Reverse charge mechanism for VAT/GST scheme

This article describes a generic approach for setting up reverse charge functionality for countries/regions that adopt the VAT or GST schemes.

The country/region availability of the functionality is managed by the following features in the Feature management workspace.

| Feature | Country/region |

|---|---|

| No specific feature | Austria Belgium Bulgaria Croatia Cyprus Czech Republic Denmark Estonia Finland France Germany Hungary Iceland Ireland Italy Latvia Liechtenstein Lithuania Luxembourg Netherlands Norway Poland Portugal Romania Saudi Arabia Singapore Slovakia Slovenia Spain Sweden Switzerland United Kingdom United Arabic Emirates |

| Reverse charge for additional countries/regions | Bahrain Kuwait Oman Qatar |

| Enable reverse charge mechanism for VAT/GST scheme | All other countries/regions except: Brazil India Russia |

For more information, see the Enable Reverse charge mechanism for VAT/GST scheme feature section later in this article.

Reverse Charge is a tax schema that moves the responsibility for the accounting and reporting of VAT from the seller to the buyer of goods and/or services. Therefore, recipients of goods and/or services report both the output VAT (in the role of a seller) and the input VAT (in the role of a purchaser) on their VAT statement.

In some countries or regions, the Reverse Charge schema is implemented only for some goods and/or services, and there are additional conditions or thresholds on sales amounts. In other countries or regions, the responsibility for VAT payment depends on the status of the supplier and the buyer. If the buyer is liable to pay VAT, this fact must be clearly indicated on the invoice that the supplier issues. For example, the invoice must include the words "Reverse charge" and must indicate which positions are under the Reverse Charge schema.

To apply the reverse charge, you must complete the following setup.

Set up sales tax codes

We recommend that you use separate sales tax codes for sales operations and purchase operations.

| Sales tax code for sales | Create a sales tax code for reverse charge sales operations (Tax > Indirect taxes > Sales tax > Sales tax codes). |

| Sales tax code for purchases | Create positive and negative sales tax codes for the reverse charge VAT for purchases (Tax > Indirect taxes > Sales tax > Sales tax codes).

For more information, see the next section, "Set up sales tax groups and item sales tax groups." |

Set up sales tax groups and item sales tax groups

We recommend that you use separate sales tax groups for sales operations and purchase operations.

| Sales tax groups for sales | Create a sales tax group for sales operations that have the reverse charge (Tax > Indirect taxes > Sales tax > Sales tax groups). On the Setup tab, include the sales tax code for the reverse charge in this group. Select the Exempt and Reverse charge check boxes for the sales tax code. |

| Sales tax groups for purchases | Create a sales tax group for purchase operations that have the reverse charge (Tax > Indirect taxes > Sales tax > Sales tax groups). On the Setup tab, include both positive and negative sales tax codes in this group. Select the Reverse charge check box for the sales tax code that has a negative value. |

| Item sales tax groups | Create or update the item sales tax group with the sales tax code that has a negative value (Tax > Indirect taxes > Sales tax > Item sales tax groups). You must assign the default item sales tax group to the products and categories that are subject to the reverse charge. |

Set up reverse charge item groups

On the Reverse charge item groups page (Tax > Setup > Sales tax > Reverse charge item groups), you can define groups of products or services, or individual products or services, that the reverse charge can be applied to. For each reverse charge item group, define the list of items, item groups, and categories for sales and/or purchases.

Set up reverse charge rules

On the Reverse charge rules page (Tax > Setup > Sales tax > Reverse charge rules), you can define the applicability rules for purchase and sales purposes. You can configure a set of reverse charge applicability rules. For each rule, set the following fields:

- Document type – Select Purchase order, Vendor invoice journal, Sales order, Free text invoice, Customer invoice journal, and/or Vendor invoice.

- Country/region type of the partner – Select Domestic, EU, GCC, or Foreign. Alternatively, if the rule can be applied to all trade partners, regardless of the country or region of their address, select All.

- Domestic delivery address – Select this check box to apply the rule to deliveries within the same country or region. This check box can't be selected for the Vendor invoice journal and Customer invoice journal document types.

- Reverse charge item group – Select the group that the rule can be applied to.

- Threshold amount – The Reverse Charge schema is applied to an invoice only if the value of items and/or services that are included in the reverse charge item group exceeds the limit that you specify here.

You can also use the Effective date and Expiration date fields to define the period when the rule is effective.

Additionally, you can specify whether a notification appears and the document line is updated with the default reverse charge sales tax group if the condition for that document line is met. The following options are available:

- None – The document line isn't updated.

- Prompt – A notification appears to confirm that the reverse charge can be applied.

- Set – The document line is updated without additional notification.

Set up Country/region properties

On the Foreign trade parameters page (Tax > Setup > Sales tax > Foreign trade > Foreign trade parameters), on the Country/region properties tab, set the country/region of the current legal entity to Domestic. Set the Country/region type of the EU countries/regions that participate in the EU trade with the current legal entity to EU. Set the Country/region type of the GCC countries/regions that participate in the GCC trade with the current legal entity to GCC.

Set up default parameters

To enable the functionality for reverse charge VAT, on the General ledger parameters page, on the Reverse charge tab, set the Enable reverse charge option to Yes. In the Purchase order sales tax group and Sales order tax group fields, select the default sales tax groups. When a reverse charge applicability condition is met, the sales or purchase order line is updated with these sales tax groups.

Reverse charge on a sales invoice

For sales under the Reverse Charge schema, the seller doesn't charge VAT. Instead, the invoice indicates both the items that are subject to the reverse charge VAT and the total amount of the reverse charge VAT.

When a sales invoice that has the reverse charge is posted, the sales tax transactions have the Sales tax payable tax direction and zero sales tax, and the Reverse charge and Exempt check boxes are selected.

Reverse charge on a purchase invoice

For purchases under the Reverse Charge schema, the purchaser who receives the invoice that has the reverse charge acts as a buyer and a seller for VAT accounting purposes.

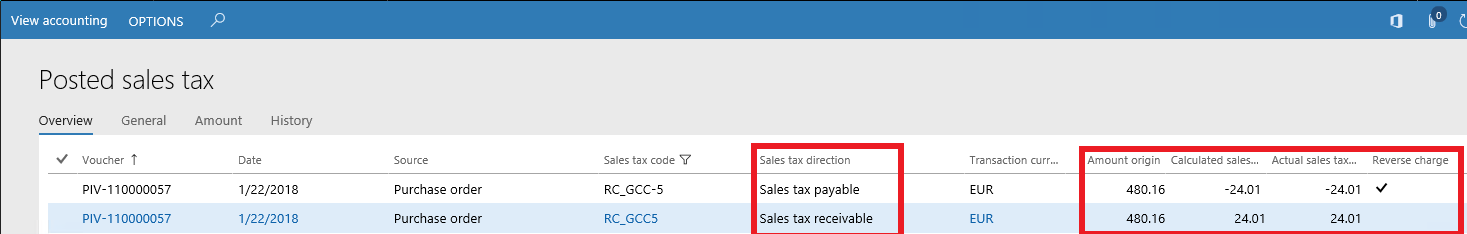

When a purchase invoice that has the reverse charge is posted, two sales tax transactions are created. One transaction has the Sales tax receivable tax direction. The other transaction has the Sales tax payable tax direction, and the Reverse charge check box is selected.

In the following screenshot, one transaction has the Sales tax receivable direction, and the other transaction has the Sales tax payable direction.

Enable Reverse charge mechanism for VAT/GST scheme feature

In the Feature management workspace, find the feature and select Enable.

After you enable the feature, the Reverse charge tab is available in all legal entities. Enable the Reverse charge functionality for a legal entity by setting the Enable reverse charge option to Yes.

The following pages and menu items related to the feature setup will be available:

- Reverse charge item groups (Tax > Setup > Sales tax > Reverse charge item groups). For more information, see the Set up reverse charge item groups section.

- Reverse charge rules (Tax > Setup > Sales tax > Reverse charge rules). See Set up reverse charge rules.

- Foreign trade parameters (Tax > Setup > Sales tax > Foreign trade > Foreign trade parameters). See Set up Country/region properties.

The Reverse charge check box will be available on the Sales tax group and Posted sales tax pages. For more information, see the sections, Set up sales tax groups and item sales tax groups, Reverse charge on a sales invoice, and Reverse charge on a purchase invoice.