Understand taxes and credits

Appropriate roles: User management admin | Billing admin | Admin agent | Sales agent

Taxes and VAT

You're taxed based on your details, not your customers' details, because the billing relationship is between Microsoft and you.

You can submit your tax identifier during the account setup process or through a support request later. You'll see any changes reflected on your next billing cycle.

For withholding and sales tax exemption, you must submit tax documentation through a support request. You'll see the changes and appropriate refunds on your next billing cycle. Find out more information on submitting withholding tax.

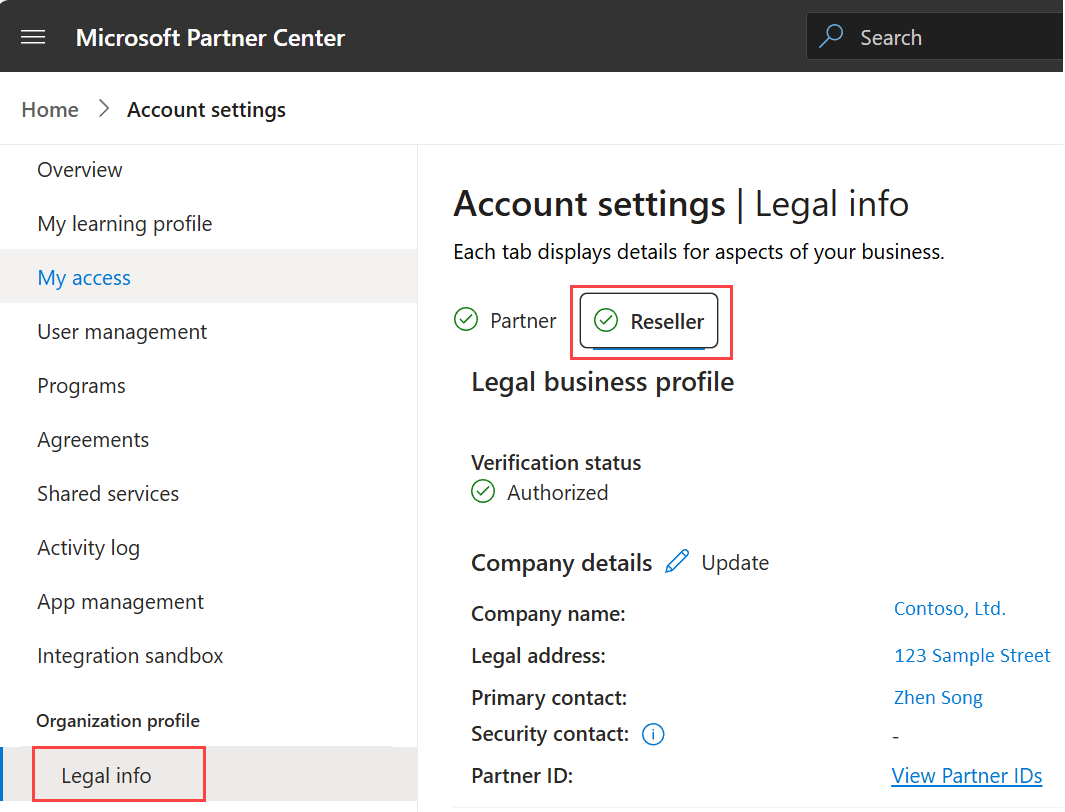

For value-added tax (VAT) exemption, you must submit your VAT ID (validated by Microsoft) through Accounts Settings > Legal Info > Reseller > Bill-to Info. If the VAT ID is submitted after account setup, your invoices before that request won't have a VAT ID stamped on the invoice PDF. You'll see the changes on your next billing cycle.

Work with your tax advisor to file tax exemptions based on your location and the locations of your customers. For more tax information, consult your local tax office or tax advisor.

Add a VATID to your billing profile

You can update your billing profile to include your VAT ID by using the following procedure (but not in every country or region).

To update your billing profile with your VAT ID, use the following steps:

Sign in to Partner Center and select the Settings (gear) icon.

Select Account settings.

Select Legal Info.

Select the Reseller tab.

In the Bill-to Info section, choose Update.

For Company Tax ID, specify your VAT ID number.

Note

You can update your Microsoft AI Cloud Partner Program tax ID yourself during the renewal period when you start the purchase flow. If you want to update your tax ID and you aren't in the renewal window, create a support ticket using the Partner Center account associated with Incentives. (To do so, you must be enrolled in one of the Incentives programs.)

File a tax exemption

Before filing a tax exemption, make sure you understand the following points:

You must file a tax exemption for each Cloud Solution Provide program (CSP) tenant.

You must submit either your tax ID number or Federal Employer Identification Number (FEIN). This number usually appears on your tax certificate. To learn more about updating VAT or your tax ID number, see Understand taxes and credits.

The validity of your sales tax exemption has legal guidelines specific to the local Department of Tax Revenue (or similar department) depending on your location and must be managed accordingly. While many locations have blanket tax certificates that are renewed annually, some locations might renew at two or more years. Verify this and other information by checking your certificate or contacting your local tax authority.

When you're ready to file your tax exemption, request support through Partner Center and supply the appropriate information.

Common tax forms

To set up Microsoft as a company in your Accounts Payable system, you need certain tax forms, including Certificates of Tax Residency. To ensure you're meeting all tax requirements, download the tax information from Partner Center support topic - Tax information (CSP).

Tax implications of having customers from different countries or regions

To understand the tax implications of serving customers from different countries as a Cloud Solution Provider (CSP) program, follow these guidelines.

Key points

- No impact from customer location: Your customers' locations don't affect your tax calculations. Whether they're domestic or international, your CSP billing applies the same tax rules.

- Tax calculations are based on partner location: The taxes applied to your transactions depend on the location of your business.

- Microsoft handles your CSP invoice taxes: Microsoft calculates taxes based on your location and local tax regulations. You're responsible for remitting these taxes to Microsoft. In some cases, you might need to pay taxes to your local authorities and submit a withholding tax certificate to avoid double taxation.

How taxes are applied in the CSP program

- Partner invoicing: When you add a customer and make a purchase, Microsoft calculates the applicable taxes based on your billing address and local tax rules. These taxes are included in your invoice.

- Reconciliation: Microsoft provides invoices and reconciliation documents to help you track taxes accurately.

Examples

Scenario 1: CSP partner in the EU

- Your location: Germany

- Customer locations: France, Italy, and the UK

- Tax implications: Microsoft applies the correct sales tax rates to comply with German tax laws. You pay the taxes to Microsoft, ensuring compliance with the respective jurisdictions.

Scenario 2: CSP partner in the US

- Your location: Texas

- Customer locations: California and New York

- Tax implications: Microsoft applies the correct sales tax rates to comply with US and Texas state tax laws. You pay the taxes to Microsoft, ensuring compliance with the respective jurisdictions.

Important

Adding customers from different countries or regions doesn't affect your tax obligations as a CSP partner. Your taxes are based on your business location, and Microsoft handles the tax calculations and compliance based on where you are.

Tip

Although the tax basis is your location as a partner, you might need to manage VAT or sales tax for international customers when billing them. Make sure to comply with local tax laws and seek professional advice if necessary.

By focusing on your local tax responsibilities and using Microsoft invoices, you can ensure smooth operation and compliance.

Cancellation policy for new commerce subscriptions and resources

To successfully cancel subscriptions and resources in the new commerce system, follow these steps:

Key points

Identify your subscription type: Determine if your subscription is one of the following types:

- License-based or online service product

- Software or perpetual software subscription

- Non-Microsoft marketplace product

- Azure plan subscription

- Azure reservation

- Azure savings plan

Understand cancellation policies: Each type has its own rules. Make sure you know them before starting.

Resource-specific cancellation guide

For a smooth cancellation process, refer to these detailed guides:

- License-based products or online services, software or perpetual software subscription, and non-Microsoft marketplace products: Follow the instructions for cancellation within the allowed period.

- Azure plan subscription: Specific procedures are available for canceling Azure plan subscriptions. Ensure all active resources under the plan are terminated or migrated before cancellation.

- Azure reservation: Understand the implications of canceling reservations, including potential refunds or penalties. For step-by-step instruction, refer to the guidelines.

- Azure savings plan: Review the terms of the savings plan as cancellations might affect cost savings. Follow the instructions provided.

Important

- Refunds: Some subscriptions like reservations or prepaid subscriptions might provide partial refunds or no refunds upon cancellation.

Tip

- Identify your subscription type: Determine whether your subscription falls under license-based products, Azure reservation, or Azure savings plan.

- Follow documentation: Use the linked resources to guide you through the cancellation process.

- Terminate active resources: For Azure-related subscriptions, ensure all dependent resources are properly shut down or migrated.

- Prepare for cancellation: Back up data, terminate active resources, and review financial implications.

- Initiate cancellation: To complete the process, follow the steps outlined in the documentation.

- Confirm completion: After cancellation, verify that the subscription or resource is fully terminated, and no further charges apply.

If you encounter challenges during the cancellation process or need clarification on specific policies, contact the support team.

Support

For tax-related inquiries, cancellations, refunds, submit a support ticket through Partner Center. Allow up to two weeks for Microsoft to respond and resolve the issue.