series_shapes_fl()

Gilt für: ✅Microsoft Fabric✅Azure Data Explorer✅Azure Monitor✅Microsoft Sentinel

Die Funktion series_shapes_fl() ist eine benutzerdefinierte Funktion (UDF), die positiven/negativen Trend erkennt oder in einer Datenreihe springt. Diese Funktion verwendet eine Tabelle, die mehrere Zeitreihen (dynamische numerische Matrix) enthält, und berechnet Trend- und Sprungergebnisse für jede Datenreihe. Die Ausgabe ist ein Wörterbuch (dynamisch), das die Bewertungen enthält.

Syntax

T | extend series_shapes_fl(, y_series erweitert)

Erfahren Sie mehr über Syntaxkonventionen.

Parameter

| Name | Type | Erforderlich | Beschreibung |

|---|---|---|---|

| y_series | dynamic |

✔️ | Eine Arrayzelle mit numerischen Werten. |

| advanced | bool |

Der Standardwert ist false. Legen Sie diesen Parameter fest, true um zusätzliche berechnete Parameter auszugeben. |

Funktionsdefinition

Sie können die Funktion definieren, indem Sie den Code entweder als abfragedefinierte Funktion einbetten oder wie folgt als gespeicherte Funktion in Ihrer Datenbank erstellen:

Definieren Sie die Funktion mithilfe der folgenden Let-Anweisung. Es sind keine Berechtigungen erforderlich.

Wichtig

Eine Let-Anweisung kann nicht alleine ausgeführt werden. Auf sie muss eine tabellarische Ausdrucksanweisung folgen. Informationen zum Ausführen eines funktionierenden Beispiels series_shapes_fl()finden Sie unter Beispiel.

let series_shapes_fl=(series:dynamic, advanced:bool=false)

{

let n = array_length(series);

// calculate normal dynamic range between 10th and 90th percentiles

let xs = array_sort_asc(series);

let low_idx = tolong(n*0.1);

let high_idx = tolong(n*0.9);

let low_pct = todouble(xs[low_idx]);

let high_pct = todouble(xs[high_idx]);

let norm_range = high_pct-low_pct;

// trend score

let lf = series_fit_line_dynamic(series);

let slope = todouble(lf.slope);

let rsquare = todouble(lf.rsquare);

let rel_slope = abs(n*slope/norm_range);

let sign_slope = iff(slope >= 0.0, 1.0, -1.0);

let norm_slope = sign_slope*rel_slope/(rel_slope+0.1); // map rel_slope from [-Inf, +Inf] to [-1, 1]; 0.1 is a clibration constant

let trend_score = norm_slope*rsquare;

// jump score

let lf2=series_fit_2lines_dynamic(series);

let lslope = todouble(lf2.left.slope);

let rslope = todouble(lf2.right.slope);

let rsquare2 = todouble(lf2.rsquare);

let split_idx = tolong(lf2.split_idx);

let last_left = todouble(lf2.left.interception)+lslope*split_idx;

let first_right = todouble(lf2.right.interception)+rslope;

let jump = first_right-last_left;

let rel_jump = abs(jump/norm_range);

let sign_jump = iff(first_right >= last_left, 1.0, -1.0);

let norm_jump = sign_jump*rel_jump/(rel_jump+0.1); // map rel_jump from [-Inf, +Inf] to [-1, 1]; 0.1 is a clibration constant

let jump_score1 = norm_jump*rsquare2;

// filter for jumps that are not close to the series edges and the right slope has the same direction

let norm_rslope = abs(rslope/norm_range);

let jump_score = iff((sign_jump*rslope >= 0.0 or norm_rslope < 0.02) and split_idx between((0.1*n)..(0.9*n)), jump_score1, 0.0);

let res = iff(advanced, bag_pack("n", n, "low_pct", low_pct, "high_pct", high_pct, "norm_range", norm_range, "slope", slope, "rsquare", rsquare, "rel_slope", rel_slope, "norm_slope", norm_slope,

"trend_score", trend_score, "split_idx", split_idx, "jump", jump, "rsquare2", rsquare2, "last_left", last_left, "first_right", first_right, "rel_jump", rel_jump,

"lslope", lslope, "rslope", rslope, "norm_rslope", norm_rslope, "norm_jump", norm_jump, "jump_score", jump_score)

, bag_pack("trend_score", trend_score, "jump_score", jump_score));

res

};

// Write your query to use the function here.

Beispiel

Um eine abfragedefinierte Funktion zu verwenden, rufen Sie sie nach der definition der eingebetteten Funktion auf.

let series_shapes_fl=(series:dynamic, advanced:bool=false)

{

let n = array_length(series);

// calculate normal dynamic range between 10th and 90th percentiles

let xs = array_sort_asc(series);

let low_idx = tolong(n*0.1);

let high_idx = tolong(n*0.9);

let low_pct = todouble(xs[low_idx]);

let high_pct = todouble(xs[high_idx]);

let norm_range = high_pct-low_pct;

// trend score

let lf = series_fit_line_dynamic(series);

let slope = todouble(lf.slope);

let rsquare = todouble(lf.rsquare);

let rel_slope = abs(n*slope/norm_range);

let sign_slope = iff(slope >= 0.0, 1.0, -1.0);

let norm_slope = sign_slope*rel_slope/(rel_slope+0.1); // map rel_slope from [-Inf, +Inf] to [-1, 1]; 0.1 is a clibration constant

let trend_score = norm_slope*rsquare;

// jump score

let lf2=series_fit_2lines_dynamic(series);

let lslope = todouble(lf2.left.slope);

let rslope = todouble(lf2.right.slope);

let rsquare2 = todouble(lf2.rsquare);

let split_idx = tolong(lf2.split_idx);

let last_left = todouble(lf2.left.interception)+lslope*split_idx;

let first_right = todouble(lf2.right.interception)+rslope;

let jump = first_right-last_left;

let rel_jump = abs(jump/norm_range);

let sign_jump = iff(first_right >= last_left, 1.0, -1.0);

let norm_jump = sign_jump*rel_jump/(rel_jump+0.1); // map rel_jump from [-Inf, +Inf] to [-1, 1]; 0.1 is a clibration constant

let jump_score1 = norm_jump*rsquare2;

// filter for jumps that are not close to the series edges and the right slope has the same direction

let norm_rslope = abs(rslope/norm_range);

let jump_score = iff((sign_jump*rslope >= 0.0 or norm_rslope < 0.02) and split_idx between((0.1*n)..(0.9*n)), jump_score1, 0.0);

let res = iff(advanced, bag_pack("n", n, "low_pct", low_pct, "high_pct", high_pct, "norm_range", norm_range, "slope", slope, "rsquare", rsquare, "rel_slope", rel_slope, "norm_slope", norm_slope,

"trend_score", trend_score, "split_idx", split_idx, "jump", jump, "rsquare2", rsquare2, "last_left", last_left, "first_right", first_right, "rel_jump", rel_jump,

"lslope", lslope, "rslope", rslope, "norm_rslope", norm_rslope, "norm_jump", norm_jump, "jump_score", jump_score)

, bag_pack("trend_score", trend_score, "jump_score", jump_score));

res

};

let ts_len = 100;

let noise_pct = 2;

let noise_gain = 3;

union

(print tsid=1 | extend y = array_concat(repeat(20, ts_len/2), repeat(150, ts_len/2))),

(print tsid=2 | extend y = array_concat(repeat(0, ts_len*3/4), repeat(-50, ts_len/4))),

(print tsid=3 | extend y = range(40, 139, 1)),

(print tsid=4 | extend y = range(-20, -109, -1))

| extend x = range(1, array_length(y), 1)

//

| extend shapes = series_shapes_fl(y)

| order by tsid asc

| fork (take 4) (project tsid, shapes)

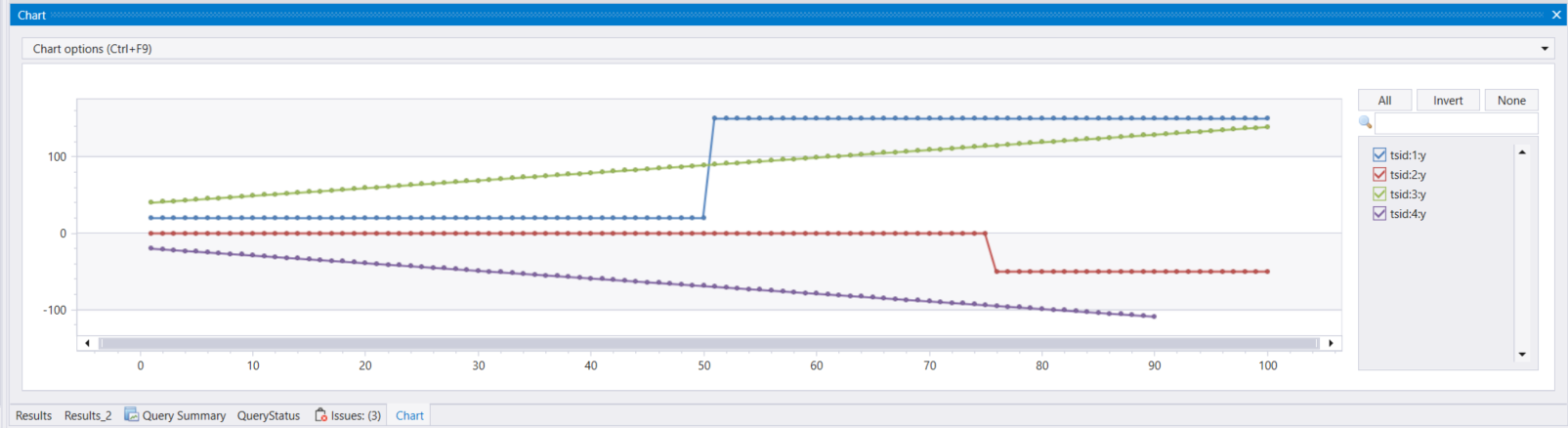

| render timechart with(series=tsid, xcolumn=x, ycolumns=y)

Output

Die jeweiligen Trend- und Sprungergebnisse:

tsid shapes

1 {

"trend_score": 0.703199714530169,

"jump_score": 0.90909090909090906

}

2 {

"trend_score": -0.51663751343174869,

"jump_score": -0.90909090909090906

}

3 {

"trend_score": 0.92592592592592582,

"jump_score": 0.0

}

4 {

"trend_score": -0.92592592592592582,

"jump_score": 0.0

}