential licensing revenue.

We do this for the "big 4" products of Win2k3 server, SQL Server, Exchange Server, and Office System.

So we have the data for each of the products (and summed up) by customer (TPID means Top Parent ID).

Next step, organize it by city. In other words, for a given product, which city represents the largest upgrade opportunity? You wouldn't want to do an event for Office System in Fairfax, if there's no upgrade opportunity (say many of the customers have EA's) and you may want to do a SQL Server event in Norfolk (where's there a lot of data management surrounding the port, for example).

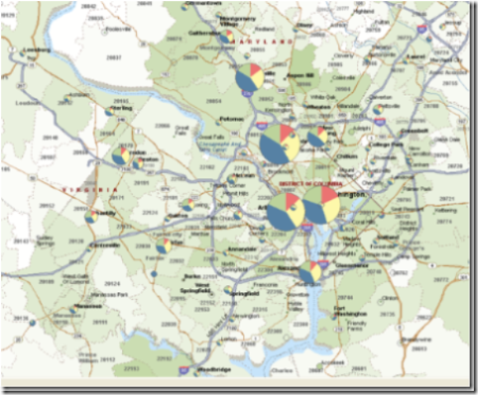

We also map it out using MapPoint to visually represent the data and see if there are any trends that jump out at us.

Without the data, you're sort of flying blind. We du use the 80-20 rule often to help narrow the list down, since-even though we're Microsoft, we do have limited resources. :-)

Ok, that tells us the city, but not where in the city to locate it. Some of these cities (most of them) encompass large areas.

We have found over time that customers prefer events (at least those in the morning when most of ours and our partners are) near their offices (over 70% in the case of Synergy events, for example).

So, we identify the largest opportunity by zip code within the largest city opportunities.

Now, we can help ourselves (and our partners) determine where we should locate an event for a given topic so that it is closest to the largest number of customers with whom we would like to speak.

Lastly, we allocate the slots around based on a proportional approach-for example, you'd want to have 4 times as many events in DC as you would in Gaithersburg.

Of course, there's always some human "gut feel" check, but it happens at the end, not at the beginning of the process.

Location, location, location...it still matters. And hopefully, it takes some of the guesswork out of the equation for our partners.

Comments

Anonymous

March 07, 2007

That is an interesting way to approach it. Although you seem to be missing a few key customer behaviors.... Customers who purchased licenses but don't know how or are otherwise waiting to implement the product. Customers who don't want to upgrade. Customers who have applications preventing them from upgrades. Customers who have upgraded and are now having difficulty and will most likely not repeat business. Another question I have is surrounding customer requests, if customer's want information is that added to the equation?Anonymous

March 07, 2007

Josh, These are great points. A few comments. It comes down to what we know about the customer. (What we should know is another topic, of course) The issues you addressed can only be raised when we (or a partner) reaches out to a customer and it is incumbent upon the partner to not just think about driving awareness/attendance for the event, but also to diagnose and solve the customers problem. If the customer doesn't know how to implement, he can be helped. Why doesn't he want to upgrade? What were the problems w/previous upgrades? I'm not saying sell the new version and disappear, but if you don't own the most recent version, at the very least, we want to know why... Thoughts?Anonymous

March 07, 2007

Well that's kind of my point.... If customer focused presentations are targeted at upgrade sales, aren't some of these other customers are being overlooked? For example if I bought a set of office licenses because I needed office (not because of a presentation) and am not unsure of the best way to deploy it, happening to see an upcoming presentation on that subject would be valuable to me. Can MS see who owns but has not activated licenses? I have not been following all of the activation changes but this data set would be valuable.... For the not wanting to upgrade folks and the customers with previous problems, perhaps coming by a presentation that is focused on their issues would make a difference or at least make the account team's job easier...Anonymous

March 07, 2007

The comment has been removedAnonymous

March 07, 2007

I can get notified, right before the comments this section has the information.... Comment Notification If you would like to receive an email when updates are made to this post, please register here Subscribe to this post's comments using RSSAnonymous

March 08, 2007

In the post on smarter placement of partner events , I mentioned that there was another filter throughAnonymous

May 03, 2007

In Microsoft-speak, "IW" means "Information Worker" and Bill Gates outlined a vision for what that mightAnonymous

May 24, 2007

Once upon a time, the marketing department was a match. It was responsible for lighting a spark and theAnonymous

May 30, 2007

Great marketers always think about the next step. Karen at Corporate Network Services ran a successfulAnonymous

July 16, 2007

Mike Kenzie from Global Data Consultants wants to make sure that he gets the Right Customers to his event.Anonymous

September 11, 2007

I hosted a webcast on Smarter Event Placment this morning for 25 people. It was an opportunity for meAnonymous

November 28, 2007

When you start a new position, you are blessed and cursed with experience . You want to bring your wealth