How ML Accelerates Claim Automation & Revenue at GAFFEY Healthcare

This post is co-authored by Muxi Li, Data Scientist, and Danielle Dean, Senior Data Scientist Lead at Microsoft.

Machine learning can help modern businesses utilize their data to become more profitable. GAFFEY Healthcare is a leading healthcare technology solution provider, and they help their customers – who include over 200 healthcare systems, hospitals and physician practices – accelerate their revenue cycle. Microsoft and GAFFEY Healthcare recently collaborated on a pilot to deploy ML in GAFFEY’s claims automation and processing engine at a couple of hospitals using Azure cloud services, and are now working to move this system into production for many more of their customers.

The cash flow at healthcare organizations is frequently slowed down by insurance companies postponing claim payments. GAFFEY now uses ML to make predictions around:

Whether a human collector is needed to accelerate the claim payment process, and

How long it will take for an insurance company to pay a claim (0-60 days, 60-90 days, or 90+ days) based on historical patient and claim payment information.

GAFFEY is now able to target workflow processes to help its customers speed up their payment collections, while keeping its labor cost lower by eliminating non value added touches.

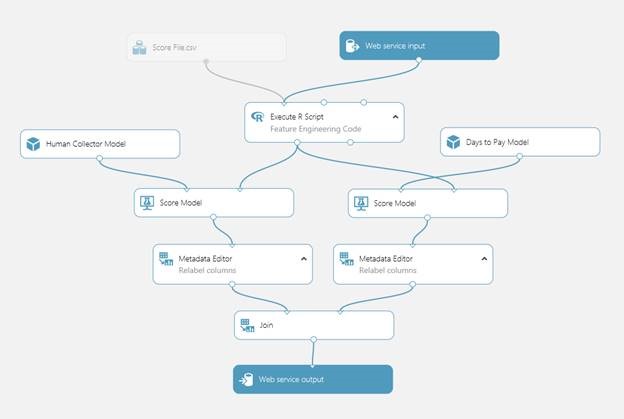

To make predictions, a binary classification model was developed to determine whether a human collector is needed to have the insurance company pay the claim, and a multiclass classification model was developed to predict how long it will take for an insurance company to pay a claim. Azure Machine Learning was used to develop the two models, which work on the same input data composed of insurance and claim information. Boosted decision trees gave the most accurate results, both for the two-class and multi-class models. The trained models were then used in the scoring workflow shown in Figure 1 below, and deployed as a web service. The web service takes the claim and insurance information as the input, and outputs the probability of a human collector being needed and the predicted length of time for a claim to be paid.

Figure 1. Scoring Workflow for predicting need for human collector and number of days for payment.

In addition, Azure cloud services were utilized to set up an automated data pipeline for GAFFEY. Figure 2 below illustrates how the on premise data in their system is automatically pulled and aggregated into the cloud using Azure Data Factory. The ML models described above are consumed by a daily batch request to the machine learning REST API for the new claims, and the results are automatically pushed back to their data center for use in their claim processing rule engine.

Figure 2. Automated data movement pipeline using Azure Data Factory.

By deploying this automated data movement and processing pipeline and utilizing ML, GAFFEY has been able to improve their operational efficiency through accurate predictions on which claims should be worked on and when, resulting in better cash flow management and lower costs for their customers.

Muxi and Danielle

Follow Danielle @danielleodean